US Recession and Stock Market: Understanding the Impact

author:US stockS -

The US recession and the stock market have always been closely intertwined. A recession, characterized by a significant decline in economic activity, often results in a bearish stock market. Conversely, the stock market's performance can be a bellwether for an impending recession. This article delves into the relationship between the two, providing insights into how they interact and the potential implications for investors.

What is a Recession?

A recession is generally defined as a period of significant economic decline, marked by a decrease in GDP, increased unemployment, and a drop in consumer spending. The National Bureau of Economic Research (NBER) identifies a recession as a significant decline in economic activity that is spread across the economy and lasts more than a few months.

The Stock Market and Recession

The stock market is a reflection of the overall economic health of a country. When the economy is performing well, companies tend to do well, and investors are optimistic about the future. This optimism is reflected in higher stock prices. Conversely, when the economy is in a recession, companies face challenges, leading to lower profits and, subsequently, lower stock prices.

How Does a Recession Affect the Stock Market?

A US recession can have several impacts on the stock market:

Lower Corporate Profits: During a recession, companies often face reduced demand for their products and services, leading to lower revenues and profits. This can be reflected in lower earnings reports and, subsequently, lower stock prices.

Increased Unemployment: A recession typically leads to higher unemployment rates. When people are out of work, they have less money to spend, leading to a further decline in consumer spending and economic activity.

Lower Consumer Confidence: During a recession, consumer confidence tends to fall. This can lead to reduced spending on non-essential items, further affecting corporate profits and stock prices.

Higher Interest Rates: Central banks often raise interest rates during a recession to combat inflation. Higher interest rates can make borrowing more expensive for companies, leading to reduced investment and hiring.

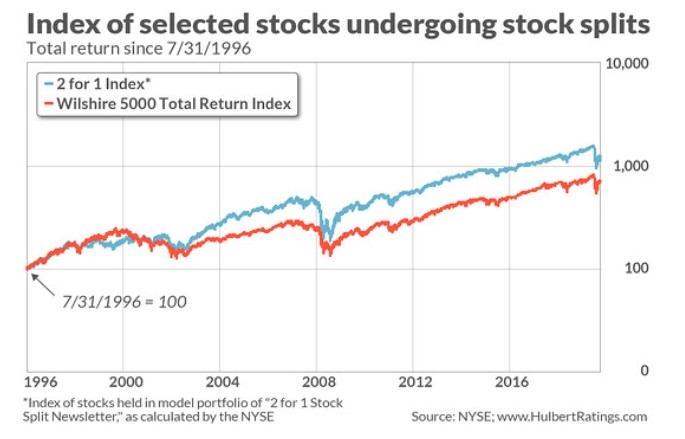

Case Study: The 2008 Financial Crisis

One of the most significant recessions in recent history was the 2008 financial crisis. The stock market plummeted as investors feared the collapse of the financial system. The S&P 500, a widely followed stock market index, fell by nearly 50% from its peak in October 2007 to its trough in March 2009.

What Should Investors Do?

Investors need to be aware of the potential risks associated with a US recession. Here are a few strategies they can consider:

Diversification: Diversifying your portfolio across different asset classes can help mitigate the risks associated with a recession.

Quality Stocks: Investing in high-quality companies with strong fundamentals can provide some protection against a recession.

Bond Investments: Bonds can provide some stability during a recession, as they tend to be less volatile than stocks.

Cash Reserves: Maintaining a cash reserve can provide you with the flexibility to take advantage of potential investment opportunities during a recession.

Understanding the relationship between the US recession and the stock market is crucial for investors. By staying informed and adopting a well-diversified investment strategy, investors can navigate the challenges posed by a recession and potentially come out stronger on the other side.

us stock market today live cha