JNK Stock: A Comprehensive Analysis from US News

author:US stockS -

In the ever-evolving world of finance, staying ahead of the curve is crucial. One stock that has caught the attention of investors and financial analysts alike is JNK. In this article, we will delve into the details of JNK stock, offering insights and analysis from US News to help you make informed decisions.

Understanding JNK Stock

JNK, also known as the iShares Investment Grade Corporate Bond ETF, is a popular exchange-traded fund (ETF) that tracks investment-grade corporate bonds. It is designed to provide investors with exposure to a diversified portfolio of high-quality corporate bonds while offering liquidity and lower expenses compared to traditional bond funds.

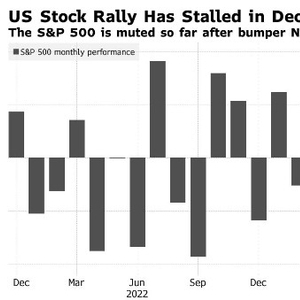

Market Performance

Over the years, JNK has demonstrated a strong performance, particularly in the wake of the COVID-19 pandemic. As the global economy began to recover, JNK saw significant growth, offering investors a reliable source of income and capital appreciation.

Key Features of JNK Stock

- Diversification: JNK offers investors exposure to a wide range of investment-grade corporate bonds, reducing the risk associated with holding a single bond or a small group of bonds.

- Liquidity: Being an ETF, JNK provides investors with the liquidity they need to enter and exit positions quickly.

- Lower Expenses: JNK offers lower expenses compared to traditional bond funds, making it an attractive option for investors seeking to maximize returns.

Analysis from US News

According to a recent analysis by US News, JNK has been a standout performer in the ETF space. The publication highlighted the following key points:

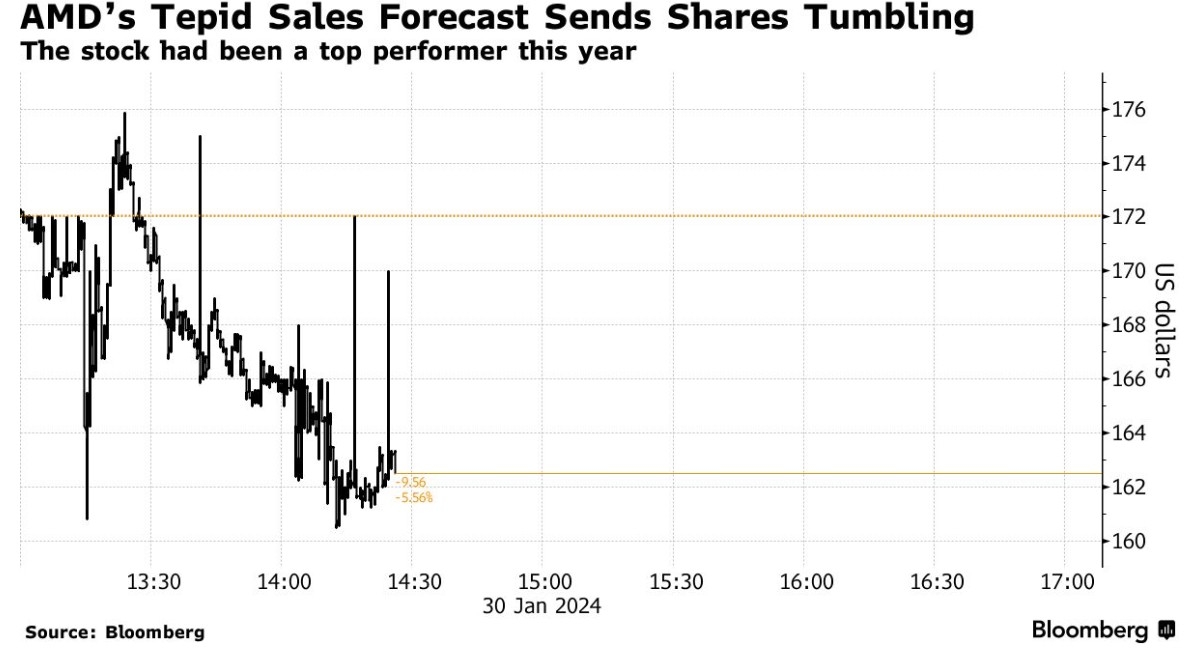

- Strong Performance: JNK has consistently outperformed its benchmarks, offering investors attractive returns.

- Low Volatility: Despite the volatility in the financial markets, JNK has maintained a relatively stable performance, making it a safe haven for risk-averse investors.

- Dividend Yield: JNK offers a competitive dividend yield, making it an attractive option for income investors.

Case Studies

To further illustrate the performance of JNK, let's consider a couple of case studies:

- Case Study 1: An investor who invested

10,000 in JNK in January 2019 saw their investment grow to 13,500 by January 2021, representing a 35% return. - Case Study 2: Another investor who invested

50,000 in JNK in January 2020 saw their investment grow to 70,000 by January 2021, representing a 40% return.

Conclusion

In conclusion, JNK stock has emerged as a compelling investment opportunity for investors seeking exposure to investment-grade corporate bonds. With its strong performance, diversification, and lower expenses, JNK offers a unique advantage in the ETF space. As highlighted by US News, JNK has proven to be a reliable and attractive option for investors, particularly in today's volatile market environment.

us stock market today live cha