Diesel Stocks in the US: A Comprehensive Guide

author:US stockS -

In the vast landscape of the United States, the demand for diesel-powered vehicles continues to soar. This has, in turn, created a significant interest in the diesel stocks market. If you're looking to invest in this thriving sector, it's crucial to understand the ins and outs of diesel stocks in the US. This article delves into the world of diesel stocks, providing you with a comprehensive guide to help you make informed decisions.

Understanding Diesel Stocks

Diesel stocks refer to shares of companies that are directly or indirectly involved in the production, distribution, and sale of diesel engines, vehicles, and related products. These stocks can include manufacturers, suppliers, and even fuel companies. Investing in diesel stocks can be a lucrative opportunity, especially as the demand for diesel-powered vehicles grows.

The Growing Demand for Diesel in the US

The demand for diesel-powered vehicles in the US has been on the rise, driven by several factors. Firstly, diesel engines are known for their high fuel efficiency and lower operating costs compared to gasoline engines. This makes them an attractive option for heavy-duty vehicles, such as trucks and buses, as well as for those who cover long distances regularly.

Secondly, the increasing focus on environmental sustainability has led to a growing preference for cleaner-burning fuels. Diesel engines, when equipped with advanced technology, emit fewer pollutants and are considered more environmentally friendly than their gasoline counterparts.

Key Players in the Diesel Stocks Market

Several key players dominate the diesel stocks market in the US. These include:

Daimler AG: A German multinational corporation, Daimler is one of the world's leading manufacturers of commercial vehicles, including trucks and buses. Their diesel-powered vehicles are widely used in the US.

Cummins Inc.: An American company specializing in engine design and manufacturing, Cummins produces a range of diesel engines used in various applications, from heavy-duty trucks to marine vessels.

Navistar International Corporation: A US-based manufacturer of commercial vehicles, including trucks, buses, and military vehicles, Navistar offers a range of diesel-powered products.

PACCAR Inc.: A leading manufacturer of heavy-duty trucks and engines, PACCAR has a significant presence in the US diesel market.

Investing in Diesel Stocks: What to Consider

When considering investing in diesel stocks, there are several factors to keep in mind:

Market Trends: Stay informed about the latest trends in the diesel market, including technological advancements and regulatory changes.

Company Performance: Evaluate the financial performance of the companies you're considering investing in. Look for strong revenue growth, profitability, and a solid balance sheet.

Risk Factors: Be aware of the risks associated with investing in diesel stocks, such as fluctuating fuel prices, competition, and regulatory challenges.

Case Study: Daimler AG

To illustrate the potential of investing in diesel stocks, let's take a look at Daimler AG. Over the past few years, Daimler has experienced significant growth in its diesel vehicle sales, driven by the increasing demand for commercial vehicles in the US. By investing in Daimler, investors have been able to capitalize on this trend and enjoy substantial returns.

In conclusion, diesel stocks in the US offer a promising investment opportunity. By understanding the market dynamics and evaluating the key players, you can make informed decisions and potentially reap significant rewards.

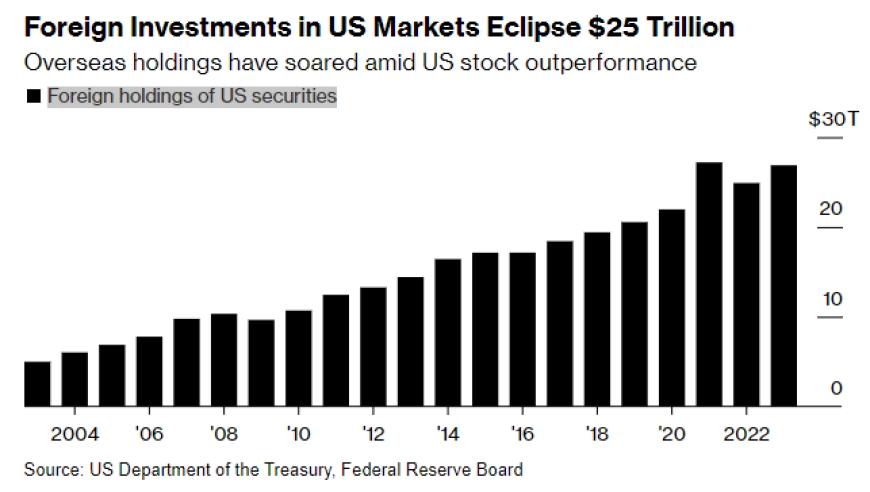

can foreigners buy us stocks