Title: Glencore US Stock: A Comprehensive Guide

author:US stockS -

In the bustling world of commodities trading, Glencore plc stands out as one of the most influential names. As an investor, understanding the ins and outs of Glencore's U.S. stock is crucial. This article delves into the details, offering a comprehensive guide to Glencore US stock, its market performance, and factors that influence its price.

Introduction to Glencore

Glencore plc is a global commodities company that operates across a diverse range of sectors, including agriculture, metals, and mining. The company has a significant presence in the U.S., making its U.S. stock a popular investment choice among U.S. investors.

Understanding Glencore US Stock

Glencore's U.S. stock is listed on the New York Stock Exchange (NYSE) under the ticker symbol "GLNCY." This stock represents the company's shares in the U.S. market, allowing investors to gain exposure to Glencore's global operations.

Market Performance

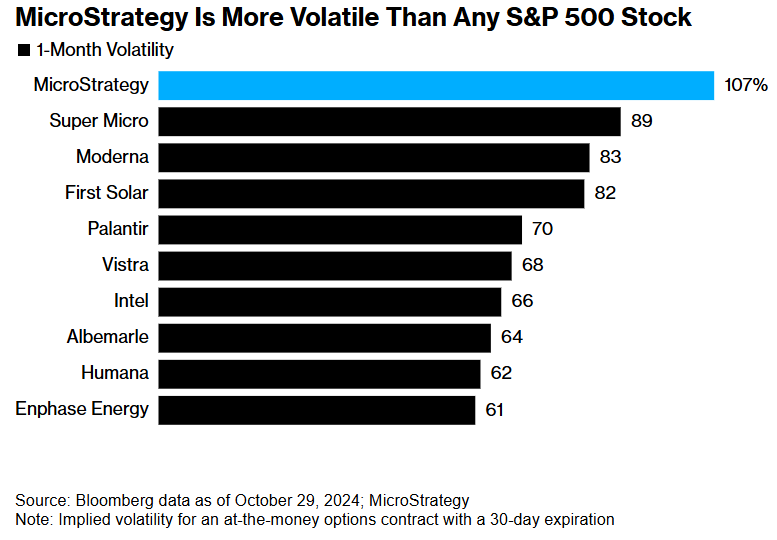

The performance of Glencore US stock has been influenced by various factors, including global economic conditions, commodity prices, and the company's operational efficiency. Over the years, the stock has seen both highs and lows, reflecting the volatile nature of the commodities market.

Factors Influencing Glencore US Stock Price

Several factors can influence the price of Glencore US stock. Here are some key factors to consider:

Commodity Prices: Glencore's revenue is primarily derived from the sale of commodities. As such, fluctuations in commodity prices, such as copper, zinc, and coal, can significantly impact the company's earnings and, consequently, the stock price.

Global Economic Conditions: Economic conditions, particularly in major commodity-consuming countries, can influence commodity prices and, in turn, Glencore's stock performance.

Operational Efficiency: Glencore's ability to optimize its operations, reduce costs, and increase production can positively impact its earnings and, subsequently, the stock price.

Regulatory Environment: Changes in the regulatory environment, especially in the mining and commodities sectors, can affect Glencore's operations and, consequently, its stock price.

Case Study: Glencore's Acquisition of Xstrata

One notable event in Glencore's history was its acquisition of Xstrata in 2013. This acquisition, valued at $39 billion at the time, transformed Glencore into one of the world's largest diversified natural resource companies. The stock price of Glencore US stock surged following the announcement of the acquisition, reflecting investors' optimism about the merged entity's future prospects.

Conclusion

Understanding Glencore US stock requires a keen eye on global economic conditions, commodity prices, and the company's operational efficiency. By keeping these factors in mind, investors can make informed decisions regarding their investment in Glencore US stock.

can foreigners buy us stocks