Best Stock to Trade with Options Trading Platform

author:US stockS -

In the world of stock trading, options provide a powerful tool for investors looking to enhance their portfolio. But with so many options trading platforms available, choosing the best stock to trade can be a daunting task. This article delves into the best stock to trade with an options trading platform, providing insights into how to make informed decisions and maximize returns.

Understanding Options Trading

Before we dive into the specifics of the best stock to trade, it's essential to understand the basics of options trading. Options are financial derivatives that give the buyer the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specific time frame. This flexibility makes options a popular choice for investors seeking to hedge their bets or capitalize on market movements.

The Best Stock to Trade

When it comes to the best stock to trade with an options trading platform, it's crucial to consider several factors. These include the stock's volatility, liquidity, and overall market trends. Here are some of the top stocks that have proven to be excellent choices for options trading:

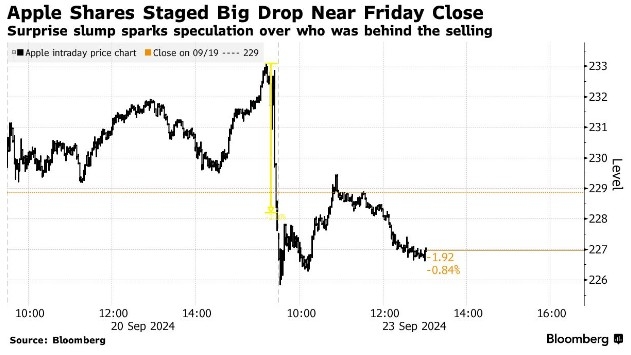

- Apple (AAPL): As one of the world's most valuable companies, Apple offers a high level of liquidity and volatility, making it an ideal stock for options trading. Its consistent performance and strong market position make it a popular choice among investors.

- Microsoft (MSFT): Microsoft is another highly liquid and volatile stock that has consistently performed well over the years. Its diverse product line and global presence make it a stable investment, while its high volatility provides opportunities for options traders.

- Tesla (TSLA): Tesla is a high-risk, high-reward stock that has experienced significant volatility in recent years. Its cutting-edge technology and rapid growth have made it a favorite among options traders looking to capitalize on potential price swings.

- Amazon (AMZN): Amazon is a highly volatile stock that has seen rapid growth in recent years. Its diverse product offerings and expanding market presence make it an attractive option for options traders seeking to profit from market movements.

Case Studies

To illustrate the potential of options trading, let's look at a few case studies involving the stocks mentioned above:

- Apple (AAPL): An options trader may have purchased a call option on Apple with a strike price of

150 and an expiration date of one month. If the stock price rises above 150 during this period, the trader can exercise the option and profit from the price difference. - Microsoft (MSFT): A trader may have purchased a put option on Microsoft with a strike price of

250 and an expiration date of three months. If the stock price falls below 250, the trader can exercise the option and profit from the price difference. - Tesla (TSLA): A trader may have purchased a call option on Tesla with a strike price of

400 and an expiration date of one month. If the stock price rises above 400, the trader can exercise the option and profit from the price difference. - Amazon (AMZN): A trader may have purchased a put option on Amazon with a strike price of

3,000 and an expiration date of six months. If the stock price falls below 3,000, the trader can exercise the option and profit from the price difference.

Conclusion

In conclusion, when it comes to the best stock to trade with an options trading platform, it's essential to consider factors such as volatility, liquidity, and market trends. Stocks like Apple, Microsoft, Tesla, and Amazon offer excellent opportunities for options traders looking to enhance their portfolio. By understanding the basics of options trading and conducting thorough research, investors can make informed decisions and maximize their returns.

can foreigners buy us stocks