Understanding the Dynamics of US Shell Stock

author:US stockS -

In the bustling world of financial markets, "US Shell Stock" has emerged as a topic of considerable interest among investors. This article aims to delve into the intricacies of Shell stocks, their significance in the American market, and the potential opportunities they present. By understanding the dynamics of Shell stocks, investors can make informed decisions and capitalize on the volatile yet rewarding nature of the energy sector.

What is a Shell Stock?

A Shell Stock refers to the shares of a company that owns a significant portion of assets but has minimal operations or profits. In the case of oil and gas companies, Shell stocks are often associated with entities that own large oil and gas reserves but have minimal production capabilities. These companies may be in the process of reorganization, restructuring, or simply waiting for the right time to exploit their assets.

The Importance of Shell Stocks in the US Market

The United States is one of the largest energy markets in the world, and Shell stocks play a crucial role in its dynamics. These stocks offer investors a unique opportunity to gain exposure to the energy sector without being directly involved in production or exploration activities. Some key reasons why Shell stocks are important in the US market include:

- Access to Energy Sector without Direct Involvement: Investors who want to benefit from the energy sector's growth without the complexities of managing production operations can invest in Shell stocks.

- Potential for High Returns: Shell stocks can offer high returns, especially if the underlying assets are valuable and the company is able to successfully restructure or exploit its resources.

- Diversification: Shell stocks can be a valuable addition to an investment portfolio, as they offer diversification benefits by providing exposure to the energy sector.

Understanding the Risks

While Shell stocks offer potential benefits, it's essential to understand the risks involved. Some key risks associated with Shell stocks include:

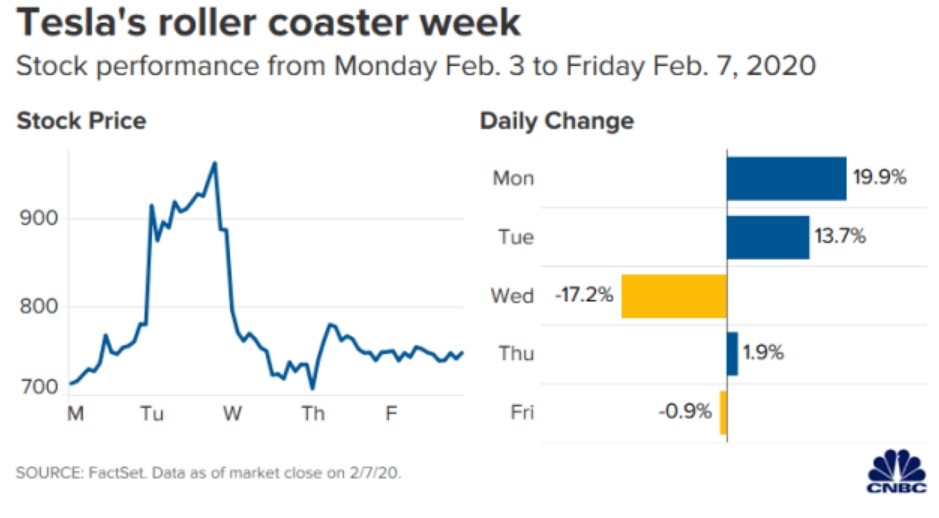

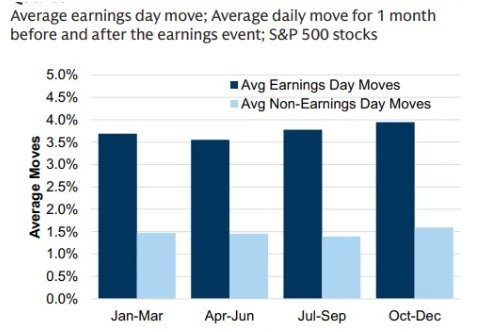

- Volatility: The energy sector is highly volatile, and Shell stocks are no exception. Prices can fluctuate significantly based on factors such as oil prices, geopolitical events, and regulatory changes.

- Uncertainty in Operations: Shell stocks may be associated with companies that have limited operational capabilities, which can lead to uncertainty regarding future profitability.

- Regulatory Changes: The energy sector is subject to strict regulations, and changes in regulations can impact the value of Shell stocks.

Case Studies: Successful Shell Stock Investments

Several successful investments in Shell stocks demonstrate the potential of this asset class. One notable example is the investment in Royal Dutch Shell (RDS.A) during the 2000s. Despite the volatility and uncertainty in the energy sector, RDS.A delivered impressive returns for investors who remained patient and focused on the long term.

Another example is the investment in Apache Corporation (APA) during the late 1990s. APA was a Shell stock at the time and experienced significant growth as it successfully exploited its oil and gas reserves. Investors who bought APA shares at the right time were able to achieve substantial returns.

Conclusion

Understanding the dynamics of US Shell Stock is crucial for investors looking to gain exposure to the energy sector without being directly involved in production or exploration activities. While Shell stocks offer potential benefits, they also come with risks that need to be carefully considered. By conducting thorough research and staying informed about the energy sector, investors can make informed decisions and potentially capitalize on the rewards that Shell stocks can offer.

can foreigners buy us stocks