August 29, 2025 US Stock Market Closing Summary

author:US stockS -

The Markets in Review

Stock Market Overview

On August 29, 2025, the US stock market concluded a tumultuous trading session that saw significant fluctuations. As investors grappled with a mix of economic data, geopolitical tensions, and corporate earnings reports, the major indices experienced a rollercoaster ride.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average closed down by 0.78% on the day, primarily due to concerns about the global economic slowdown. The index saw a mix of winners and losers, with sectors like energy and financials leading the decline.

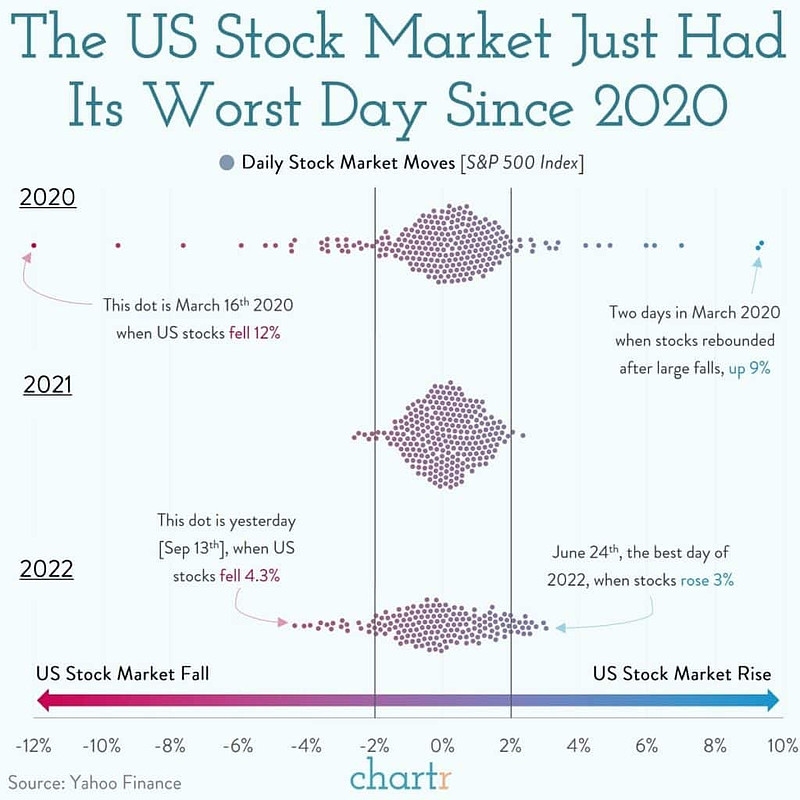

S&P 500

The S&P 500 followed a similar trajectory, closing down 0.85% for the day. The index was weighed down by a decline in technology stocks, which accounted for a significant portion of the index's composition.

NASDAQ Composite

The NASDAQ Composite saw the most significant decline, with a 1.23% drop on the day. This was largely due to a selloff in growth stocks, which were hit by rising interest rates and concerns about inflation.

Economic Data and Earnings Reports

Several economic reports were released on August 29, 2025, which had a significant impact on the stock market. The Bureau of Labor Statistics reported that the unemployment rate remained at 3.8%, slightly above market expectations.

Corporate Earnings Reports

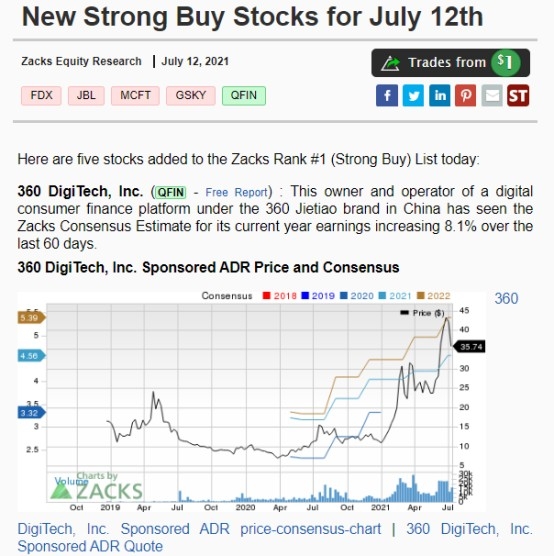

Several major companies released their earnings reports during the trading session. Among the highlights were:

- Apple Inc. (AAPL) reported stronger-than-expected earnings, but the stock closed down on concerns about slowing iPhone sales.

- Amazon.com Inc. (AMZN) saw a decline in earnings, but the stock managed to close flat on the day, supported by strong revenue growth.

- Microsoft Corporation (MSFT) reported better-than-expected earnings, with strong growth in cloud services.

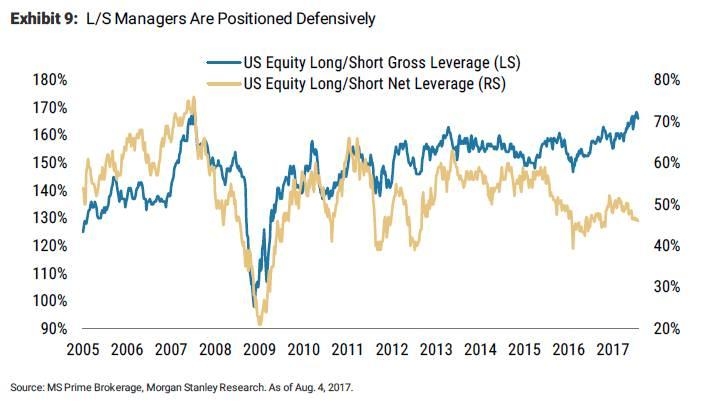

Market Sentiment

The overall market sentiment remained cautious on August 29, 2025. Investors were concerned about the rising interest rates, inflation, and geopolitical tensions. However, the strong earnings reports from several companies provided some optimism.

Sector Performance

Among the sectors, energy and financials were the worst performers, with declines of 1.45% and 1.22%, respectively. On the other hand, healthcare and consumer discretionary sectors saw gains of 0.56% and 0.43%, respectively.

Market Outlook

The market outlook for the short term remains cautiously optimistic, with investors closely monitoring economic data and corporate earnings reports. As the year progresses, investors will also keep an eye on the Federal Reserve's monetary policy decisions.

Case Study: Apple Inc. (AAPL)

Apple's earnings report on August 29, 2025, provided mixed signals. While the company reported stronger-than-expected earnings, concerns about slowing iPhone sales led to a decline in the stock price. This highlights the importance of product innovation and demand in the technology sector.

In conclusion, the US stock market closed on August 29, 2025, with significant fluctuations and mixed results. The market remains cautiously optimistic, with investors closely watching economic data and corporate earnings reports. As the year progresses, investors will need to stay vigilant and adapt to the changing market conditions.

us stock market today