US Stock Indices Today: A Comprehensive Overview

author:US stockS -

In the ever-evolving world of finance, staying updated with the latest movements in the stock market is crucial for investors and traders alike. Today, we delve into the current state of US stock indices, providing a comprehensive overview that covers the latest trends, key players, and potential future developments.

Dow Jones Industrial Average (DJIA)

The Dow Jones Industrial Average (DJIA) is one of the most widely followed stock market indices in the United States. It consists of 30 large, publicly-owned companies across various sectors, including technology, finance, and healthcare. As of today, the DJIA is showing a mixed performance, with some sectors leading the way while others lagging behind.

S&P 500 Index

The S&P 500 Index is another key indicator of the US stock market's health. It includes 500 of the largest publicly-traded companies in the country, representing a broad range of industries. The S&P 500 has been on a steady uptrend over the past few months, driven by strong earnings reports and positive economic data.

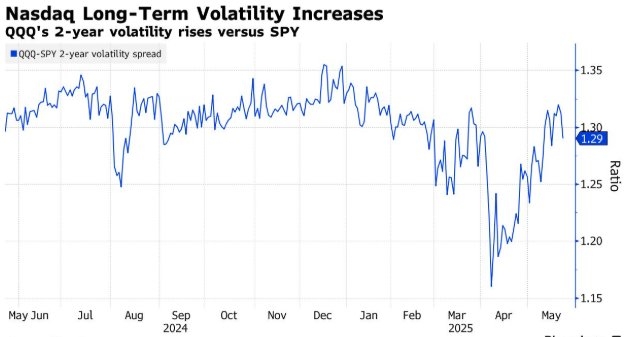

NASDAQ Composite Index

The NASDAQ Composite Index is a key gauge of the technology sector's performance. It includes all stocks listed on the NASDAQ exchange, which is known for its high-tech companies. The NASDAQ has been one of the strongest performers in recent months, with tech giants like Apple and Microsoft leading the charge.

Key Factors Influencing Stock Indices

Several factors have been driving the movements in US stock indices today. Here are some of the most significant ones:

Economic Data: The latest economic reports, such as GDP growth, unemployment rates, and inflation data, have been closely watched by investors. Positive economic data tends to boost stock indices, while negative data can lead to declines.

Corporate Earnings: Strong earnings reports from major companies can drive stock indices higher, as investors become more optimistic about the overall health of the market. Conversely, weak earnings can lead to declines.

Political Events: Political events, such as elections or policy changes, can have a significant impact on stock indices. For example, the recent midterm elections in the United States have been closely watched by investors, as they could lead to changes in policies affecting the stock market.

Global Events: Global events, such as trade wars or geopolitical tensions, can also influence US stock indices. For instance, the ongoing trade war between the United States and China has been a major concern for investors.

Case Study: Apple's Impact on the NASDAQ Composite Index

One notable example of how individual companies can influence stock indices is Apple's impact on the NASDAQ Composite Index. As one of the largest companies listed on the NASDAQ, Apple's stock price has a significant impact on the index's performance. In recent months, Apple has reported strong earnings and released new products, which has helped drive the NASDAQ higher.

Conclusion

In conclusion, today's US stock indices reflect a complex mix of economic, political, and global factors. While the DJIA, S&P 500, and NASDAQ Composite Index have shown mixed performance, it's important for investors to stay informed about the latest developments and trends. By doing so, they can make more informed decisions and navigate the ever-changing landscape of the stock market.

us stock market today