Geely Stock in US Dollars: A Comprehensive Guide

author:US stockS -

In the ever-evolving world of global finance, keeping up with the stock market can be a daunting task. One particular stock that has caught the attention of many investors is Geely, a leading Chinese automaker. This article aims to provide a comprehensive guide on Geely stock in US dollars, covering its performance, potential, and factors that could impact its value.

Understanding Geely Stock

Geely Holding Group, or simply Geely, is a multinational automotive manufacturer based in China. The company has made significant strides in the global market, particularly in the United States, where it has gained a strong presence through its acquisition of Volvo Cars and its partnership with Ford Motor Company.

Geely stock is listed on the Hong Kong Stock Exchange (HKEX) under the ticker symbol "0175.HK." However, for investors looking to invest in Geely stock in US dollars, it is important to understand the currency conversion and the potential risks involved.

Geely Stock Performance

Over the past few years, Geely stock has shown impressive growth, particularly in the US dollar. In 2020, the stock experienced a significant surge, reaching an all-time high of around $12.50 per share. This growth can be attributed to several factors, including the company's expansion into new markets, its strong partnership with leading automakers, and its commitment to innovation.

Factors Influencing Geely Stock Value

Several factors can influence the value of Geely stock in US dollars. Here are some key factors to consider:

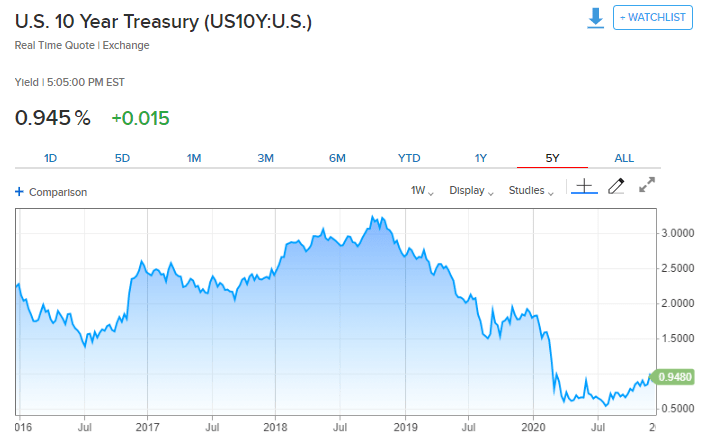

- Economic Conditions: The global economy plays a crucial role in the automotive industry. Factors such as inflation, interest rates, and trade policies can impact Geely's performance and, subsequently, its stock value.

- Automotive Industry Trends: The automotive industry is constantly evolving, with new technologies and consumer preferences shaping the market. Geely's ability to adapt to these trends will play a significant role in its stock performance.

- Company Performance: Geely's financial performance, including revenue, earnings, and market share, will directly impact its stock value. Investors should closely monitor these metrics to make informed decisions.

Case Study: Geely's Acquisition of Volvo Cars

One of the most significant milestones in Geely's history was its acquisition of Volvo Cars in 2010. This move has proven to be a strategic success, as Volvo has helped Geely establish a strong presence in the premium automotive market. The acquisition has also allowed Geely to leverage Volvo's expertise in safety, design, and technology, further enhancing its competitive advantage.

Investing in Geely Stock in US Dollars

Investing in Geely stock in US dollars requires careful consideration of various factors. Here are some tips for investors:

- Do Your Research: Before investing, it is crucial to conduct thorough research on Geely's financial performance, market trends, and potential risks.

- Diversify Your Portfolio: To mitigate risks, consider diversifying your investment portfolio by including other stocks and assets.

- Stay Informed: Keep up with the latest news and developments in the automotive industry and the global economy to make informed decisions.

Conclusion

Geely stock in US dollars has shown significant potential for growth, thanks to the company's strong performance and strategic partnerships. However, investing in the stock requires careful consideration of various factors and thorough research. By staying informed and making informed decisions, investors can potentially benefit from the growth of Geely stock in US dollars.

us stock market live