Chinese Companies on US Stock Exchange: A Comprehensive Guide

author:US stockS -

In recent years, Chinese companies have made significant strides in the global market, and their presence on the US stock exchange is a testament to their growing influence. This article delves into the world of Chinese companies listed on US stock exchanges, exploring the opportunities and challenges they face.

Understanding the Landscape

The US stock exchange has long been a hub for international companies looking to expand their reach. Chinese companies, with their rapid economic growth and technological advancements, have become a significant part of this landscape. From tech giants like Alibaba and Tencent to consumer goods companies like BYD, these firms have captured the attention of investors worldwide.

Benefits of Listing on US Stock Exchanges

1. Access to Capital: One of the primary reasons Chinese companies choose to list on US stock exchanges is to access a larger pool of capital. The US stock market is one of the largest and most liquid in the world, providing ample opportunities for companies to raise funds for expansion and innovation.

2. Enhanced Reputation: Listing on a reputable US stock exchange can significantly enhance a company's reputation. It signals to investors that the company is committed to transparency and accountability, which can attract more investors and improve market confidence.

3. Global Reach: Being listed on a US stock exchange allows Chinese companies to reach a global audience of investors. This can help them expand their market reach and increase brand recognition on a global scale.

Challenges Faced by Chinese Companies

Despite the numerous benefits, Chinese companies listed on US stock exchanges face several challenges:

1. Regulatory Hurdles: The US regulatory environment can be complex and challenging for foreign companies. Compliance with US financial reporting standards and regulations can be a significant hurdle for these firms.

2. Political Tensions: The relationship between the US and China has been strained in recent years, which can impact Chinese companies listed on US stock exchanges. These companies may face increased scrutiny and potential regulatory actions due to geopolitical tensions.

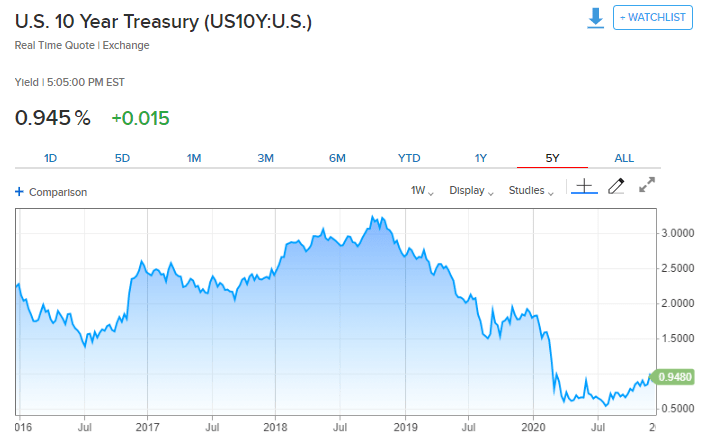

3. Market Volatility: The US stock market is known for its volatility, and Chinese companies are no exception. Fluctuations in the market can impact their share prices and overall performance.

Case Studies

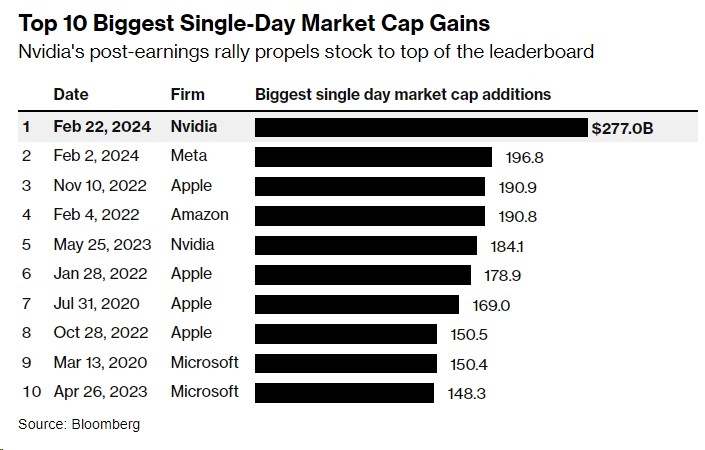

1. Alibaba Group Holding Limited: Alibaba, one of the world's largest e-commerce platforms, listed on the New York Stock Exchange in 2014. Since then, the company has successfully raised billions of dollars in capital and expanded its global footprint.

2. Tencent Holdings Limited: Tencent, a leading Chinese tech company, listed on the Hong Kong Stock Exchange and the New York Stock Exchange. The company has diversified its portfolio, venturing into areas such as gaming, finance, and social media.

Conclusion

Chinese companies listed on US stock exchanges have become an integral part of the global market. While they face challenges, the opportunities for growth and expansion are immense. As the relationship between the US and China continues to evolve, these companies will play a crucial role in shaping the future of international business.

us stock market live