Unlocking the Potential of Teva US Stock: A Comprehensive Guide

author:US stockS -

In the vast landscape of the pharmaceutical industry, Teva US Stock stands out as a key player. For investors and industry enthusiasts, understanding the intricacies of Teva's stock is crucial. This article delves into the essentials of Teva US Stock, providing insights into its performance, market trends, and future prospects.

Teva Pharmaceuticals USA Inc. Overview

Teva Pharmaceuticals USA Inc. is a subsidiary of the larger Israeli-based Teva Pharmaceutical Industries Ltd. It is one of the world's largest generic drug manufacturers, offering a wide range of pharmaceutical products to the US market. Teva's product portfolio includes generics, specialty medicines, and active pharmaceutical ingredients (APIs).

Market Performance

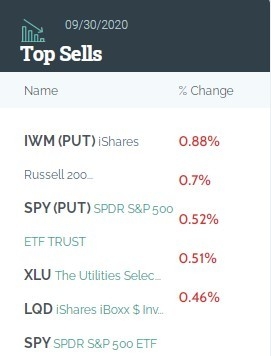

The performance of Teva US Stock has been subject to various market dynamics. Over the past few years, the stock has experienced both peaks and valleys, reflecting the industry's volatility. Understanding the market performance involves analyzing key factors such as revenue growth, earnings reports, and market trends.

Key Factors Influencing Teva US Stock

Several factors significantly influence the performance of Teva US Stock. These include:

- Regulatory Changes: Changes in healthcare regulations can have a substantial impact on the pharmaceutical industry, affecting Teva's operations and market positioning.

- Competitive Landscape: The competitive landscape, especially in the generics segment, plays a pivotal role. Teva's ability to compete with other major players is crucial for its stock performance.

- Innovation and Pipeline: The development of new drugs and the strength of Teva's pipeline are critical factors. Innovation is key to sustaining growth and attracting investors.

Teva's Pipeline: A Source of Optimism

Teva's pipeline is a source of optimism for investors. The company has a robust pipeline of both generic and specialty drugs. This includes products in various therapeutic areas, such as neurology, rheumatology, and cardiovascular diseases.

Case Study: Teva's Acquisition of Allergan's Generic Business

In 2019, Teva completed the acquisition of Allergan's generic pharmaceuticals business. This deal significantly expanded Teva's product portfolio and market presence. The acquisition was a strategic move to bolster Teva's position in the generics market and diversify its revenue streams.

Teva US Stock: A Long-Term Investment Opportunity

Despite the challenges faced by the pharmaceutical industry, Teva US Stock presents a long-term investment opportunity. The company's strong pipeline, diversification strategies, and focus on innovation make it a compelling investment choice for investors seeking exposure to the healthcare sector.

Conclusion

Understanding Teva US Stock requires a comprehensive analysis of its market performance, key factors influencing its stock, and its strategic positioning in the pharmaceutical industry. With a robust pipeline and a focus on innovation, Teva US Stock remains a compelling investment opportunity for those willing to navigate the complexities of the pharmaceutical market.

toys r us stocks