Best US Stocks 2020: Top Performing Investments

author:US stockS -Performin(3)2020(11)Stocks(1218)Best(250)Top(184)

The year 2020 was unlike any other, bringing unprecedented challenges and opportunities to the financial markets. As investors navigated through the chaos, certain stocks emerged as the cream of the crop. This article delves into the best US stocks of 2020, analyzing their performance, and providing insights for future investments.

Tech Giants Dominate

In 2020, technology stocks played a pivotal role in driving the stock market's performance. Companies like Apple, Microsoft, and Amazon were at the forefront, showcasing remarkable resilience and growth even during the global pandemic. These tech giants have a strong hold on their respective markets, offering investors a solid foundation for long-term investments.

Apple's impressive revenue growth and robust product portfolio made it one of the best US stocks of 2020. The tech giant's services division, which includes Apple Music, iCloud, and Apple Pay, contributed significantly to its revenue streams. Moreover, Apple's commitment to innovation and market dominance has positioned it for continued success in the coming years.

Similarly, Microsoft experienced a surge in its stock price in 2020. The tech giant's cloud computing services, particularly Azure, played a crucial role in driving its growth. With businesses increasingly adopting cloud-based solutions, Microsoft's cloud services business is expected to grow further, making it a compelling investment opportunity.

E-commerce and Online Retailers Shine Bright

The shift towards online shopping in 2020 was another significant trend that favored e-commerce companies. Amazon, the e-commerce behemoth, saw a dramatic increase in sales due to the pandemic-induced surge in online shopping. Amazon's Prime membership, which offers fast shipping, streaming services, and exclusive deals, has helped the company retain its dominant position in the e-commerce market.

In addition to Amazon, other online retailers such as Walmart and eBay also performed well in 2020. Walmart's aggressive expansion into online grocery shopping and eBay's continued focus on enhancing its platform's user experience have contributed to their success.

Energy Stocks Make a Comeback

Despite the uncertainty surrounding the global economy, energy stocks made a comeback in 2020. As the world slowly recovers from the pandemic, the demand for energy is expected to increase. Companies like ExxonMobil and Chevron experienced a surge in their stock prices due to rising oil prices.

ExxonMobil's commitment to innovation and its strategic focus on low-carbon energy solutions have positioned the company for sustainable growth. Similarly, Chevron's exploration and production activities, coupled with its robust dividend yield, make it an attractive investment option.

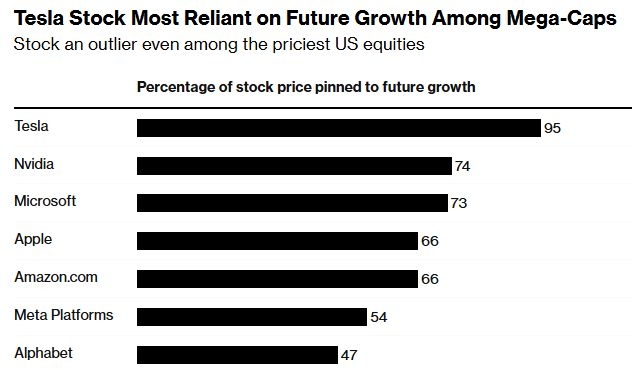

Case Study: Tesla

One of the standout performers in 2020 was Tesla, the electric vehicle (EV) manufacturer. Despite the global economic downturn, Tesla's stock price surged significantly. The company's innovative technology, robust product lineup, and ambitious expansion plans have made it a darling of the stock market.

Tesla's focus on developing a robust charging infrastructure, expanding its global presence, and diversifying its product portfolio has helped it maintain its growth trajectory. Its recent acquisition of solar panel manufacturer SolarCity and battery manufacturer Maxwell further strengthened its position in the renewable energy sector.

In conclusion, 2020 provided a unique opportunity for investors to identify high-performing stocks. Tech giants, e-commerce companies, energy stocks, and EV manufacturers were the stars of the year, delivering impressive returns to their investors. As we move forward, it's crucial to keep a close eye on these sectors and consider the best US stocks that have the potential to deliver sustainable growth.

toys r us stocks