Unlocking Opportunities: The Dynamic World of BLP US Stock

author:US stockS -In the ever-evolving landscape of the financial market, understanding the intricacies of the BLP US Stock can be a game-changer for investors. This article delves into the key aspects of BLP US Stock, offering insights into its potential, risks, and how to navigate this exciting market.

What is BLP US Stock?

BLP US Stock refers to the shares of the company BLP US, which operates in the United States. These stocks are traded on major exchanges, making them accessible to both retail and institutional investors. BLP US, like many other companies, offers a range of products and services that cater to diverse market segments.

Understanding the Market Dynamics

The stock market is influenced by a variety of factors, including economic indicators, company performance, and global events. To make informed decisions, investors need to stay updated with the latest market trends. Here's a breakdown of the key factors that can impact BLP US Stock:

- Economic Indicators: Economic indicators such as GDP growth, unemployment rates, and inflation can significantly affect the stock market. A strong economy often leads to higher stock prices, while a weak economy can cause them to fall.

- Company Performance: The financial health of BLP US, including its revenue, profits, and growth prospects, plays a crucial role in determining its stock price. Investors should analyze the company's quarterly and annual reports to gauge its performance.

- Global Events: Events such as political instability, trade wars, and natural disasters can have a profound impact on the stock market. These events can lead to volatility and uncertainty, making it essential for investors to stay informed.

Navigating the Risks

Investing in stocks always comes with risks, and BLP US Stock is no exception. Here are some of the key risks to consider:

- Market Risk: The stock market can be unpredictable, and prices can fluctuate significantly. This risk is inherent in all stock investments.

- Company-Specific Risk: Factors such as poor management decisions, product failures, or regulatory changes can impact the performance of BLP US and, consequently, its stock price.

- Liquidity Risk: If BLP US Stock is not highly traded, it may be difficult to buy or sell shares at a fair price.

Strategies for Success

To succeed in investing in BLP US Stock, it's important to adopt a strategic approach:

- Diversification: Diversifying your portfolio can help mitigate risks. By investing in a variety of stocks, you can reduce the impact of any single stock's performance on your overall portfolio.

- Long-Term Perspective: Investing in stocks is a long-term endeavor. By focusing on the long-term performance of BLP US, you can ride out short-term market volatility.

- Continuous Learning: Stay informed about the market and BLP US's performance. Continuous learning can help you make better investment decisions.

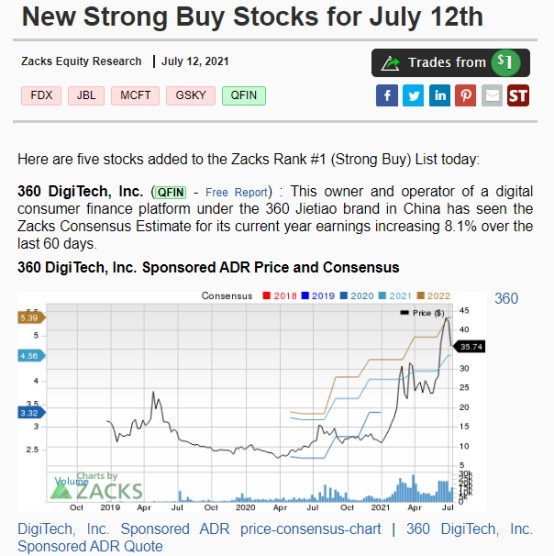

Case Study: BLP US Stock Performance

Let's consider a hypothetical case study to illustrate the potential of BLP US Stock. Over the past five years, BLP US has seen a steady increase in revenue and profits. During this period, the stock price has also appreciated significantly. This trend suggests that investing in BLP US Stock could be a profitable venture for long-term investors.

In conclusion, the world of BLP US Stock offers exciting opportunities for investors. By understanding the market dynamics, navigating the risks, and adopting a strategic approach, investors can potentially achieve substantial returns. Stay informed, stay disciplined, and keep exploring the dynamic world of BLP US Stock.

toys r us stocks