US Stock Collapse 2021: The Aftermath and Lessons Learned

author:US stockS -

The year 2021 marked a tumultuous period for the US stock market, witnessing a dramatic collapse that left investors reeling and policymakers grappling with the repercussions. This article delves into the causes, consequences, and lessons learned from the US stock collapse of 2021.

Causes of the Stock Market Collapse

The 2021 US stock market collapse can be attributed to several key factors:

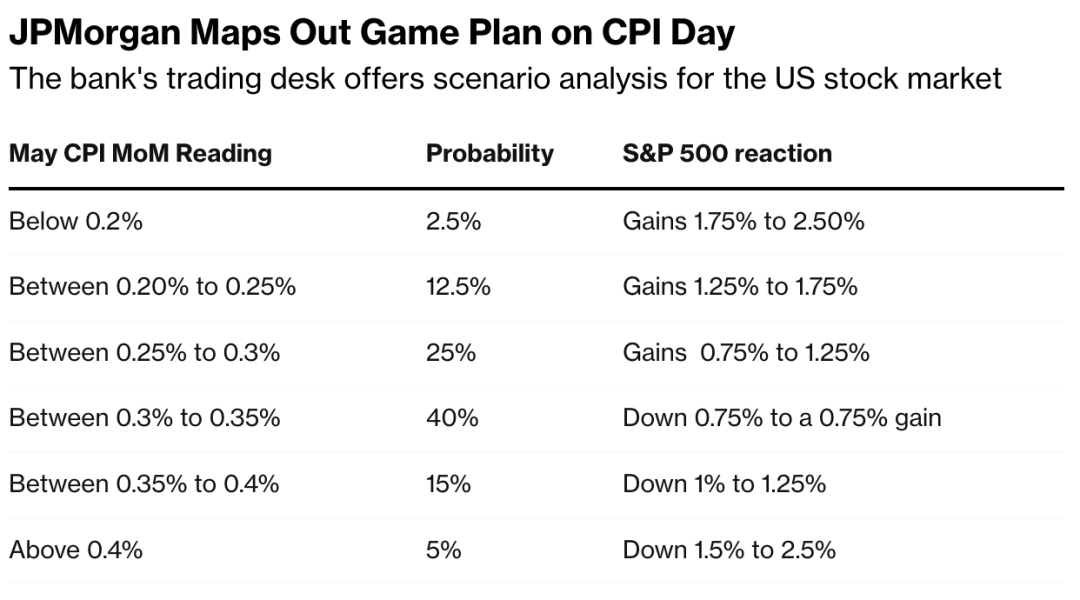

- Inflation Concerns: Rising inflation, driven by factors such as supply chain disruptions and increased consumer demand, raised concerns about the Federal Reserve's ability to control it. This led to a sell-off in stocks, particularly in sectors sensitive to inflation like energy and consumer goods.

- Rising Interest Rates: The Federal Reserve's decision to raise interest rates in response to inflation further contributed to the stock market downturn. Higher interest rates make borrowing more expensive, which can hurt corporate profits and investment returns.

- Economic Uncertainty: The ongoing COVID-19 pandemic and its economic impact continued to create uncertainty, leading investors to sell off stocks in search of safer assets.

Consequences of the Stock Market Collapse

The US stock market collapse of 2021 had several significant consequences:

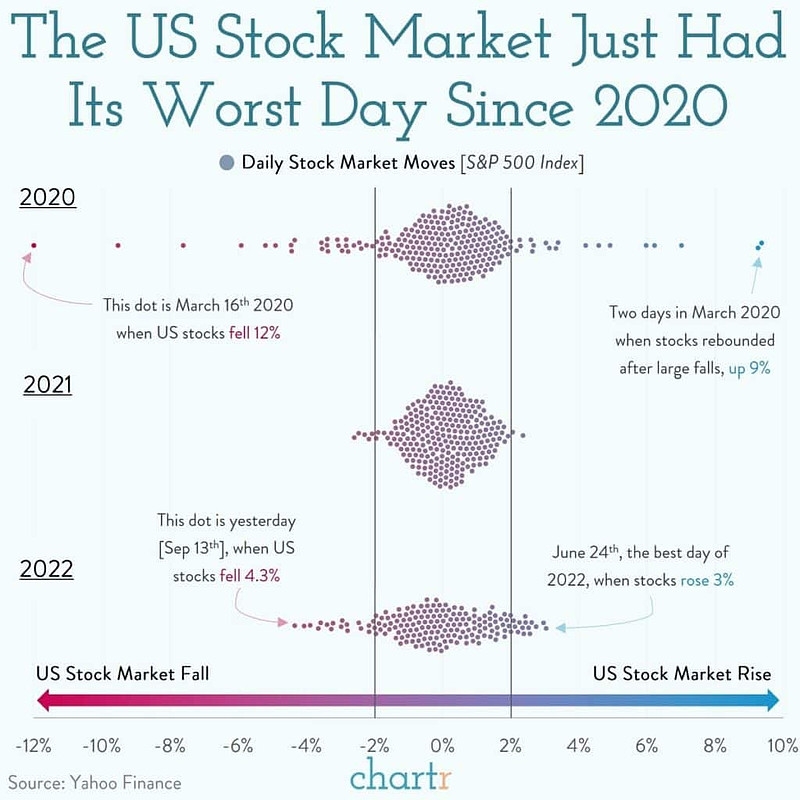

- Market Volatility: The stock market experienced unprecedented volatility, with wild swings in prices as investors reacted to the latest news and data. This volatility made it difficult for investors to predict market movements and make informed decisions.

- Investor Losses: Many investors, particularly those invested in riskier assets like stocks, suffered significant losses. This led to increased skepticism about the stock market and a shift towards more conservative investment strategies.

- Economic Impact: The stock market collapse had a broader economic impact, as it eroded investor confidence and led to reduced consumer spending. This, in turn, impacted corporate earnings and job creation.

Lessons Learned

The 2021 US stock market collapse offers several valuable lessons:

- Risk Management: Investors need to understand the risks associated with their investments and diversify their portfolios to mitigate potential losses.

- Economic Analysis: Staying informed about economic indicators and trends is crucial for making informed investment decisions.

- Long-Term Perspective: Investing should be a long-term endeavor, and investors should focus on their long-term goals rather than short-term market fluctuations.

Case Study: Tesla's Stock Collapse

One notable example of the 2021 stock market collapse was Tesla's stock, which experienced a significant downturn. The company's stock price plummeted by nearly 20% in a single day, amid concerns about rising costs and production delays.

This case highlights the importance of conducting thorough research and understanding the specific risks associated with individual stocks. Investors who were well-informed about Tesla's business and market conditions were better able to navigate the stock's volatility.

In conclusion, the US stock market collapse of 2021 was a complex event driven by a combination of factors. Understanding the causes, consequences, and lessons learned from this event can help investors better navigate future market downturns and make more informed investment decisions.

toys r us stocks