Total US Stock Market Volume: Insights and Analysis

author:US stockS -

The total US stock market volume is a critical indicator of market activity and investor sentiment. Understanding this metric can provide valuable insights into the health and trends of the US stock market. In this article, we delve into the concept of total US stock market volume, its significance, and how it can influence investment decisions.

What is Total US Stock Market Volume?

Total US stock market volume refers to the total number of shares traded on all US exchanges in a given period. This includes the New York Stock Exchange (NYSE), NASDAQ, and other regional exchanges. The volume is typically measured in shares and is an essential component of market analysis.

Significance of Total US Stock Market Volume

Market Activity: The total US stock market volume reflects the level of trading activity in the market. A high volume indicates strong market activity, while a low volume suggests a lack of interest or caution among investors.

Investor Sentiment: Total US stock market volume can provide insights into investor sentiment. A rising volume often indicates optimism and confidence, while a declining volume may suggest uncertainty or bearishness.

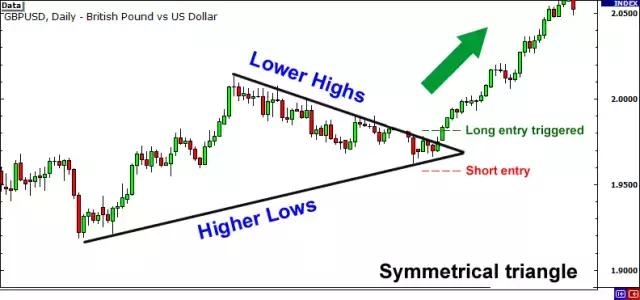

Market Trends: Analyzing the total US stock market volume over time can help identify trends and patterns. For example, a sustained increase in volume may indicate a strong upward trend, while a decrease in volume could signal a potential reversal.

Factors Influencing Total US Stock Market Volume

Several factors can influence the total US stock market volume:

Economic Indicators: Economic data, such as GDP growth, unemployment rates, and inflation, can impact investor confidence and, subsequently, market volume.

Political Events: Political events, such as elections or policy changes, can cause volatility and affect market volume.

Market News: News and rumors can create uncertainty and cause investors to react, leading to changes in market volume.

Case Study: The 2020 Stock Market Crash

One notable example of the impact of total US stock market volume is the 2020 stock market crash. In February 2020, the total US stock market volume reached an all-time high of 11.2 billion shares. However, by March, the volume plummeted to 4.3 billion shares as the market crashed due to the COVID-19 pandemic.

This case study highlights how sudden and unexpected events can cause significant changes in market volume and investor sentiment.

Conclusion

Total US stock market volume is a vital metric for understanding market activity, investor sentiment, and trends. By analyzing this metric, investors can gain valuable insights into the health and potential future movements of the US stock market. As always, it's crucial to consider various factors and conduct thorough research before making investment decisions.

toys r us stocks