Stocks That Have Dropped Recently: Identifying Opportunities and Risks

author:US stockS -

In the volatile world of the stock market, it's not uncommon for certain stocks to experience a sudden drop in value. These fluctuations can be due to a variety of factors, including economic changes, company-specific issues, or broader market trends. For investors, identifying stocks that have dropped recently can be a critical step towards capitalizing on potential opportunities or mitigating risks. In this article, we'll delve into what drives these drops, how to identify them, and what it means for your investment strategy.

Understanding the Reasons for Stock Drops

1. Economic Factors: Economic downturns, such as recessions or inflationary pressures, can significantly impact stock prices. Companies that are heavily dependent on consumer spending or have high levels of debt may be particularly vulnerable to economic shifts.

2. Company-Specific Issues: Negative news or developments within a company, such as poor earnings reports, management changes, or product recalls, can lead to a drop in stock price.

3. Market Sentiment: Investor sentiment can also drive stock prices. If investors lose confidence in a particular sector or company, they may sell off their shares, leading to a drop in prices.

Identifying Stocks That Have Dropped Recently

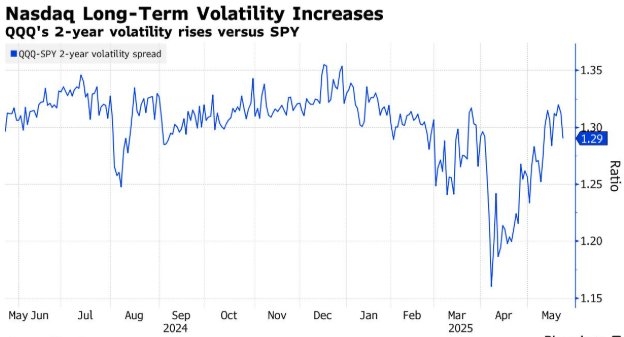

1. Stock Price Volatility: One of the first indicators of a potential drop in stock price is increased volatility. This can be seen in sudden and significant price swings.

2. Negative News: Pay close attention to any negative news or developments related to a particular stock. This can include earnings reports, regulatory issues, or product recalls.

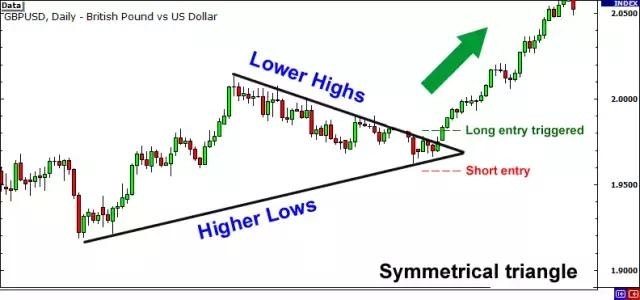

3. Technical Analysis: Technical analysis tools, such as moving averages and oscillators, can help identify stocks that are showing signs of weakness.

Opportunities and Risks

1. Opportunities: Stocks that have dropped recently may present attractive buying opportunities. If the drop is due to a temporary issue or market sentiment, the stock may rebound in the future.

2. Risks: However, it's important to carefully evaluate the reasons behind the drop. If the drop is due to long-term issues, such as poor financial performance or industry challenges, the stock may continue to decline.

Case Study: Tesla

Consider the case of Tesla, which experienced a significant drop in stock price following its earnings report in the first quarter of 2022. The drop was attributed to concerns about supply chain disruptions and production delays. While some investors sold off their shares, others saw this as an opportunity to buy at a lower price. In the following months, Tesla's stock price recovered, demonstrating the potential for upside in stocks that have dropped recently.

Conclusion

In conclusion, stocks that have dropped recently can present both opportunities and risks. By understanding the reasons behind the drops and using the right tools and analysis, investors can make informed decisions. Whether you're looking for a short-term trading opportunity or a long-term investment, it's important to do your homework and stay informed about market trends and company-specific news.

toys r us stocks