US Semiconductors Stocks: A Comprehensive Guide to Investment Opportunities

author:US stockS -

In the rapidly evolving technology landscape, US semiconductors stocks have become a cornerstone for investors seeking high-growth opportunities. These companies are at the forefront of innovation, driving advancements in various industries, from automotive to consumer electronics. This article delves into the world of US semiconductors stocks, exploring key players, market trends, and investment strategies.

Understanding the Semiconductors Industry

The semiconductor industry is a crucial component of the global technology ecosystem. These tiny electronic components are essential for a wide range of applications, including computers, smartphones, and automotive systems. The industry is characterized by rapid technological advancements, intense competition, and high barriers to entry.

Key Players in the US Semiconductors Market

Several leading US semiconductor companies dominate the market, each with its unique strengths and market positioning. Here are some of the key players:

- Intel Corporation: As one of the oldest and most established semiconductor companies, Intel is a leader in CPU and GPU technology. The company's recent focus on developing advanced process technologies, such as 3nm, positions it for future growth.

- Texas Instruments: Known for its wide range of analog and embedded processing products, Texas Instruments has a strong presence in the automotive, industrial, and consumer electronics markets.

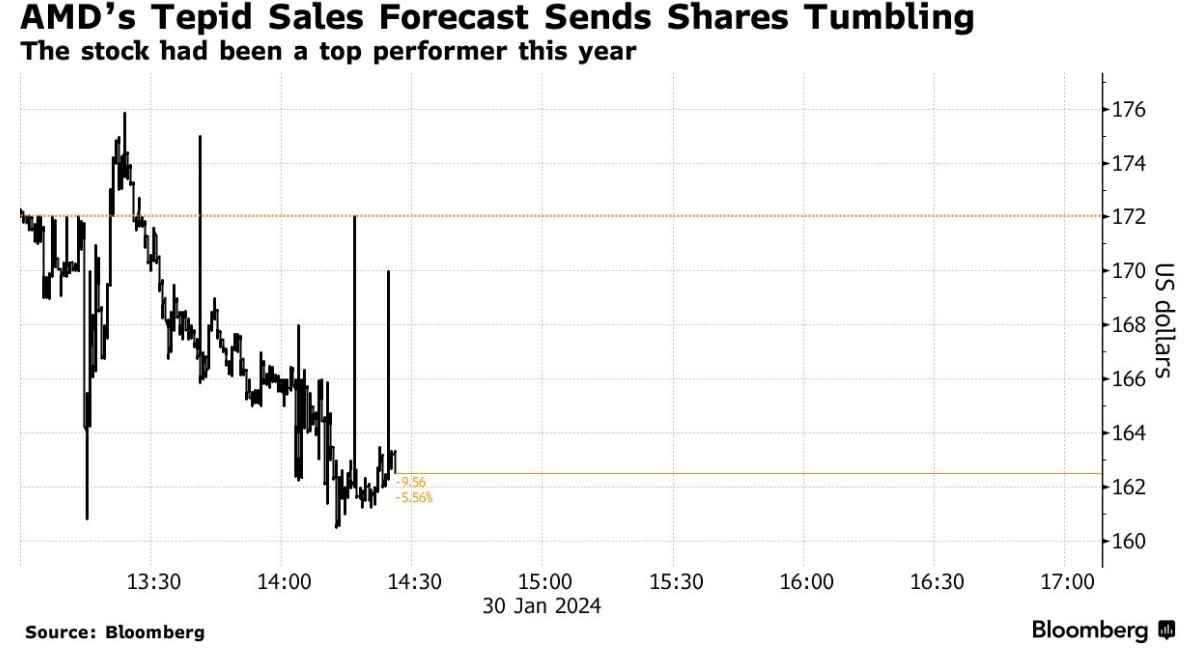

- AMD: AMD has gained significant market share in the CPU and GPU markets, particularly with its Ryzen and Radeon products. The company's competitive pricing and innovative designs have helped it challenge Intel's dominance.

- NVIDIA: As a leader in GPU technology, NVIDIA has expanded its presence into AI, autonomous vehicles, and data center markets. The company's cutting-edge graphics processing units (GPUs) are crucial for high-performance computing and gaming applications.

Market Trends and Opportunities

The semiconductor industry is driven by several key trends, including:

- Increased demand for high-performance computing: As data centers and AI applications continue to grow, the demand for high-performance computing hardware, such as GPUs and CPUs, is expected to rise.

- Automotive semiconductor market: The automotive industry is undergoing a significant transformation, with the rise of electric vehicles and autonomous driving technologies. This trend is expected to drive demand for semiconductors in the automotive sector.

- 5G technology: The rollout of 5G networks is expected to drive increased demand for semiconductors in various applications, including mobile devices, IoT, and industrial automation.

Investment Strategies for US Semiconductors Stocks

Investing in US semiconductors stocks requires a thorough understanding of the industry and its key players. Here are some investment strategies to consider:

- Diversify your portfolio: Investing in a mix of semiconductor companies can help mitigate risks associated with market fluctuations and technological changes.

- Focus on innovation: Companies with a strong focus on research and development are more likely to adapt to market changes and stay competitive.

- Analyze financial metrics: Evaluate key financial metrics, such as revenue growth, profit margins, and debt levels, to assess the financial health of a semiconductor company.

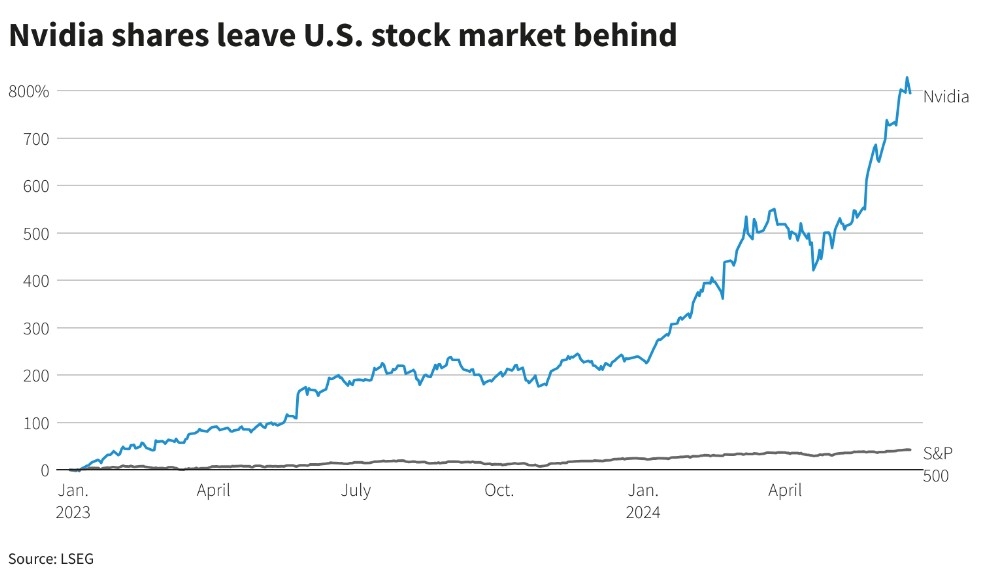

Case Study: NVIDIA's Growth Story

NVIDIA's rise to prominence in the semiconductor industry is a testament to the power of innovation and strategic positioning. The company's focus on GPU technology has allowed it to capture significant market share in various sectors, including gaming, AI, and autonomous vehicles. By investing in cutting-edge research and development, NVIDIA has been able to stay ahead of the competition and drive growth.

In conclusion, US semiconductors stocks offer exciting investment opportunities for those willing to navigate the complexities of the industry. By understanding key players, market trends, and investment strategies, investors can make informed decisions and potentially benefit from the high-growth potential of this dynamic sector.

toys r us stocks