Maximizing Your Financial Potential: A Comprehensive Guide to Finac

author:US stockS -

In today's fast-paced world, managing your finances effectively is crucial for achieving long-term success. Whether you're a seasoned investor or just starting out, understanding the basics of financial management can make a significant difference in your life. This article delves into the concept of Finac, offering insights into how you can maximize your financial potential.

Understanding Finac

The term "Finac" is a portmanteau of "finance" and "accelerate." It refers to the process of accelerating your financial growth and stability through strategic planning and smart investments. By adopting a Finac approach, you can ensure that your financial future is secure and prosperous.

Setting Financial Goals

The first step in implementing a Finac strategy is to set clear, achievable financial goals. These goals should be specific, measurable, attainable, relevant, and time-bound (SMART). For instance, you might aim to save a certain percentage of your income each month or invest in a diversified portfolio.

Budgeting and Expense Management

Creating a budget is essential for managing your finances effectively. Track your income and expenses, and prioritize your spending. Allocate funds for essential expenses, savings, and investments. By doing so, you can ensure that you're not overspending and that you're consistently moving towards your financial goals.

Building an Emergency Fund

An emergency fund is a crucial component of a solid financial plan. It provides a financial cushion in case of unexpected expenses or loss of income. Aim to save at least three to six months' worth of living expenses in a separate, easily accessible account.

Investing Wisely

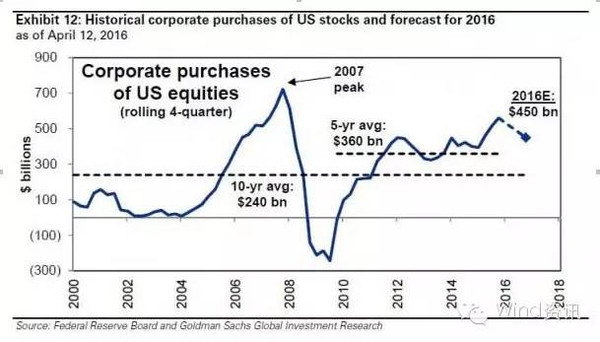

Investing is a powerful tool for growing your wealth over time. However, it's important to invest wisely. Educate yourself on different investment options, such as stocks, bonds, mutual funds, and real estate. Consider your risk tolerance, investment horizon, and financial goals when selecting investments.

Case Study: John's Finac Journey

John, a 30-year-old software engineer, decided to adopt a Finac approach to manage his finances. He started by setting clear financial goals, including saving for retirement and purchasing a home. John created a budget, allocated funds for savings and investments, and built an emergency fund.

Within a year, John had saved $10,000 for his emergency fund and was consistently investing a portion of his income. He diversified his portfolio, investing in a mix of stocks, bonds, and mutual funds. As a result, John's investments grew by 15% over the next two years, significantly boosting his financial stability.

Conclusion

By adopting a Finac approach, you can take control of your financial future and achieve your goals. Remember to set clear financial goals, manage your expenses, build an emergency fund, and invest wisely. With dedication and discipline, you can maximize your financial potential and secure a prosperous future.

toys r us stocks