US Futures Stock Market Reaction: A Comprehensive Analysis

author:US stockS -

The stock market is a dynamic and ever-evolving landscape, where investors and traders alike are constantly seeking insights to inform their decisions. One key area of focus is the US futures stock market, which serves as a bellwether for the broader market. In this article, we delve into the various factors that influence the reaction of the US futures stock market and how investors can leverage this information to their advantage.

Understanding the US Futures Stock Market

The US futures stock market is a segment of the stock market that operates outside of regular trading hours. It allows investors to trade contracts based on the expected prices of various stocks, indices, and commodities. This market is particularly significant because it provides a glimpse into how the market might open the next day, giving investors an opportunity to anticipate market movements.

Key Factors Influencing the US Futures Stock Market

Several factors can influence the reaction of the US futures stock market. Here are some of the most notable:

- Economic Data: Economic indicators such as GDP, unemployment rates, and inflation data can significantly impact the stock market. For instance, if the GDP growth rate is higher than expected, it could lead to a positive reaction in the futures market.

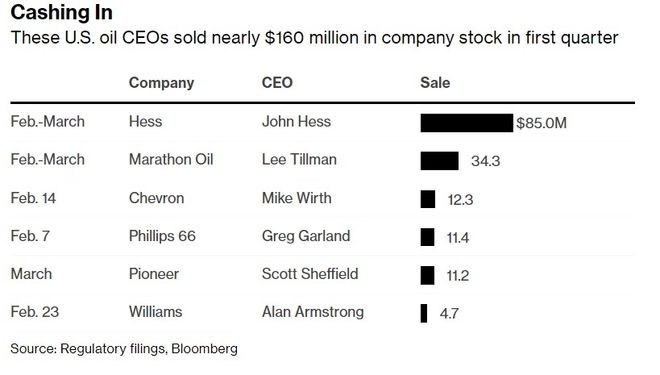

- Corporate Earnings Reports: When companies release their earnings reports, investors closely analyze the financial results to gauge the company's performance and future prospects. Positive earnings reports can drive the futures market higher, while negative reports can lead to a downturn.

- Global Events: Global events, such as political instability or natural disasters, can have a profound impact on the US futures stock market. For example, the COVID-19 pandemic caused a sharp decline in the stock market, as investors became concerned about the economic outlook.

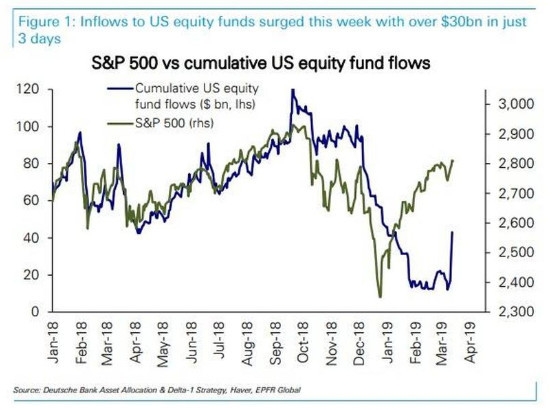

- Market Sentiment: The overall sentiment of investors can also influence the futures market. When investors are optimistic about the market, they are more likely to buy stocks, leading to a positive reaction in the futures market. Conversely, negative sentiment can lead to a sell-off.

Case Studies: The Impact of Key Events on the US Futures Stock Market

To illustrate the impact of key events on the US futures stock market, let's consider a few case studies:

- Brexit: In 2016, the UK voted to leave the European Union, causing significant uncertainty in the global markets. The US futures stock market reacted negatively, with the S&P 500 futures falling sharply in the days following the vote.

- COVID-19 Pandemic: As mentioned earlier, the COVID-19 pandemic caused a sharp decline in the stock market. The US futures market was no exception, with the S&P 500 futures falling to record lows in March 2020.

- Election of Joe Biden: The election of Joe Biden as President of the United States in 2020 led to a positive reaction in the futures market. Investors were optimistic about the potential for infrastructure spending and other stimulus measures.

Conclusion

The US futures stock market is a valuable tool for investors seeking to anticipate market movements. By understanding the key factors that influence the market and analyzing past events, investors can make more informed decisions. As always, it's important to do your own research and consult with a financial advisor before making any investment decisions.

toys r us stocks