US Stock Market Analysis: February 11, 2019

author:US stockS -

The stock market is a dynamic and ever-changing landscape, and the day of February 11, 2019, was no exception. This article delves into the key events, trends, and insights that shaped the US stock market on that historic day. By understanding the context and the market's response, investors can gain valuable insights into the factors that drive stock prices and market movements.

Market Overview

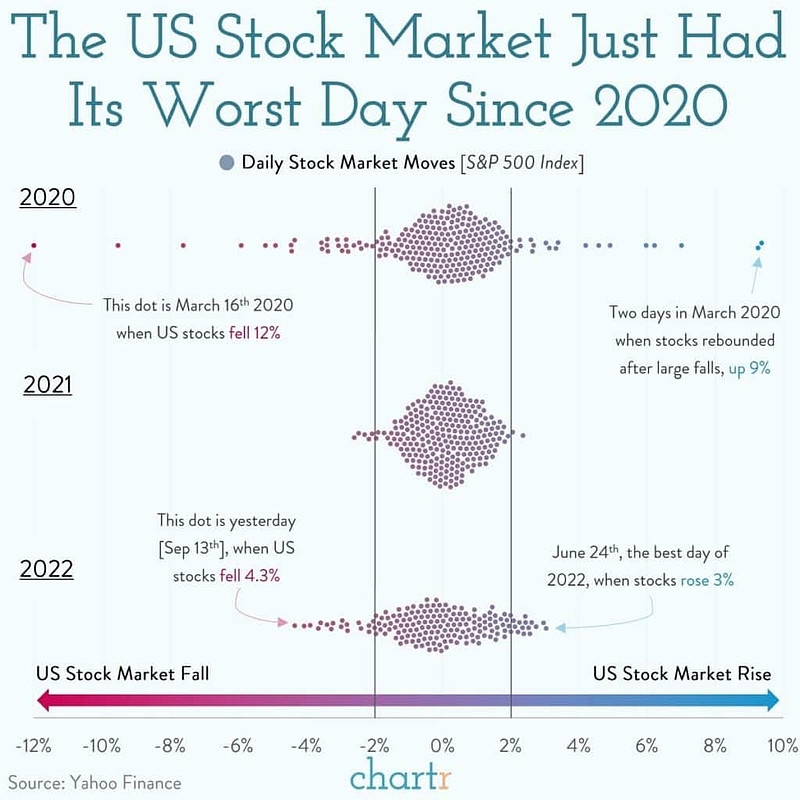

On February 11, 2019, the US stock market experienced a significant shift, with major indices like the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite all witnessing notable movements. The day's trading was marked by volatility, as investors reacted to a mix of economic data, corporate earnings reports, and geopolitical events.

Economic Data

One of the key factors influencing the stock market on February 11, 2019, was the release of economic data. The US Department of Labor reported a lower-than-expected unemployment rate, which initially sent the market higher. However, as the day progressed, investors began to question the sustainability of the economic growth, leading to a sell-off in the afternoon.

Corporate Earnings Reports

Corporate earnings reports also played a crucial role in shaping the market's direction on February 11, 2019. Several major companies, including Apple and Microsoft, reported strong earnings, which initially boosted investor confidence. However, as the day went on, some companies issued cautious outlooks, which caused investors to become more cautious and led to a pullback in the market.

Geopolitical Events

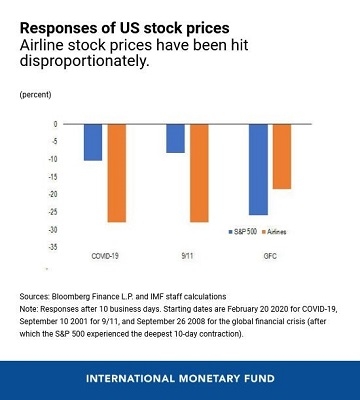

Geopolitical events also had a significant impact on the US stock market on February 11, 2019. Tensions between the United States and Iran were high, and investors were concerned about the potential for a military conflict. This uncertainty contributed to the market's volatility, as investors weighed the potential risks and rewards.

Market Movements

The S&P 500, one of the most widely followed stock market indices, opened the day at 2,840.76 and closed at 2,820.23, a decline of 0.5%. The Dow Jones Industrial Average, which includes 30 of the largest companies in the United States, opened at 25,874.94 and closed at 25,817.86, a decline of 0.3%. The Nasdaq Composite, which tracks the performance of technology stocks, opened at 7,912.23 and closed at 7,904.86, a decline of 0.1%.

Case Study: Apple Inc.

One notable case study from February 11, 2019, was the earnings report from Apple Inc. The company reported strong revenue and earnings, which initially sent its stock higher. However, as the day went on, investors began to question the sustainability of Apple's growth, leading to a pullback in the stock price.

Conclusion

February 11, 2019, was a day of significant volatility in the US stock market, driven by a mix of economic data, corporate earnings reports, and geopolitical events. By understanding the key factors that influenced the market on that day, investors can gain valuable insights into the factors that drive stock prices and market movements. As the stock market continues to evolve, staying informed and adaptable is crucial for success.

new york stock exchange