Can Indians Buy US Stocks? A Comprehensive Guide

author:US stockS -

Are you an Indian investor looking to expand your portfolio? One of the most popular destinations for international investment is the United States. But can Indians buy US stocks? The answer is a resounding yes! This guide will explore the process, advantages, and considerations for investing in US stocks from India.

Understanding the Basics

Firstly, it's important to understand that investing in US stocks means purchasing shares of companies listed on American stock exchanges, such as the New York Stock Exchange (NYSE) or the NASDAQ. These exchanges offer a diverse range of companies across various industries, from technology giants like Apple and Microsoft to consumer goods companies like Procter & Gamble.

How Can Indians Buy US Stocks?

1. Open a Foreign Currency Account: To invest in US stocks, you need a foreign currency account. Indian investors can open an account with a bank that offers international trading services. This account will allow you to hold US dollars and other foreign currencies.

2. Open a Brokerage Account:

3. Convert INR to USD: Once your accounts are set up, you can convert your Indian rupees (INR) to US dollars (USD) through your brokerage account or a bank. This currency exchange is necessary to fund your investment.

4. Research and Select Stocks: Conduct thorough research on the companies you are interested in. Look for companies with strong fundamentals, a good track record, and a promising future. Remember to consider your risk tolerance and investment goals.

5. Place Your Order: Using your brokerage account, place an order to buy shares of the selected company. You can choose from various order types, including market orders, limit orders, and stop orders.

Advantages of Investing in US Stocks from India

1. Diversification: Investing in US stocks allows Indian investors to diversify their portfolios and reduce risk. The US market is one of the largest and most developed in the world, offering exposure to a wide range of sectors and industries.

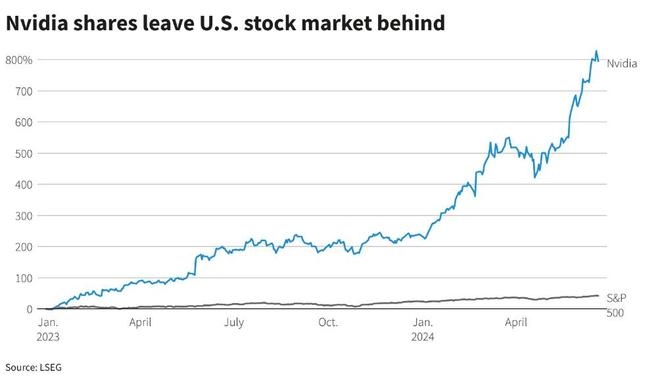

2. Potential for High Returns: Historically, the US stock market has provided significant returns for investors. Investing in companies like Apple, Amazon, and Google can offer substantial growth potential.

3. Access to Cutting-Edge Technology and Innovation: The US is home to many leading technology and innovation companies. Investing in these companies can provide exposure to the latest advancements and technologies.

Considerations for Indian Investors

1. Currency Fluctuations: Exchange rate fluctuations can impact your investment returns. Monitor the USD/INR exchange rate regularly and consider using hedging strategies to mitigate risks.

2. Regulatory Differences: Be aware of the regulatory differences between Indian and US markets. Understand the tax implications and reporting requirements for your investments.

3. Transaction Costs: Be mindful of transaction costs, such as brokerage fees and currency conversion fees, as they can affect your overall returns.

Case Study: Investing in Apple

Consider an Indian investor who invested

Conclusion

Investing in US stocks can be a lucrative opportunity for Indian investors. By understanding the process, considering the risks, and conducting thorough research, you can build a diversified and potentially profitable portfolio. So, can Indians buy US stocks? Absolutely!

new york stock exchange