US Stock Indexes Drift Lower After a Relentless Rally

author:US stockS -

After a relentless rally that has seen US stock indexes soar to new heights, investors are now facing a reality check. The relentless rise has led to concerns about overheating and market saturation, causing some investors to reconsider their positions. In this article, we delve into the reasons behind the recent downward trend and what it could mean for the future of the stock market.

What Caused the Downtrend?

The primary reasons for the recent downward trend in US stock indexes include:

- Economic Concerns: The global economy is facing a host of challenges, including trade tensions, rising inflation, and slowing growth. These factors have led to increased uncertainty in the market, causing investors to pull back on their investments.

- Valuation Concerns: The stock market has reached historic highs, and some investors are concerned that the current valuations may be too high, making it risky to invest in certain sectors.

- Rate Hikes by the Federal Reserve: The Federal Reserve has signaled that it plans to continue raising interest rates, which can have a negative impact on the stock market, as higher rates can increase borrowing costs and slow economic growth.

Impact on Different Sectors

The downward trend has affected various sectors differently:

- Tech Stocks: The tech sector, which has been one of the strongest performers over the past few years, has seen some of the biggest declines. Companies like Apple and Microsoft have been among the hardest hit.

- Financial Stocks: The financial sector has also been impacted, as rising interest rates can affect the profitability of banks and other financial institutions.

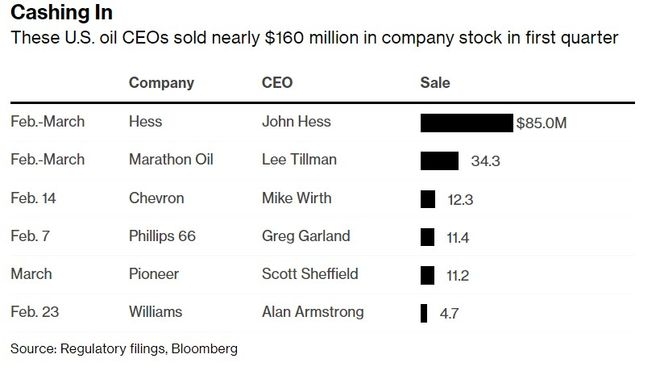

- Energy Stocks: Energy stocks have seen some positive movement, as the rise in oil prices has helped to boost their valuations.

Case Study: Apple Inc.

Apple Inc., one of the largest companies in the world, has been among the hardest hit by the recent downturn. The stock has seen a significant decline in recent months, as investors have become concerned about the company's growth prospects and the impact of the global economy on its revenue.

What Does the Future Hold?

While the current downward trend in US stock indexes is concerning, it is important to remember that markets can be unpredictable. Here are a few factors that could impact the future of the stock market:

- Economic Growth: If the global economy can maintain a moderate pace of growth, the stock market may continue to perform well.

- Policy Decisions: The Federal Reserve's decision on interest rates and government policy decisions will also play a crucial role in the stock market's future performance.

- Market Sentiment: Investor sentiment can quickly shift, and the stock market could see a turnaround if investor optimism returns.

In conclusion, the recent downward trend in US stock indexes is a wake-up call for investors who have been riding the relentless rally. While concerns about economic uncertainty and market saturation are valid, it is important to keep a long-term perspective and focus on the factors that will ultimately drive the market's performance.

new york stock exchange