Recent Earnings Momentum: A Look into US Stocks

author:US stockS -

In the ever-evolving landscape of the stock market, recent earnings momentum has become a crucial factor for investors seeking to capitalize on potential growth. This article delves into the current trends in US stocks, highlighting key sectors and companies that are driving the market's upward trajectory.

Understanding Earnings Momentum

Earnings momentum refers to the rate at which a company's earnings are growing. It is a critical indicator of a company's financial health and potential for future growth. Companies with strong earnings momentum are often seen as attractive investment opportunities, as they are likely to continue generating profits and increasing their stock prices.

Recent Trends in US Stocks

The US stock market has seen a surge in recent earnings momentum, driven by several key factors. Let's take a closer look at some of the most notable trends:

1. Technology Sector

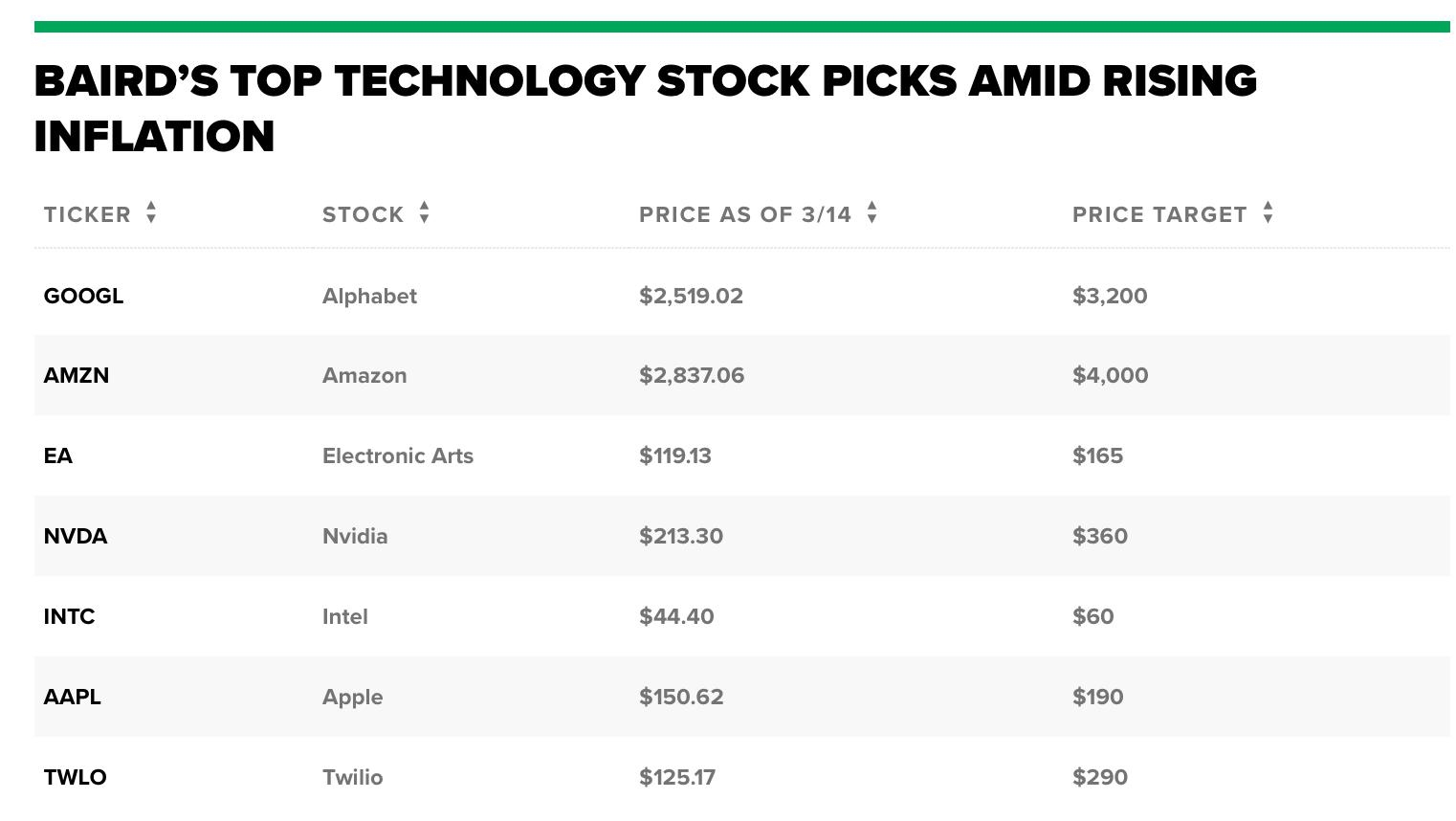

The technology sector has been a major driver of recent earnings momentum in the US stock market. Companies like Apple, Microsoft, and Amazon have reported strong earnings growth, driven by increased demand for their products and services. The rise of remote work and digital transformation has further fueled this growth, making the technology sector a key area to watch.

2. Healthcare Sector

The healthcare sector has also seen significant earnings momentum, thanks to the growing demand for medical products and services. Companies like Johnson & Johnson, Pfizer, and Moderna have reported strong earnings growth, driven by increased sales of vaccines and other healthcare products. The aging population and advancements in medical technology are expected to continue driving this trend.

3. Consumer Discretionary Sector

The consumer discretionary sector has experienced a surge in recent earnings momentum, driven by increased consumer spending. Companies like Disney, Nike, and Home Depot have reported strong earnings growth, as consumers have resumed spending on leisure activities and home improvement projects. The ongoing recovery from the COVID-19 pandemic is expected to further boost this trend.

Case Studies

To illustrate the recent earnings momentum in the US stock market, let's take a look at a few case studies:

1. Apple Inc.

Apple Inc. has been a leader in the technology sector, reporting strong earnings growth quarter after quarter. The company's iPhone, iPad, and Mac products have seen increased demand, driven by the rise of remote work and online learning. Apple's earnings momentum is expected to continue, as the company continues to innovate and expand its product lineup.

2. Johnson & Johnson

Johnson & Johnson has reported strong earnings growth, driven by increased sales of its healthcare products. The company's vaccine and pharmaceutical products have seen significant demand, particularly during the COVID-19 pandemic. Johnson & Johnson's earnings momentum is expected to continue, as the company continues to invest in research and development to bring new products to market.

Conclusion

Recent earnings momentum in the US stock market has been driven by strong performance in key sectors such as technology, healthcare, and consumer discretionary. Investors looking to capitalize on this trend should consider companies with strong earnings momentum and a solid track record of growth. As always, it is important to conduct thorough research and consult with a financial advisor before making any investment decisions.

new york stock exchange