US Airline Stocks to Buy: A Comprehensive Guide

author:US stockS -

Are you looking to invest in the aviation industry but unsure which airline stocks to buy? With the rise of low-cost carriers and the ongoing recovery of the aviation sector, there are numerous opportunities available. This article will explore some of the best US airline stocks to consider for investment in 2023.

Delta Air Lines (DAL)

Delta Air Lines is one of the largest airlines in the United States and a leading carrier in the global aviation industry. The company has a strong financial position and a diverse route network, making it an attractive investment opportunity. Delta has also been investing in its fleet and technology, which should help it maintain its competitive edge in the industry.

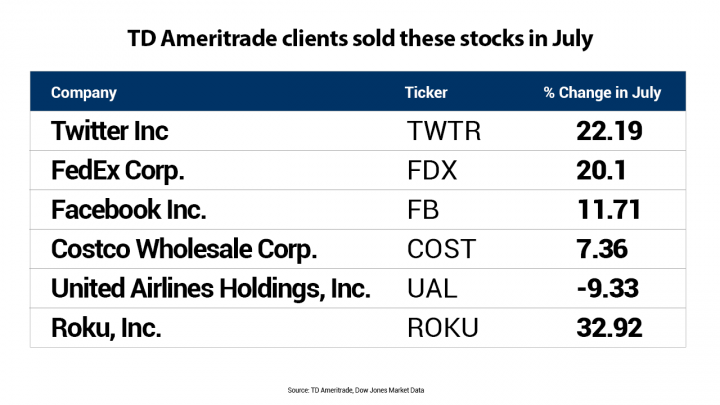

United Airlines (UAL)

United Airlines is another major US airline with a robust route network and a solid financial position. The company has been making significant investments in its fleet and customer experience, which should help it attract more passengers. United also has a strong presence in international markets, which could benefit from the ongoing recovery in global travel.

American Airlines (AAL)

American Airlines is the largest airline in the United States and a leading carrier in the global aviation industry. The company has a diverse route network and a strong financial position, making it an attractive investment opportunity. American has also been investing in its fleet and technology, which should help it maintain its competitive edge in the industry.

Southwest Airlines (LUV)

Southwest Airlines is known for its low-cost, no-frills approach to flying. The company has a strong financial position and a loyal customer base, making it an attractive investment opportunity. Southwest has also been investing in its fleet and technology, which should help it maintain its competitive edge in the low-cost airline market.

JetBlue Airways (JBLU)

JetBlue Airways is a leading low-cost carrier in the United States with a strong focus on customer service. The company has a solid financial position and a growing route network, making it an attractive investment opportunity. JetBlue has also been investing in its fleet and technology, which should help it maintain its competitive edge in the low-cost airline market.

Case Study: Alaska Airlines (ALK)

Alaska Airlines is a regional carrier with a strong focus on customer service and a commitment to sustainability. The company has a solid financial position and a growing route network, making it an attractive investment opportunity. Alaska Airlines has also been investing in its fleet and technology, which should help it maintain its competitive edge in the regional airline market.

Conclusion

Investing in airline stocks can be a lucrative opportunity, but it's important to do your research and understand the risks involved. The airlines mentioned in this article are some of the best US airline stocks to consider for investment in 2023. However, it's essential to conduct your own due diligence and consult with a financial advisor before making any investment decisions.

new york stock exchange