Should I Sell US Stocks?

author:US stockS -

Are you contemplating selling your US stocks? This is a decision that requires careful consideration, especially given the current volatile market conditions. In this article, we will explore the factors you should consider before making this crucial decision. We will delve into the current market trends, the impact of economic indicators, and the potential risks and rewards of selling your US stocks.

Understanding the Current Market Trends

The stock market is a dynamic entity that is influenced by a multitude of factors. Before deciding to sell your US stocks, it is essential to understand the current market trends. As of now, the US stock market is experiencing a mix of growth and uncertainty. While some sectors are performing exceptionally well, others are struggling.

Economic Indicators to Consider

Economic indicators play a significant role in determining the performance of the stock market. Before selling your US stocks, it is crucial to consider the following economic indicators:

- Interest Rates: The Federal Reserve's decision to raise or lower interest rates can have a significant impact on the stock market. Higher interest rates can lead to increased borrowing costs, which may negatively affect the stock market.

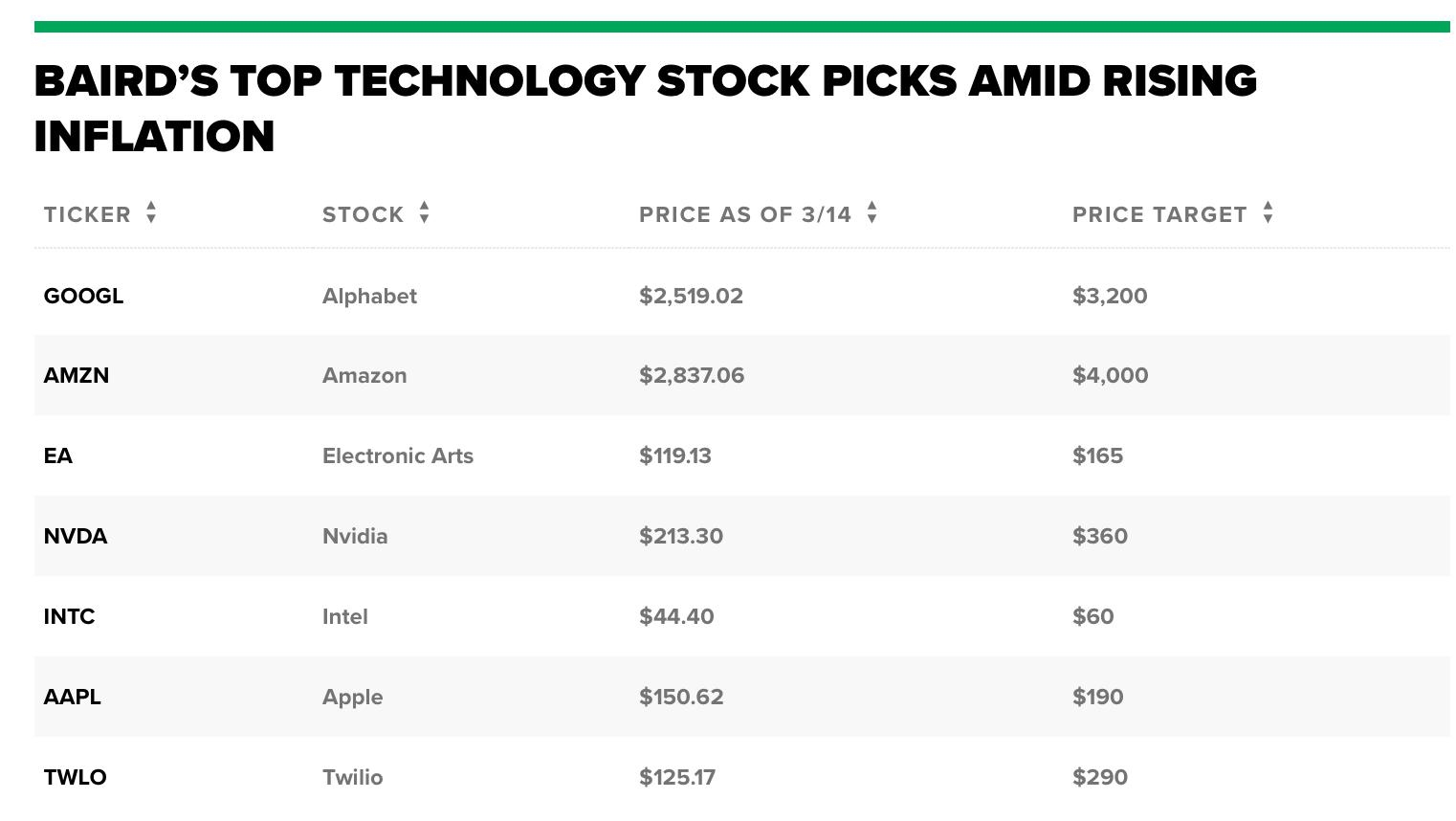

- Inflation: Inflation can erode the purchasing power of your investments. Monitoring inflation rates is essential to understand the potential impact on your investments.

- GDP Growth: The Gross Domestic Product (GDP) is a measure of the economic health of a country. A strong GDP growth rate can indicate a robust economy, which is typically positive for the stock market.

Risks and Rewards of Selling Your US Stocks

Selling your US stocks comes with its own set of risks and rewards. Here are some factors to consider:

Risks:

- Market Volatility: The stock market is subject to volatility, which can lead to significant fluctuations in your investment value.

- Economic Uncertainty: Economic factors such as inflation, interest rates, and political instability can impact the stock market.

- Tax Implications: Selling your stocks may result in capital gains tax, which can affect your overall investment returns.

Rewards:

- Potential for Higher Returns: Selling your stocks and reinvesting in other assets may provide you with the opportunity to achieve higher returns.

- Diversification: Selling your stocks can help you diversify your investment portfolio, reducing your exposure to market risks.

- Access to Cash: Selling your stocks can provide you with access to cash, which can be used for various purposes, such as paying off debts or funding other investments.

Case Studies

To illustrate the potential impact of selling US stocks, let's consider two case studies:

- Case Study 1: An investor sold their US stocks during the 2008 financial crisis, resulting in significant losses. However, they were able to reinvest in other assets, which eventually provided them with higher returns.

- Case Study 2: An investor decided to sell their US stocks after witnessing a surge in inflation. By doing so, they were able to mitigate the potential impact of inflation on their investments.

In conclusion, deciding whether to sell your US stocks is a complex decision that requires careful consideration of various factors. By understanding the current market trends, economic indicators, and the potential risks and rewards, you can make an informed decision that aligns with your investment goals and risk tolerance.

new york stock exchange