Title: Unlocking Success: Top US Stocks with Strong Fundamentals

author:US stockS -

In the vast and dynamic world of US stocks, identifying companies with strong fundamentals can be the key to long-term success and substantial returns. These stocks are often overlooked but hold the potential for significant growth. This article will delve into the importance of strong fundamentals and highlight some of the top US stocks that have stood the test of time.

Understanding Strong Fundamentals

Before diving into specific stocks, it's crucial to understand what constitutes strong fundamentals. These include factors such as strong financial statements, high profitability, robust growth prospects, and strong management. Companies with these attributes are more likely to weather economic downturns and deliver consistent returns over the long term.

Financial Statements

One of the first places to look when evaluating a company's fundamentals is its financial statements. These include the balance sheet, income statement, and cash flow statement. Key metrics to look at include:

- Earnings Per Share (EPS): This measures the company's profitability on a per-share basis.

- Price-to-Earnings (P/E) Ratio: This compares the company's stock price to its EPS, providing an indication of how much investors are willing to pay for each dollar of earnings.

- Return on Equity (ROE): This measures how efficiently a company is using its shareholders' equity to generate profits.

- Debt-to-Equity Ratio: This compares the company's debt to its equity, indicating how leveraged the company is.

Profitability and Growth

Beyond financial statements, companies with strong profitability and growth prospects are also desirable. Look for companies with a consistent history of increasing earnings and revenue, as well as positive cash flow. Here are a few companies that have demonstrated these qualities:

- Apple Inc. (AAPL): With its strong brand, innovative products, and robust financials, Apple is a classic example of a company with strong fundamentals.

- Microsoft Corporation (MSFT): Microsoft has a diversified portfolio of products and services, with a strong focus on cloud computing and AI, making it another top pick.

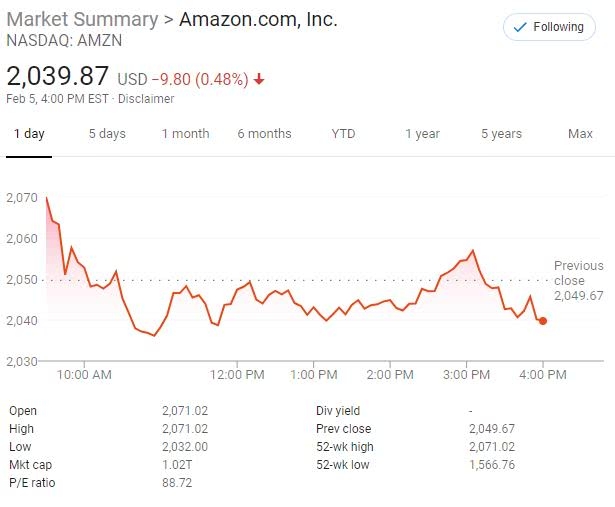

- Amazon.com Inc. (AMZN): Despite recent market volatility, Amazon remains a leader in e-commerce and cloud computing, with impressive growth prospects.

Management and Industry Position

Lastly, it's important to consider the quality of a company's management and its position in the industry. Look for companies with a strong leadership team and a clear vision for the future. In addition, companies with a strong position in their respective industries are more likely to weather industry-specific challenges.

Case Study: Visa Inc. (V)

One company that has consistently demonstrated strong fundamentals is Visa Inc. (V). With a strong balance sheet, high profitability, and a leadership position in the global payments industry, Visa has been a top performer for investors.

Visa's financial statements are a testament to its strong fundamentals. The company has a solid track record of increasing EPS, a strong P/E ratio, and a high ROE. Additionally, Visa's debt-to-equity ratio is low, indicating its financial stability.

Furthermore, Visa's management team is well-respected, and the company has a strong position in the global payments industry. As the world continues to move towards a cashless society, Visa's growth prospects remain strong.

In conclusion, investing in companies with strong fundamentals can be a recipe for long-term success. By focusing on financial statements, profitability, growth prospects, and management, investors can identify top US stocks that have the potential to deliver significant returns. Whether you're a seasoned investor or just starting out, understanding these principles can help you make informed investment decisions.

new york stock exchange