Understanding and Investing in US Stocks: A Comprehensive Guide

author:US stockS -

In today's globalized world, investing in US stocks has become increasingly popular among both seasoned investors and beginners. With a robust market and a diverse range of companies, the US stock market offers numerous opportunities for growth and profitability. This article delves into the essentials of investing in US stocks, providing you with the knowledge to make informed decisions.

What Are US Stocks?

US stocks, also known as shares, represent ownership in a company. When you purchase a US stock, you are essentially buying a portion of that company. This ownership comes with certain rights, such as voting in shareholder meetings and receiving dividends, if the company decides to distribute them.

The Importance of Research

Before investing in US stocks, it's crucial to conduct thorough research. This includes understanding the company's financial health, industry trends, and overall market conditions. By doing so, you can identify potential risks and rewards associated with each investment.

Types of US Stocks

There are several types of US stocks, each with its unique characteristics:

- Common Stocks: These are the most common type of stock and provide voting rights and potential dividends.

- Preferred Stocks: These stocks offer fixed dividends and priority in receiving assets in the event of bankruptcy.

- Blue-Chip Stocks: These represent well-established companies with stable earnings and low volatility.

- Growth Stocks: These companies are expected to grow at an above-average rate and often reinvest earnings into the business rather than paying dividends.

Key Factors to Consider When Investing in US Stocks

When investing in US stocks, several key factors should be taken into account:

- Financial Health: Examine the company's financial statements, including the income statement, balance sheet, and cash flow statement. Look for signs of profitability, stability, and growth.

- Industry Trends: Stay informed about the industry in which the company operates. Understanding industry trends can help you predict future performance.

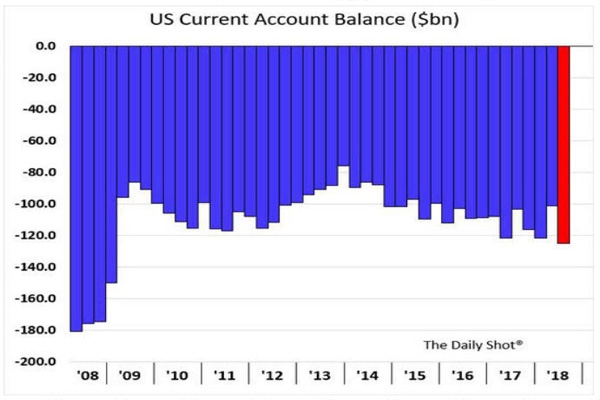

- Market Conditions: Keep an eye on the overall market and economic indicators. Economic downturns can negatively impact stock prices.

- Dividends: If you're looking for regular income, consider companies that offer dividends.

Top US Stocks to Watch

Several US stocks have consistently performed well over the years. Here are a few to consider:

- Apple Inc. (AAPL): A leading technology company with a strong market presence and innovative products.

- Microsoft Corporation (MSFT): A dominant player in the software industry, offering a wide range of products and services.

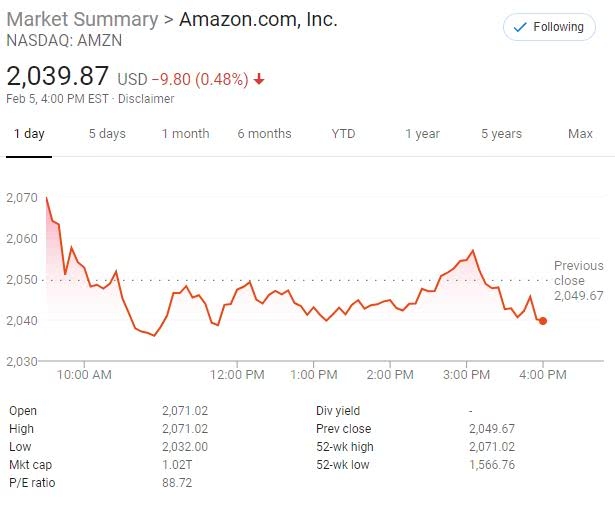

- Amazon.com, Inc. (AMZN): The world's largest online retailer, with a strong focus on e-commerce and cloud computing.

- Facebook, Inc. (FB): A social media giant with a vast user base and a diverse range of revenue streams.

Case Study: Tesla, Inc. (TSLA)

Tesla, Inc. (TSLA) is a prime example of a successful US stock. As an electric vehicle manufacturer, Tesla has revolutionized the automotive industry. Despite facing numerous challenges, the company has seen significant growth in its stock price over the years. This success can be attributed to Tesla's innovative products, strong brand, and visionary leadership.

In conclusion, investing in US stocks can be a lucrative opportunity. By conducting thorough research, understanding key factors, and staying informed about market trends, you can make informed decisions and potentially achieve substantial returns. Always remember to diversify your portfolio to mitigate risks and seek professional advice if needed.

new york stock exchange