How Can I Buy Indian Stocks from US?

author:US stockS -

Are you interested in investing in Indian stocks but unsure of how to do it from the United States? Look no further! This article will guide you through the process of buying Indian stocks from the comfort of your home. Whether you're a seasoned investor or a beginner, understanding how to invest in Indian stocks can open up a world of opportunities.

Understanding the Basics

Before diving into the process, it's essential to understand the basics of investing in Indian stocks. India is one of the fastest-growing economies in the world, making it an attractive market for investors. The Indian stock market is regulated by the Securities and Exchange Board of India (SEBI), ensuring transparency and fairness.

Step-by-Step Guide to Buying Indian Stocks from the US

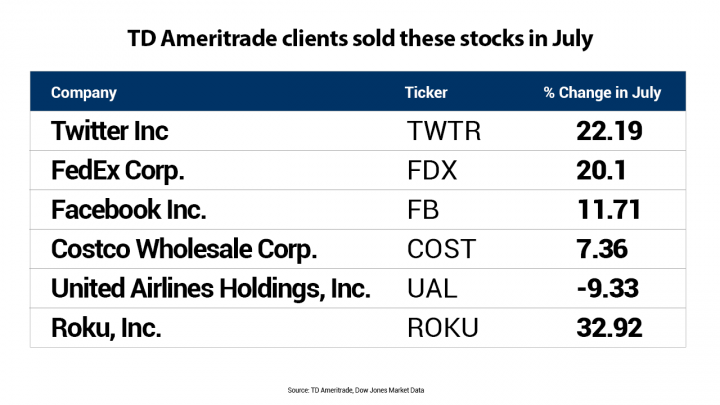

Choose a Brokerage Firm: The first step is to select a brokerage firm that allows you to trade Indian stocks. Several reputable brokers offer this service, including Fidelity, TD Ameritrade, and E*TRADE. Make sure to research and compare the fees, minimum deposit requirements, and customer service of different brokers.

Open a Brokerage Account: Once you've chosen a brokerage firm, you'll need to open an account. This process typically involves providing personal information, proof of identity, and financial details. Some brokers may require a minimum deposit to start trading.

Fund Your Account: After opening your brokerage account, you'll need to fund it. You can transfer funds from your bank account or use a credit/debit card. Ensure that the currency is in Indian rupees, as this is the currency used in the Indian stock market.

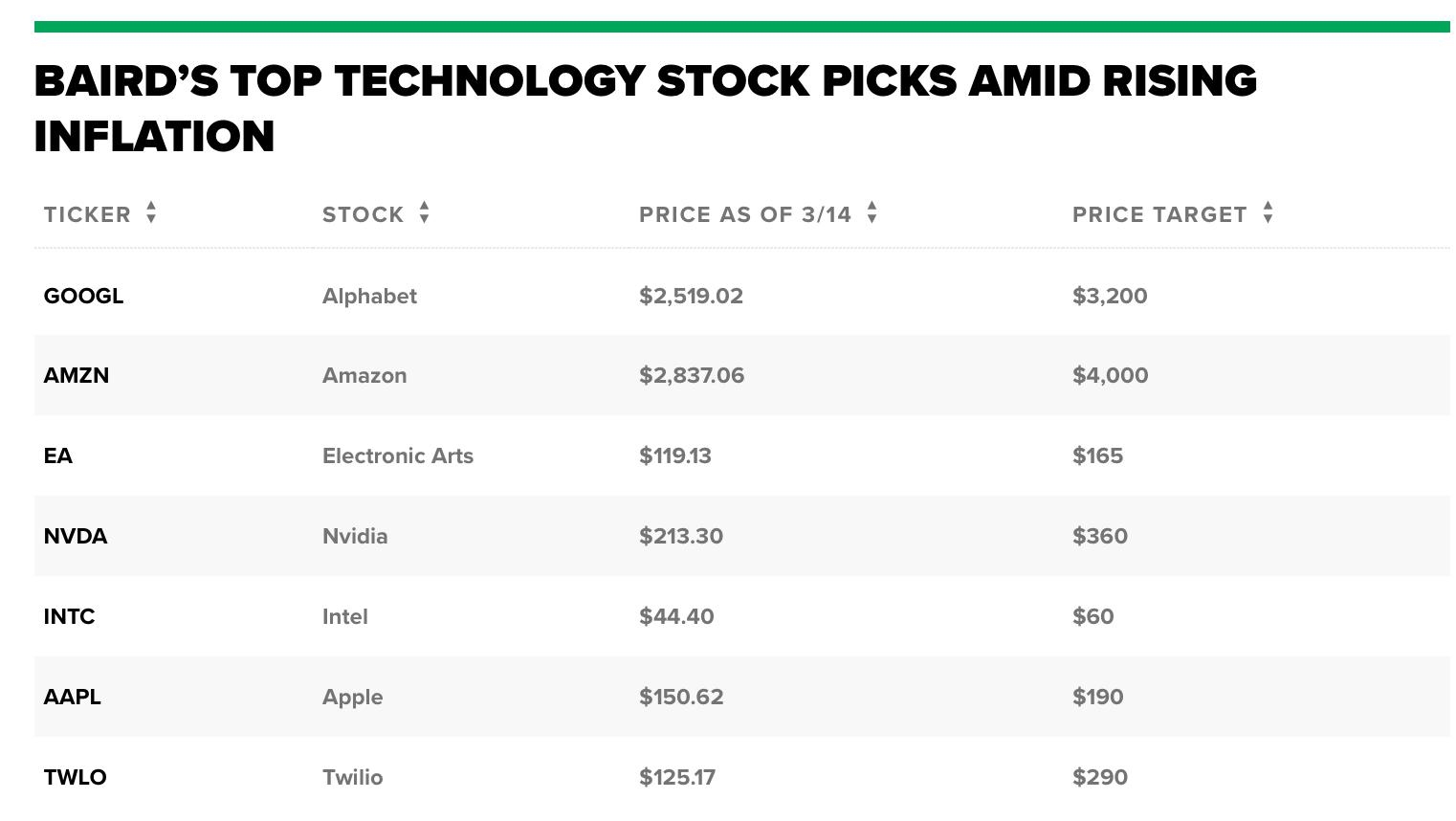

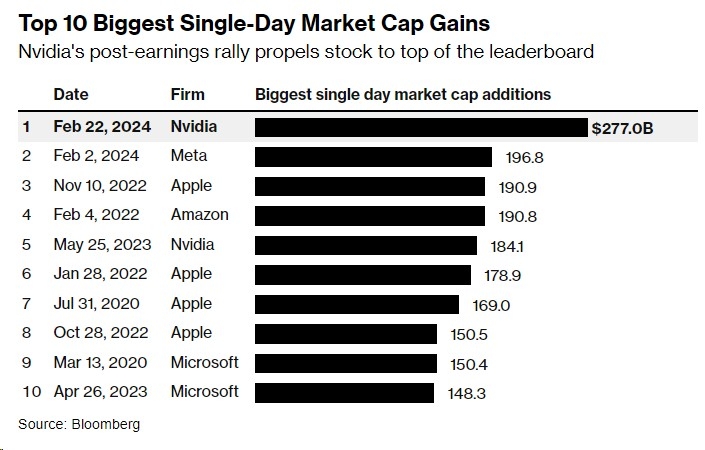

Research Indian Stocks: Before investing, it's crucial to research the stocks you're interested in. Look for companies with strong fundamentals, such as good financial health, a strong management team, and a solid growth outlook. You can use financial websites and apps to stay updated on the latest news and trends in the Indian stock market.

Place Your Order: Once you've chosen a stock, it's time to place your order. You can do this through your brokerage platform, either by entering the stock symbol and the number of shares you want to buy or by using a limit order to set a specific price at which you want to buy the stock.

Monitor Your Investments: After placing your order, keep an eye on your investments. Monitor the stock's performance and stay informed about any news or events that could impact its value. Remember that investing in stocks involves risks, and it's essential to be prepared for potential losses.

Case Study: Investing in Indian Tech Stocks

One popular sector in the Indian stock market is technology. Consider the example of Tata Consultancy Services (TCS), one of India's leading IT services companies. Over the past few years, TCS has seen significant growth, driven by its strong presence in the global IT market. By investing in TCS, you could have gained substantial returns, especially if you bought the stock at a low price and held onto it for the long term.

Conclusion

Investing in Indian stocks from the US can be a rewarding experience. By following these steps and conducting thorough research, you can successfully invest in the Indian stock market. Remember to choose a reputable brokerage firm, stay informed about market trends, and monitor your investments regularly. Happy investing!

new york stock exchange