Can Canadians Trade in US Stocks? A Comprehensive Guide

author:US stockS -

Are you a Canadian investor looking to diversify your portfolio? Curious about trading in US stocks? You're not alone. Many Canadians are interested in investing in the United States, but there are important considerations to keep in mind. In this article, we'll explore whether Canadians can trade in US stocks, the process involved, and the benefits and risks of doing so.

Understanding the Basics

Firstly, it's important to understand that Canadians can trade in US stocks, but there are certain requirements and limitations to be aware of. The process is similar to trading in Canadian stocks, but there are a few key differences.

Eligibility and Requirements

To trade in US stocks, you need to open a brokerage account with a firm that is registered with the US Securities and Exchange Commission (SEC). There are several reputable brokers that cater to international clients, such as TD Ameritrade, E*TRADE, and Charles Schwab.

When opening an account, you'll need to provide personal information, including your Canadian address, social insurance number (SIN), and proof of identity. Some brokers may also require a proof of residence document.

Understanding the Process

Once you have an account, the process of trading in US stocks is similar to trading in Canadian stocks. You can use the same platforms and tools to research stocks, place orders, and manage your portfolio.

Benefits of Trading in US Stocks

There are several advantages to trading in US stocks:

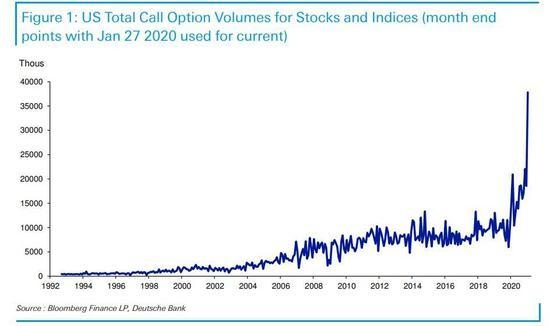

- Diversification: The US stock market is one of the largest and most diversified in the world. By investing in US stocks, you can gain exposure to a wide range of industries and sectors.

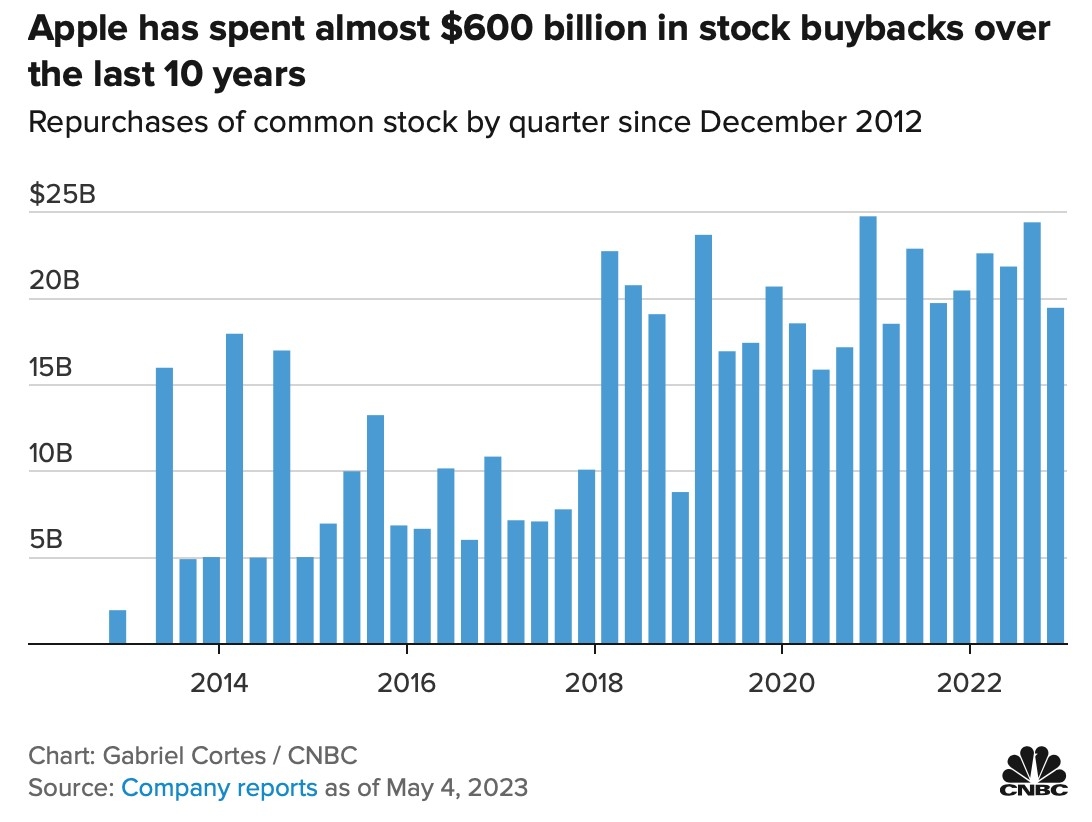

- Potential for Higher Returns: The US stock market has historically offered higher returns than the Canadian market. This is due to factors such as larger companies, more innovation, and a more developed financial system.

- Access to Global Brands: You can invest in well-known US companies such as Apple, Google, and Microsoft, which are not available on the Canadian stock exchange.

Risks to Consider

While there are many benefits to trading in US stocks, there are also risks to consider:

- Currency Fluctuations: The value of your investments can be affected by currency exchange rates. If the Canadian dollar strengthens, the value of your US investments in Canadian dollars may decrease.

- Regulatory Differences: The US and Canadian stock markets have different regulatory frameworks, which can affect trading rules and investor protection.

- Tax Implications: If you earn income from US stocks, you may be subject to both Canadian and US tax laws.

Case Study: Investing in US Tech Stocks

Consider a Canadian investor who wants to invest in US tech stocks. They open an account with a brokerage firm that caters to international clients and begin researching companies such as Apple and Google. After careful analysis, they decide to invest in these companies, diversifying their portfolio and potentially benefiting from higher returns.

Conclusion

In conclusion, Canadians can trade in US stocks, but there are important considerations to keep in mind. By understanding the process, benefits, and risks, you can make informed decisions about whether US stocks are right for your investment strategy. Always consult with a financial advisor to ensure you're making the best choices for your portfolio.

new york stock exchange