Buy Stocks in US from India: A Comprehensive Guide

author:US stockS -

Are you an Indian investor looking to diversify your portfolio with U.S. stocks? If so, you've come to the right place. This guide will walk you through the process of buying stocks in the U.S. from India, covering everything from the necessary steps to the potential risks and rewards.

Understanding the Process

1. Open a Brokerage Account

The first step in buying U.S. stocks from India is to open a brokerage account. There are several online brokers that offer international trading services, including TD Ameritrade, E*TRADE, and Fidelity. Make sure to choose a reputable broker with good customer service and low fees.

2. Fund Your Account

Once you have opened your brokerage account, you will need to fund it. You can do this by transferring funds from your Indian bank account to your brokerage account. Some brokers may also accept wire transfers or international bank drafts.

3. Research U.S. Stocks

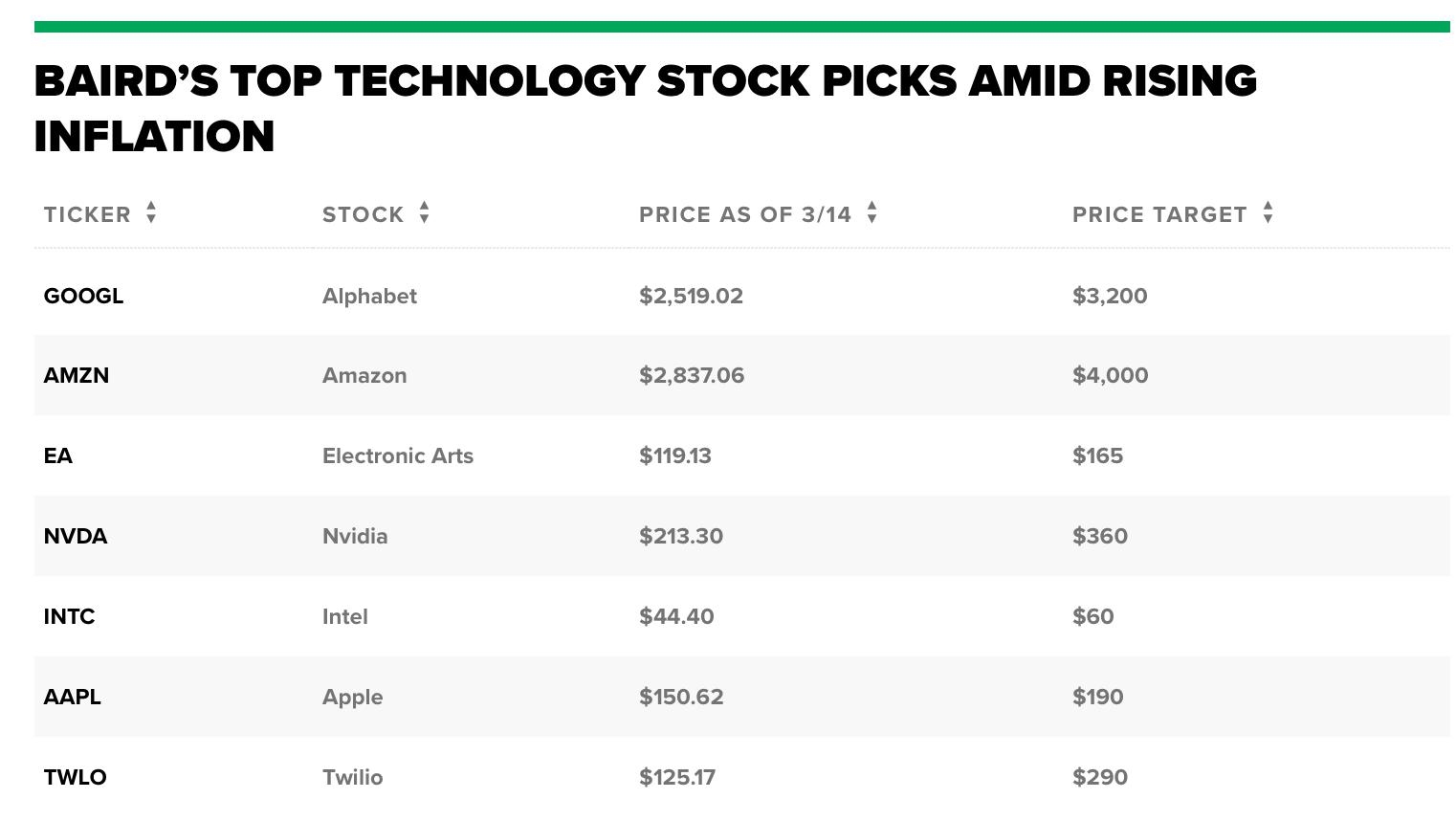

Before buying stocks, it's important to research the companies you are interested in. Look for companies with strong fundamentals, such as a good financial track record, a strong management team, and a competitive advantage in their industry. You can use financial websites like Yahoo Finance, Google Finance, and Seeking Alpha to research U.S. stocks.

4. Place Your Order

Once you have selected a stock, you can place an order through your brokerage account. You can choose to buy stocks at the current market price or set a limit order to buy at a specific price.

5. Monitor Your Investments

After you have bought stocks, it's important to monitor your investments regularly. Keep an eye on the company's financial performance, market trends, and economic indicators that may affect the stock price.

Potential Risks and Rewards

Risks

- Currency Risk: The value of the Indian rupee can fluctuate against the U.S. dollar, which can affect the value of your investments.

- Regulatory Risk: Different countries have different regulations regarding foreign investments. Make sure you understand the rules and regulations in both India and the U.S.

- Market Risk: The stock market is unpredictable, and there is always a risk of losing money.

Rewards

- Diversification: Investing in U.S. stocks can help diversify your portfolio and reduce your exposure to local market risks.

- Access to Top Companies: The U.S. stock market is home to some of the world's largest and most successful companies.

- Potential for Higher Returns: The U.S. stock market has historically offered higher returns than the Indian stock market.

Case Study: Reliance Industries Limited

As an example, let's consider Reliance Industries Limited (RIL), one of India's largest companies. RIL has a significant presence in the oil and gas industry and has a market capitalization of over $100 billion. If you believe that the oil and gas industry will continue to grow, you might consider buying RIL's American Depositary Receipts (ADRs) on the U.S. stock market.

Conclusion

Buying stocks in the U.S. from India can be a great way to diversify your portfolio and invest in top companies. By following the steps outlined in this guide and doing thorough research, you can minimize your risks and maximize your returns.

new york stock exchange