Are U.S. Tech Stocks Overvalued? A Comprehensive Analysis

author:US stockS -

In recent years, the tech industry has experienced an unprecedented surge, with U.S. tech stocks leading the charge. However, as these companies continue to soar in value, many investors are left questioning whether U.S. tech stocks are overvalued. This article delves into the factors contributing to the tech boom, the potential risks, and the future outlook for U.S. tech stocks.

The Tech Boom: A Decade of Growth

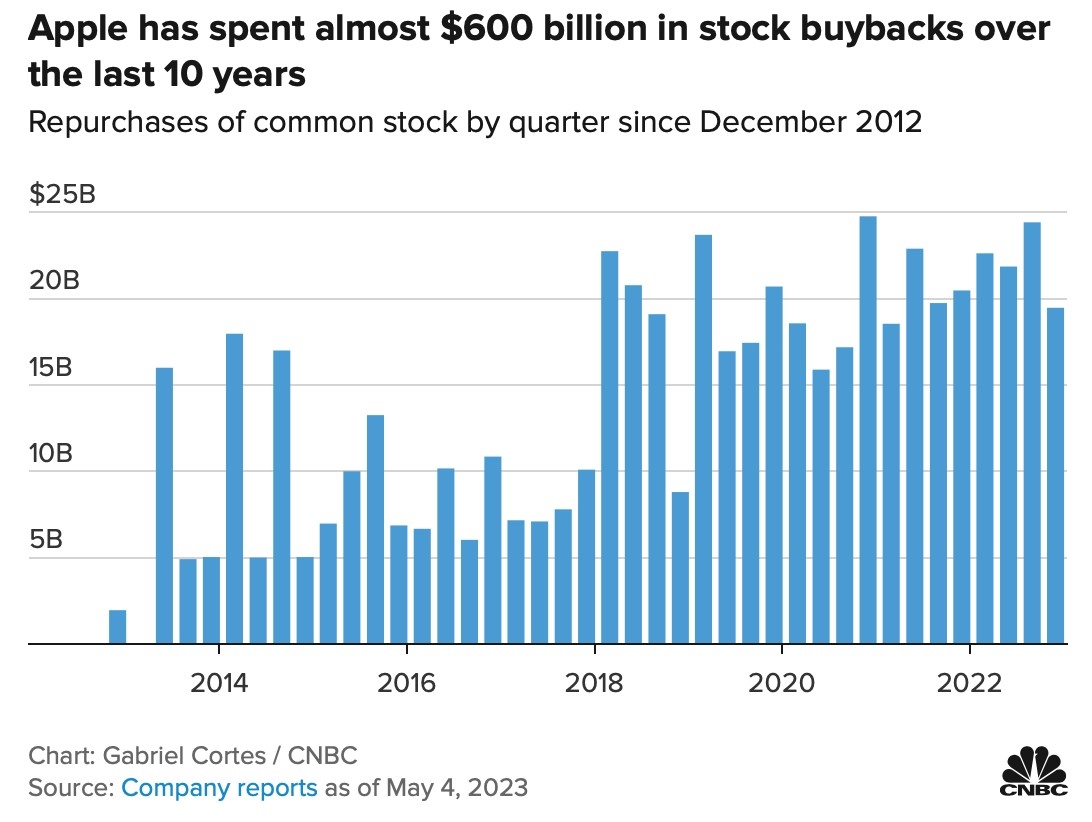

Over the past decade, U.S. tech stocks have seen substantial growth, driven by factors such as innovation, strong consumer demand, and favorable regulatory environments. Companies like Apple, Amazon, Google, and Microsoft have become household names, dominating various sectors from consumer electronics to cloud computing.

Factors Contributing to Overvaluation

Several factors have contributed to the perceived overvaluation of U.S. tech stocks:

High Valuations: Many tech companies are trading at sky-high valuations, often exceeding traditional valuation metrics. For instance, Facebook's market capitalization is over

700 billion, despite reported earnings of only 30 billion.Market Dynamics: The tech sector has seen a significant increase in initial public offerings (IPOs), with many companies going public at record valuations. This influx of new stocks has contributed to the overall market's elevated valuations.

Low Interest Rates: With interest rates at historic lows, investors have been forced to seek higher returns, often investing in high-risk assets like tech stocks.

Economic Shifts: The global shift towards remote work and online services has further bolstered the tech industry, driving up demand for tech stocks.

Potential Risks

Despite the current growth trajectory, there are risks associated with investing in U.S. tech stocks:

Regulatory Changes: The tech industry is under increasing scrutiny from regulators, with potential antitrust laws and data privacy regulations that could impact profitability.

Economic Downturns: A global economic downturn could negatively impact tech companies, particularly those that rely heavily on consumer spending.

Market Volatility: Tech stocks are known for their high volatility, with prices swinging wildly in response to news and rumors.

Case Study: Facebook’s IPO

A prime example of the tech sector's overvaluation is Facebook's IPO in 2012. At the time, Facebook was valued at

Conclusion

While U.S. tech stocks have seen significant growth, there are concerns about their overvaluation. Investors must weigh the potential risks and consider their own risk tolerance before investing in this volatile sector. As the industry continues to evolve, it remains to be seen whether U.S. tech stocks will sustain their current valuations or face a correction.

new york stock exchange