Title: Bank of America US Stock Price: A Comprehensive Analysis

author:US stockS -America(3)Bank(40)Stock(1759)Price(178)Title(519)

Introduction: In the dynamic world of finance, the stock price of a company is a crucial indicator of its performance and market perception. One such company that has been closely watched by investors and financial analysts alike is Bank of America. In this article, we will delve into the factors that influence the Bank of America US stock price, providing a comprehensive analysis to help you make informed investment decisions.

Understanding Bank of America's Stock Price: Bank of America (BAC) is one of the largest financial institutions in the United States, with a significant presence in the banking, investment, and insurance sectors. The stock price of Bank of America is determined by various factors, including the company's financial performance, market trends, and economic indicators.

Financial Performance: The financial performance of Bank of America is a key driver of its stock price. Investors closely monitor the company's earnings reports, revenue growth, and profit margins. A strong financial performance can lead to an increase in the stock price, while a weak performance can result in a decline.

Market Trends: Market trends also play a significant role in determining the Bank of America US stock price. For instance, during periods of economic growth, financial stocks, including Bank of America, tend to perform well. Conversely, during economic downturns, these stocks may face downward pressure.

Economic Indicators: Economic indicators, such as interest rates, unemployment rates, and inflation, can also impact the Bank of America stock price. For instance, higher interest rates can benefit Bank of America's net interest margins, leading to increased profitability and potentially driving up the stock price.

Sector Performance: The performance of the financial sector as a whole can also influence the Bank of America stock price. If the sector is performing well, Bank of America's stock may benefit from positive sentiment. Conversely, if the sector is struggling, Bank of America's stock may face downward pressure.

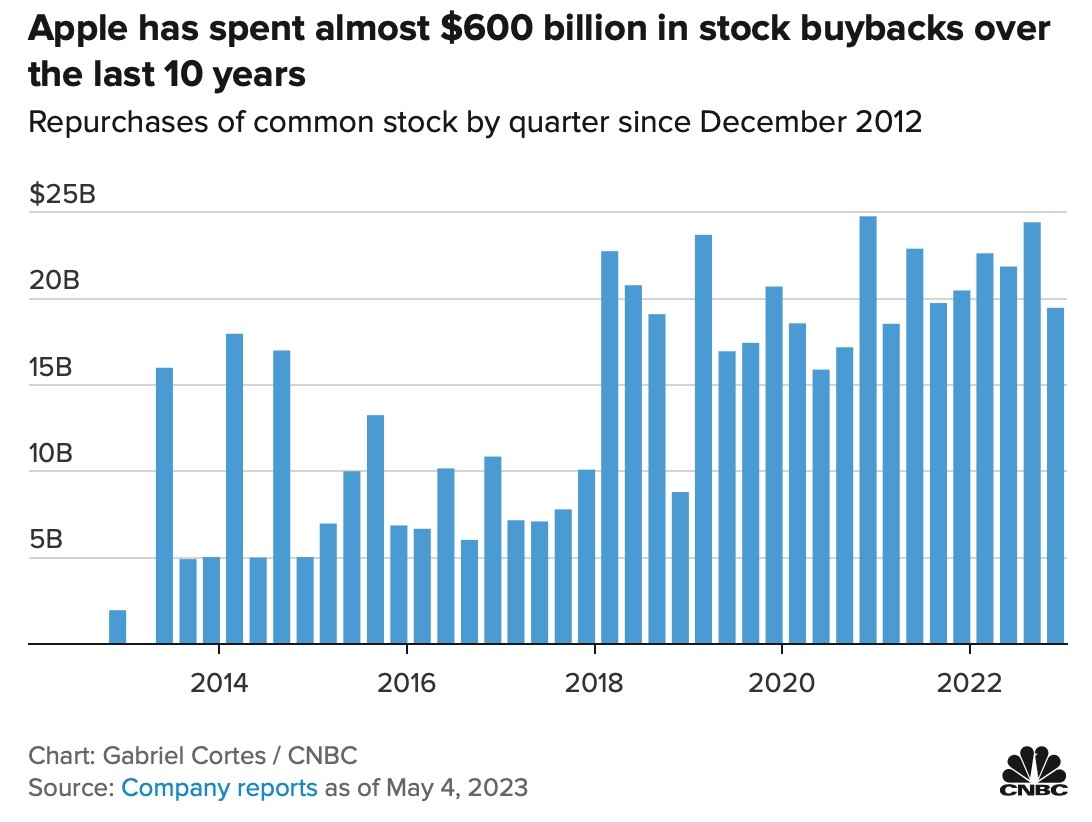

Dividends and Share Repurchases: Bank of America's dividend payments and share repurchases can also impact its stock price. A company that consistently raises its dividend or engages in share repurchases is often viewed favorably by investors, potentially leading to an increase in the stock price.

Case Study: Bank of America's Stock Price Performance in 2020 In 2020, the global economy faced unprecedented challenges due to the COVID-19 pandemic. Despite the turmoil, Bank of America's stock price performed relatively well. The company's ability to navigate the crisis and maintain profitability was a key factor in its stock price resilience. This case study highlights the importance of a strong financial performance and adaptability in driving stock price performance.

Conclusion: The Bank of America US stock price is influenced by various factors, including financial performance, market trends, economic indicators, and sector performance. Understanding these factors can help investors make informed decisions. As the financial landscape continues to evolve, keeping a close eye on these variables will be crucial for those interested in investing in Bank of America.

new york stock exchange