Unlocking the Potential of US Large Value Company Stocks

author:US stockS -Large(60)Unlocking(27)The(937)Potential(14)

In the vast landscape of the stock market, large value company stocks have always been a beacon for investors seeking stability and substantial returns. This article delves into the intricacies of investing in US large value companies, highlighting key factors to consider, potential benefits, and real-world examples that showcase the power of these investments.

Understanding Large Value Company Stocks

First, let's define what we mean by "large value company stocks." These are shares of companies that are considered large-cap stocks, meaning they have a market capitalization of over $10 billion. These companies are typically well-established, financially stable, and have a strong presence in their respective industries.

Large value companies often possess a history of reliable earnings, strong balance sheets, and a strong competitive advantage over their peers. Investors are drawn to these stocks for their stability and potential for long-term growth.

Key Factors to Consider

When evaluating large value company stocks, there are several key factors to consider:

- Financial Health: Look for companies with strong financial statements, including high revenue growth, profitability, and low debt levels.

- Market Position: Companies with a strong market position, including a large market share and a strong brand, are more likely to weather economic downturns.

- Management Team: A competent and experienced management team can make a significant difference in a company's success.

- Industry Trends: Invest in companies that are well-positioned within a growing industry or have the potential to capitalize on emerging trends.

Potential Benefits of Investing in Large Value Companies

Investing in large value companies offers several potential benefits:

- Stability: Large value companies are often less volatile than smaller companies, making them a good choice for conservative investors.

- Dividends: Many large value companies pay dividends, providing investors with a regular income stream.

- Growth Potential: While large value companies are established, they can still offer significant growth potential, especially in industries with strong long-term trends.

Real-World Examples

Let's look at a few real-world examples of successful large value company stocks:

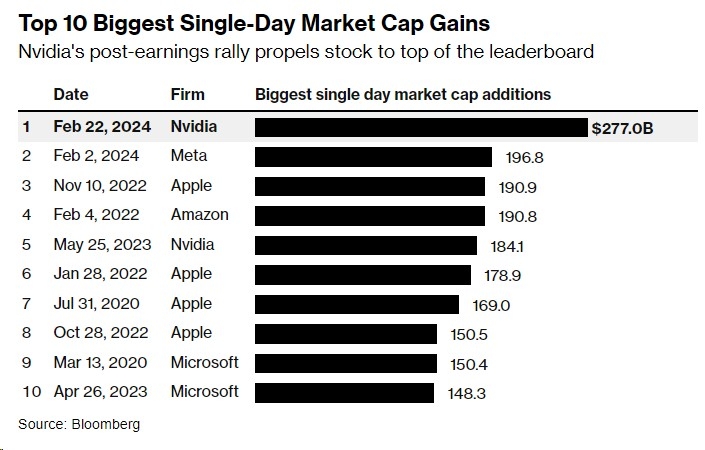

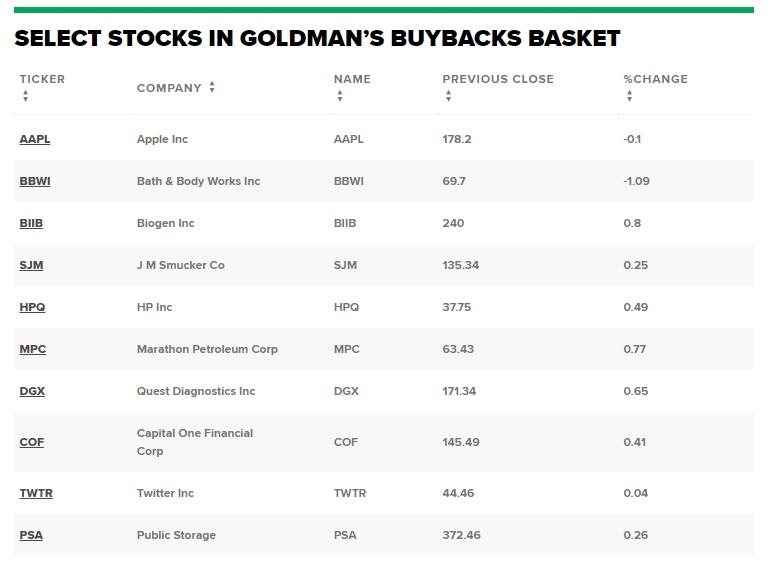

- Apple (AAPL): As one of the world's largest technology companies, Apple has a strong market position and a history of innovation. Its financial health is impeccable, and it continues to grow its revenue and earnings.

- Johnson & Johnson (JNJ): A leader in the healthcare industry, Johnson & Johnson has a diverse product portfolio and a strong brand. Its financial statements are solid, and it pays a generous dividend.

- Microsoft (MSFT): As a leader in the software industry, Microsoft has a strong market position and a history of innovation. Its financial health is excellent, and it continues to grow its revenue and earnings.

Conclusion

Investing in US large value company stocks can be a wise decision for investors seeking stability, dividends, and growth potential. By understanding the key factors to consider and evaluating the financial health and market position of potential investments, investors can make informed decisions and potentially achieve substantial returns.

new york stock exchange