How Would U.S. Stocks and the Dollar Collapse?

author:US stockS -

Understanding the Potential for Market Decline

In recent years, investors have been bombarded with a deluge of optimistic economic forecasts. However, behind the headlines of constant growth and record highs, there lurks a brewing storm that could potentially result in the collapse of U.S. stocks and the dollar. This article explores the factors that could trigger such an event, the implications for the global economy, and what investors should do to prepare.

Economic Inflation and its Consequences

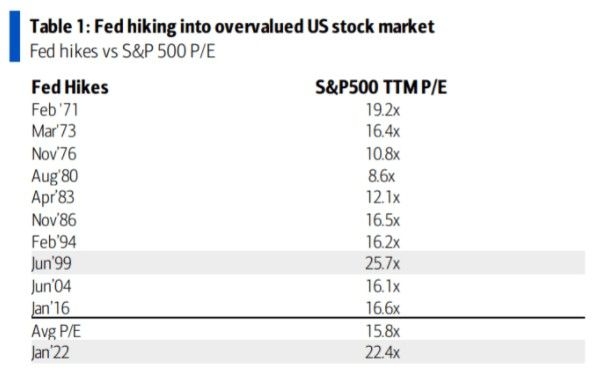

One of the primary concerns is the persistent inflationary pressures. The U.S. Federal Reserve's attempts to curb inflation by raising interest rates have led to higher borrowing costs for businesses and consumers alike. As a result, corporations are experiencing reduced profits, leading to potential stock market declines.

The Dangers of Debt

Another major factor contributing to the potential collapse is the astronomical levels of debt. U.S. corporations and the government are carrying massive amounts of debt, making them highly vulnerable to any economic downturn. As inflation continues to rise, the real value of these debts will diminish, leading to increased defaults and market turmoil.

Technological Advancements and Automation

Technological advancements have also played a significant role in the potential market collapse. As companies adopt automation and artificial intelligence, they will be able to produce more with fewer workers. This shift could lead to significant job losses and increased economic instability, which in turn, could lead to a market downturn.

International Trade and the Global Supply Chain

The current global supply chain crisis has already shown how interconnected the global economy is. If this situation continues, or if international trade disputes escalate, it could have severe implications for the U.S. stock market and the dollar. As a major trading nation, any disruptions to global trade could have a profound impact on the American economy.

The Potential Collapse

So, how might a collapse occur? It's important to note that this is a complex and multifaceted issue, with a variety of factors at play. However, some potential scenarios include:

Rising Inflation: If inflation continues to escalate, it could lead to higher interest rates and reduced consumer spending, potentially causing a stock market crash.

Debt Defaults: As the cost of living continues to rise, individuals and corporations may struggle to meet their debt obligations, leading to widespread defaults and market turmoil.

Technological Disruption: A rapid increase in automation and job losses could lead to economic instability and a market collapse.

International Trade Disputes: Escalating trade tensions and disruptions in the global supply chain could lead to a recession in the U.S.

Preparation for the Unforeseen

In light of these potential risks, it's essential for investors to remain vigilant and prepare for the unforeseen. This could include diversifying portfolios, focusing on sectors less vulnerable to market volatility, and keeping a close eye on economic indicators and policy changes.

While a full-blown collapse may seem daunting, it's crucial to recognize that markets are cyclical and prone to fluctuations. By staying informed and taking appropriate steps to mitigate risk, investors can navigate these turbulent times and protect their wealth.

Conclusion

In conclusion, the potential for a U.S. stock market and dollar collapse is a serious concern, driven by a combination of economic, technological, and international factors. By understanding the risks and preparing for the unforeseen, investors can position themselves for long-term success and weather the storms that lie ahead.

can foreigners buy us stocks