Game Over: The Stock Bubble Has Already Popped

author:US stockS -

The stock market has been a rollercoaster ride for investors over the past few years, with many speculating about the possibility of a bubble. But the time has come to face the music: the stock bubble has already popped. This article delves into the reasons behind this dramatic shift and what it means for investors moving forward.

The Rise of the Bubble

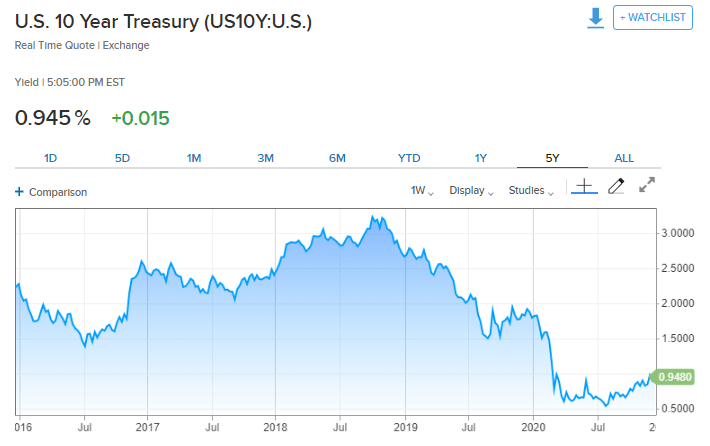

For years, the stock market has been on a steady climb, driven by low-interest rates, easy credit, and a strong economy. However, this growth was fueled by speculative investing and excessive leverage, creating a bubble that was bound to burst.

The Trigger: The Pandemic

The COVID-19 pandemic served as the catalyst for the bubble's popping. As the world shut down, many investors were forced to reassess their portfolios and seek alternative investments. This sudden shift in sentiment led to a rapid sell-off in stocks, causing the bubble to burst.

Key Indicators of the Burst Bubble

Several key indicators suggest that the stock bubble has already popped:

Stock Market Volatility: The stock market has experienced unprecedented volatility, with record-high highs and lows. This volatility is a clear sign that the market is no longer driven by fundamentals but by speculative trading.

Valuation Levels: Many stocks are now trading at levels that are well above their historical averages. This overvaluation is a sign that the market is no longer sustainable and that a correction is inevitable.

Economic Data: The economic data is also pointing to a bursting bubble. The Federal Reserve has been raising interest rates to combat inflation, which is a sign that the central bank is concerned about the state of the economy.

The Impact on Investors

The popping of the stock bubble has had a significant impact on investors. Many have seen their portfolios shrink as the value of their stocks plummeted. However, it's important to remember that this is a temporary setback and that long-term investors should remain focused on their long-term goals.

Case Studies: The Tech Sector

One of the most notable examples of the bursting bubble is the tech sector. Companies like Facebook, Amazon, and Google saw their stock prices soar to record highs, only to crash as the bubble burst. This serves as a reminder that even the most successful companies can be affected by market conditions.

The Road Ahead

The popping of the stock bubble has left many investors questioning the future of the market. However, it's important to remember that the stock market has always been cyclical. As the market adjusts to the new normal, investors should focus on diversifying their portfolios and seeking out undervalued stocks.

In conclusion, the stock bubble has already popped, and investors need to be prepared for the challenges ahead. By remaining focused on long-term goals and diversifying their portfolios, investors can navigate the turbulent waters of the stock market and emerge stronger on the other side.

can foreigners buy us stocks