Reuters US Markets: Latest Trends and Insights

author:US stockS -

The Financial World in Your Hands

In today's fast-paced world of finance, staying ahead of the curve is crucial for investors and traders. This article takes a deep dive into the latest trends and insights from Reuters US Markets, providing you with the essential information to make informed decisions.

Market Dynamics: Understanding the Key Players

One of the most significant aspects of the US market is the role played by key players such as tech giants, energy companies, and financial institutions. These players often set the tone for the market and can significantly influence investment strategies.

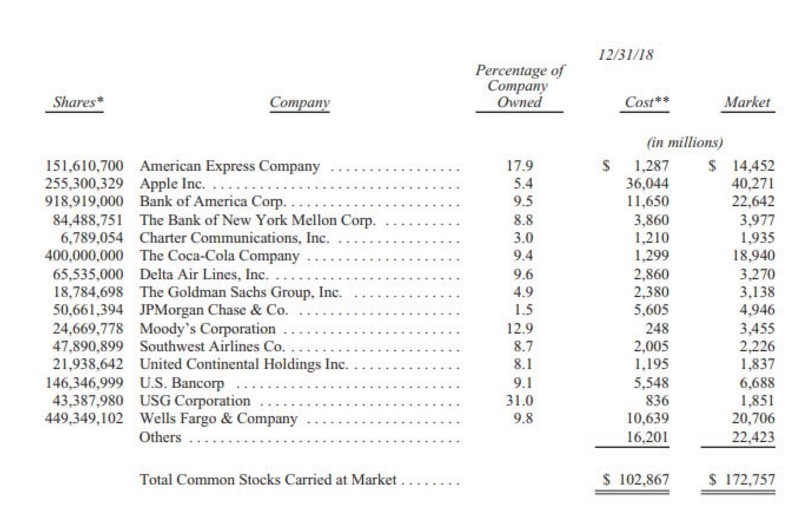

For instance, the rise of tech companies like Apple and Microsoft has had a profound impact on the market. Their stocks have become some of the most sought-after, with investors flocking to capitalize on their growth potential.

Emerging Trends: Keeping an Eye on the Horizon

Emerging trends can provide a window into the future of the US market. From sustainable investing to cryptocurrencies, there are numerous areas where innovation is driving market growth.

One such trend is the increasing focus on sustainable investing. More investors are recognizing the importance of investing in companies that prioritize environmental, social, and governance (ESG) factors. This shift has led to a growing number of sustainable funds and investment vehicles.

Global Influences: The Ripple Effect of International Events

The US market is not an island; it is influenced by global events and economic conditions. From trade wars to geopolitical tensions, international factors can have a significant impact on the US market.

Consider the impact of the recent trade war between the US and China. This conflict has caused disruptions in supply chains and affected various sectors of the US economy. It's crucial for investors to stay informed about global events and how they may impact the US market.

Case Studies: Lessons from the Past

Studying past market movements can provide valuable insights for future investment decisions. Here are a few notable case studies from Reuters US Markets:

The Dot-Com Bubble of 2000: This bubble was fueled by excessive optimism and speculative investments in technology stocks. The eventual burst led to significant market corrections, teaching investors the importance of caution and diversification.

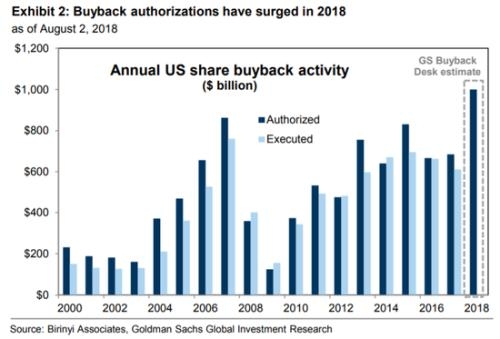

The Financial Crisis of 2008: The collapse of major financial institutions like Lehman Brothers was a pivotal moment in the US market. It highlighted the risks associated with excessive risk-taking and the importance of regulatory oversight.

The COVID-19 Pandemic: The outbreak of the pandemic in early 2020 led to a massive market sell-off. However, it also presented opportunities for long-term investors to capitalize on undervalued assets.

Navigating the Future: Staying Ahead of the Curve

As the US market continues to evolve, staying informed about the latest trends and insights is more important than ever. By keeping a close eye on market dynamics, emerging trends, and global influences, investors can navigate the complexities of the market with confidence.

Remember, investing is not just about making money; it's about making smart decisions that align with your financial goals and risk tolerance. With the right information and strategy, you can achieve success in the dynamic world of Reuters US Markets.

can foreigners buy us stocks