How Do I Invest in US Stocks? A Comprehensive Guide

author:US stockS -

Investing in US stocks can be a rewarding endeavor, but it requires knowledge, research, and a well-thought-out strategy. Whether you're a seasoned investor or just starting out, this guide will help you navigate the process of investing in US stocks. We'll cover everything from opening a brokerage account to analyzing stocks and making your first trade.

Opening a Brokerage Account

The first step in investing in US stocks is to open a brokerage account. A brokerage account is a type of account that allows you to buy and sell stocks, bonds, and other securities. There are several types of brokerage accounts to choose from, including:

- Brokerage Account: This is the most common type of account and allows you to buy and sell stocks, bonds, and other securities.

- IRA (Individual Retirement Account): An IRA is a tax-advantaged account that allows you to invest for retirement.

- Roth IRA: A Roth IRA is a tax-advantaged account that allows you to withdraw funds tax-free in retirement.

- 401(k): A 401(k) is an employer-sponsored retirement plan that allows you to invest in a variety of investments, including stocks.

When choosing a brokerage account, consider factors such as fees, investment options, and customer service. Some popular brokerage firms include Fidelity, Charles Schwab, and TD Ameritrade.

Researching Stocks

Once you have a brokerage account, the next step is to research stocks. This involves analyzing the financial health of a company, its industry, and the overall market. Here are some key factors to consider when researching stocks:

- Financial Statements: Review the company's financial statements, including the income statement, balance sheet, and cash flow statement. Look for signs of profitability, revenue growth, and a strong balance sheet.

- Earnings Reports: Pay attention to the company's earnings reports. Look for consistent earnings growth and positive revenue trends.

- Industry Analysis: Understand the industry in which the company operates. Consider factors such as competition, market demand, and regulatory environment.

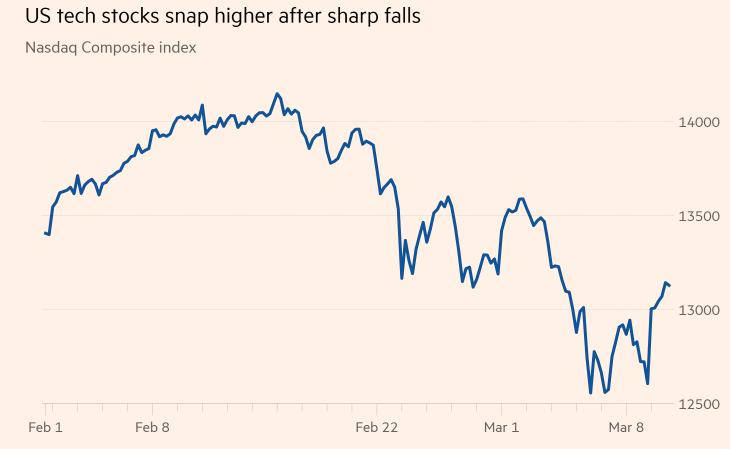

- Technical Analysis: Use technical analysis to analyze stock price trends and identify potential buying and selling opportunities.

Making Your First Trade

Once you've done your research and identified a stock you want to buy, it's time to make your first trade. Here's how to do it:

- Log in to your brokerage account.

- Enter the stock symbol and the number of shares you want to buy.

- Choose your order type, such as a market order (buy at the current price) or a limit order (buy at a specific price).

- Review your order and submit it.

Case Study: Apple Inc. (AAPL)

Let's say you've done your research and identified Apple Inc. (AAPL) as a potential investment. Here's a breakdown of your analysis:

- Financial Statements: Apple has consistently reported strong revenue and profit growth over the past few years.

- Earnings Reports: The company has beaten earnings estimates in each of the past four quarters.

- Industry Analysis: The technology industry is highly competitive, but Apple has a strong brand and loyal customer base.

- Technical Analysis: The stock has been trending upwards over the past year.

Based on this analysis, you decide to buy 100 shares of Apple at

Conclusion

Investing in US stocks can be a profitable venture, but it requires careful planning and research. By following this guide, you can open a brokerage account, research stocks, and make your first trade. Remember to stay disciplined, stay informed, and always invest with a long-term perspective.

can foreigners buy us stocks