Dow Jones Last Year: A Comprehensive Look Back

author:US stockS -

Last year was a tumultuous one for the financial world, and the Dow Jones Industrial Average was no exception. As one of the most closely watched indices in the United States, the Dow's performance last year offers a wealth of insights into the broader market trends and economic conditions. This article delves into the key factors that influenced the Dow Jones last year, offering a comprehensive look back at this critical period.

Historical Context and Market Performance

In order to understand the Dow Jones' performance last year, it is essential to consider the historical context. In 2022, the Dow experienced a significant decline, marking the end of a prolonged bull market. This decline was driven by various factors, including inflationary pressures, supply chain disruptions, and geopolitical tensions.

Inflation and Its Impact

One of the most significant factors influencing the Dow last year was inflation. The Consumer Price Index (CPI) soared to its highest level in decades, causing the Federal Reserve to raise interest rates to combat the rising prices. This increase in interest rates led to higher borrowing costs and a decrease in consumer spending, both of which negatively impacted the stock market.

Supply Chain Disruptions and Geopolitical Tensions

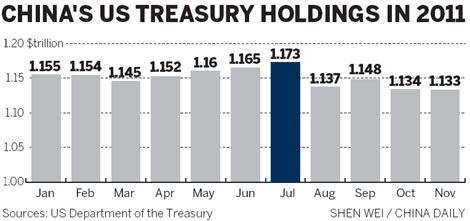

Supply chain disruptions and geopolitical tensions also played a crucial role in shaping the Dow Jones' performance last year. The COVID-19 pandemic continued to disrupt global supply chains, leading to shortages and higher prices for goods and services. Additionally, tensions between major world powers, such as the United States and China, added uncertainty to the market, leading to volatility and a decrease in investor confidence.

Sector Performance and Individual Stock Moves

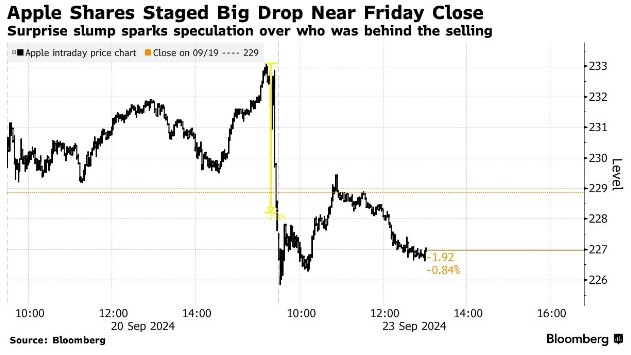

While the Dow as a whole experienced a decline, individual stocks within the index performed differently. Tech giants like Apple and Microsoft, which are among the largest components of the Dow, managed to post positive gains for the year. This highlights the importance of diversification within a portfolio and the varying performance of different sectors during periods of market stress.

Case Studies: Apple and Microsoft

To illustrate the point, let's take a closer look at Apple and Microsoft. Despite the overall decline in the Dow, both companies managed to increase their stock prices last year. Apple's strong performance can be attributed to its resilient consumer demand and successful product launches, while Microsoft's growth was driven by its robust cloud computing business and expanding enterprise market.

The Role of Diversification

Last year's market conditions highlight the importance of diversification. Investors who had a well-diversified portfolio were better equipped to withstand the downturn and even benefit from some of the outperforming sectors. Diversification can help mitigate risk by spreading investments across different asset classes, sectors, and geographic regions.

Conclusion

The Dow Jones' performance last year was influenced by a variety of factors, including inflation, supply chain disruptions, and geopolitical tensions. While the index experienced a decline, individual stocks within the index performed differently, underscoring the importance of diversification. As investors look ahead, understanding the factors that drove the Dow's performance last year can help them make informed decisions and navigate the complexities of the financial markets.

can foreigners buy us stocks