Regional Bank Loan Concerns Drag Down US Stocks

author:US stockS -

In recent times, the stock market has been experiencing a significant downturn, primarily due to concerns over the lending practices of regional banks. This article delves into the factors contributing to this decline and examines the potential implications for investors and the broader economy.

The Concerns: What's at Stake?

The concerns surrounding regional banks primarily revolve around their loan practices. These banks, which play a crucial role in financing local businesses and communities, have been under scrutiny for their risk management practices. Many investors and analysts fear that these banks may be taking on excessive risk, potentially leading to significant losses in the future.

Case Study: Silicon Valley Bank Collapse

One of the most notable examples of a regional bank facing loan-related issues is the collapse of Silicon Valley Bank (SVB). In 2020, SVB faced a liquidity crisis due to a sudden withdrawal of deposits by clients. While the bank was eventually bailed out by the government, the incident highlighted the risks associated with regional banks' lending practices.

Impact on Stock Market

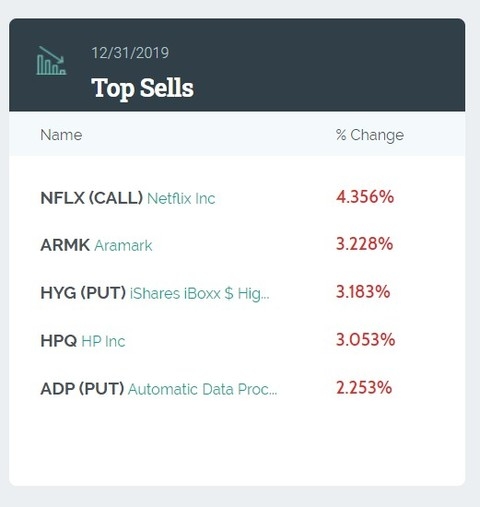

The concerns over regional banks have had a significant impact on the stock market. As investors grow increasingly concerned about the health of these banks, they are selling off their stocks, leading to a decline in the overall market. This trend has been particularly pronounced in the financial sector, with shares of regional banks falling sharply.

Why Are Investors Concerned?

Several factors have contributed to the growing concerns over regional banks' lending practices. One of the primary concerns is the high levels of debt that these banks have accumulated. As a result of the low-interest rate environment, banks have been able to borrow cheaply and lend out money at higher rates, leading to increased profits. However, this has also resulted in higher levels of debt, making these banks more vulnerable to economic downturns.

Regulatory Scrutiny

Another factor contributing to the concerns is the increasing regulatory scrutiny over the lending practices of regional banks. Regulators are increasingly focusing on the risk management practices of these banks, and any indication of poor risk management can lead to a loss of investor confidence.

The Broader Implications

The concerns over regional banks have broader implications for the economy. These banks play a crucial role in financing local businesses and communities, and any significant disruption in their lending practices can have a ripple effect throughout the economy.

Conclusion

In conclusion, the concerns over regional bank loan practices have had a significant impact on the stock market. As investors grow increasingly concerned about the health of these banks, they are selling off their stocks, leading to a decline in the overall market. While it is difficult to predict the exact outcome of these concerns, it is clear that they will continue to be a key factor in the stock market's performance in the coming months.

can foreigners buy us stocks