Understanding the Average US Income Stock Dividend Rate

author:US stockS -

In the intricate tapestry of the American stock market, one often overlooked aspect is the dividend yield, particularly the average dividend rate for stocks categorized as income investments. This article delves into what the average US income stock dividend rate signifies, how it's calculated, and why it matters to investors.

What is the Average Dividend Rate?

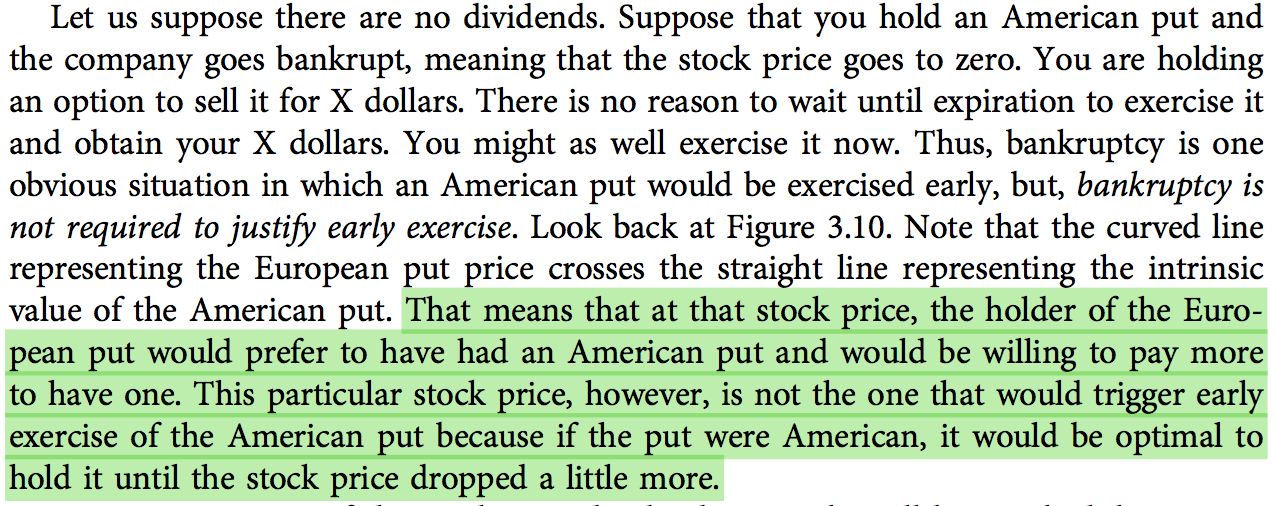

The average dividend rate refers to the average annual dividend payment that investors receive per share of a stock. This rate is a crucial indicator for income investors who seek steady cash flows from their investments. Typically, these investors look for companies with a strong history of paying dividends and a reliable track record of increasing their dividend payments over time.

Calculating the Average Dividend Rate

To calculate the average dividend rate, one needs to gather data on the dividend payments of a specific set of income stocks. This can be done by looking at the historical dividend payments of these companies and then calculating the average.

For instance, if Company A has paid dividends of

Why is the Average Dividend Rate Important?

The average dividend rate is a critical metric for several reasons:

- Income Generation: For income investors, the dividend rate is a direct measure of how much income they can expect to receive from their investments. A higher dividend rate can lead to increased cash flows and potentially a better return on investment.

- Market Trends: By analyzing the average dividend rate across various sectors and industries, investors can gain insights into market trends and identify potential opportunities or risks.

- Company Health: A company with a high average dividend rate often indicates financial stability and a strong balance sheet. This can be a positive sign for investors looking for long-term investments.

Case Study: The Average Dividend Rate in the Tech Sector

Let's take a look at the average dividend rate in the tech sector as an example. According to recent data, the average dividend rate for tech stocks stands at around 1.5%. This may seem low compared to other sectors, but it's important to consider that many tech companies have historically focused on reinvesting profits into growth rather than paying dividends.

However, some tech giants like Microsoft and Apple have started to increase their dividend payments in recent years. This shift indicates a growing trend within the sector and could be a sign for investors to consider tech stocks for their income portfolios.

Conclusion

The average US income stock dividend rate is a valuable metric for investors looking to generate income from their investments. By understanding how it's calculated and what it signifies, investors can make more informed decisions and potentially find attractive income opportunities in the stock market.

us stock market today live cha