US Stock Futures: A Comprehensive Guide to NASDAQ

author:US stockS -

In the fast-paced world of finance, staying ahead of market trends is crucial for investors. One of the most influential markets to keep an eye on is the NASDAQ, a leading index that tracks the performance of technology companies. Understanding US stock futures, particularly those related to NASDAQ, can provide valuable insights into market movements and potential investment opportunities. This article delves into the intricacies of US stock futures and their significance in the NASDAQ market.

What are US Stock Futures?

US stock futures are financial contracts that allow investors to buy or sell a specific number of shares of a particular stock at a predetermined price on a future date. These contracts are often used as a hedging tool to protect against potential losses in the underlying stock. They also provide investors with the opportunity to speculate on the future price movements of a stock without owning the actual shares.

The NASDAQ Index

The NASDAQ Composite is a widely followed stock market index that includes more than 3,000 companies. It is particularly known for its heavy concentration of technology companies, including giants like Apple, Microsoft, and Amazon. The NASDAQ index is a key indicator of the health and performance of the technology sector and the broader US stock market.

Understanding NASDAQ Stock Futures

NASDAQ stock futures are financial instruments that allow investors to speculate on the future price movements of the NASDAQ index. These futures contracts are based on the expected value of the NASDAQ index at a specific future date. By trading NASDAQ stock futures, investors can gain exposure to the technology sector without owning individual stocks.

Benefits of Trading NASDAQ Stock Futures

Hedging Against Market Volatility: NASDAQ stock futures can be used as a hedging tool to protect against potential losses in the underlying stocks. This is particularly beneficial for investors who hold significant positions in technology stocks and want to mitigate risks.

Speculation Opportunities: Investors can speculate on the future price movements of the NASDAQ index without owning the actual stocks. This provides an opportunity to capitalize on market trends and potential gains.

Leverage: NASDAQ stock futures offer leverage, allowing investors to control a larger position with a smaller amount of capital. This can amplify potential gains but also increase risks.

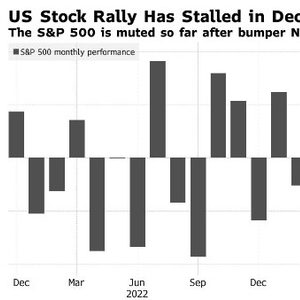

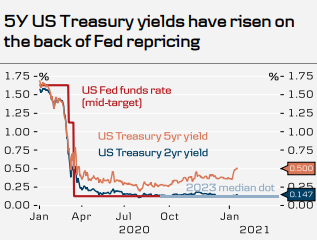

Case Study: NASDAQ Stock Futures in 2020

In 2020, the NASDAQ index experienced significant volatility due to the COVID-19 pandemic. As a result, NASDAQ stock futures became a popular tool for investors to hedge against potential losses and speculate on market movements. For example, in March 2020, when the NASDAQ index plummeted due to the pandemic, investors who held NASDAQ stock futures were able to protect their positions and potentially profit from the subsequent rally.

Conclusion

Understanding US stock futures, particularly those related to the NASDAQ index, is essential for investors looking to gain exposure to the technology sector and mitigate risks. By utilizing NASDAQ stock futures, investors can hedge against market volatility, speculate on market movements, and potentially capitalize on the growth of the technology sector.

us stock market today live cha