Title: Dividend US Stock: A Smart Investment Strategy

author:US stockS -

Investing in the stock market can be daunting, especially for beginners. However, one investment strategy that has stood the test of time is investing in dividend-paying US stocks. Dividends are payments made by a company to its shareholders, typically out of its profits. This article delves into the world of dividend-paying US stocks, explaining their benefits and how you can start investing in them.

Understanding Dividends

Dividends are a portion of a company's earnings that are distributed to its shareholders. They can be paid in cash or additional shares of stock. Companies that pay dividends are often considered stable and profitable, as they have enough profits to distribute to their shareholders.

Benefits of Dividend-Paying US Stocks

Regular Income: Dividends provide a regular income stream for investors, which can be particularly beneficial for those relying on investment income to cover expenses.

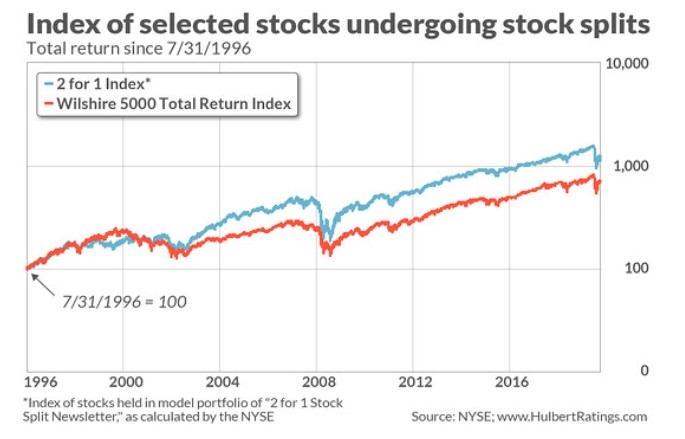

Long-Term Growth: Dividend-paying companies tend to be more stable and have a higher chance of long-term growth compared to non-dividend-paying companies.

Risk Mitigation: Dividends can serve as a cushion against market volatility. In times of economic downturn, companies with strong dividend policies are more likely to maintain or increase their dividends.

Tax Efficiency: Dividends are taxed at a lower rate than capital gains, making them a more tax-efficient investment.

How to Invest in Dividend-Paying US Stocks

Research: Start by researching companies that have a strong history of paying dividends. Look for companies with a consistent dividend growth rate and a strong financial position.

Diversify: Diversify your portfolio by investing in dividend-paying stocks across different sectors and industries. This helps mitigate risk and maximize returns.

Use Dividend Stocks Screeners: Utilize dividend stock screeners to identify companies that meet your criteria, such as dividend yield, payout ratio, and growth rate.

Consider Dividend Reinvestment Plans (DRIPs): DRIPs allow you to reinvest your dividends in additional shares of the company, potentially increasing your investment returns over time.

Case Study: Procter & Gamble (PG)

Procter & Gamble (PG) is a prime example of a dividend-paying US stock. The company has a long history of paying dividends and has increased its dividend for 64 consecutive years. With a dividend yield of around 2.3% and a strong financial position, PG is a popular choice for dividend investors.

Conclusion

Investing in dividend-paying US stocks can be a smart strategy for generating regular income and achieving long-term growth. By conducting thorough research, diversifying your portfolio, and considering dividend reinvestment plans, you can maximize your returns and mitigate risk. Remember, investing in the stock market always carries some level of risk, so it's important to do your homework and consult with a financial advisor if needed.

us stock market today live cha