Overvalued US Stocks: What Investors Need to Know

author:US stockS -

In recent years, the US stock market has seen unprecedented growth, with many stocks reaching all-time highs. However, some experts argue that this surge is due to overvaluation, and that investors should be cautious. This article delves into the reasons behind the overvalued US stocks and what investors need to know to protect their portfolios.

Understanding Overvaluation

Overvaluation occurs when the price of a stock is higher than its intrinsic value. This can happen due to a variety of factors, including market sentiment, speculation, and economic conditions. When stocks are overvalued, they are considered risky investments, as there is a higher chance of a price correction in the future.

Reasons for Overvaluation

- Low Interest Rates: The Federal Reserve has kept interest rates low for an extended period, making bonds and other fixed-income investments less attractive. This has led investors to seek higher returns in the stock market, driving up stock prices.

- Speculation: The rapid growth of technology stocks, such as those in the FAANG (Facebook, Amazon, Apple, Netflix, and Google) group, has fueled speculation and driven up their valuations.

- Economic Growth: The US economy has been growing steadily, which has bolstered investor confidence and pushed stock prices higher.

Risks of Overvalued Stocks

Investing in overvalued stocks can be risky, as the following scenarios could unfold:

- Market Correction: If the market believes that stocks are overvalued, it could lead to a market correction, where stock prices fall sharply.

- Economic Slowdown: A slowdown in the US economy could also lead to a decline in stock prices, as companies' earnings may suffer.

- Speculative Bubbles: The rapid growth of certain sectors, such as technology, can lead to speculative bubbles, where stock prices become detached from the underlying fundamentals.

Protecting Your Portfolio

To protect your portfolio from overvalued stocks, consider the following strategies:

- Diversification: Diversify your investments across different sectors, industries, and asset classes to reduce your exposure to any single stock or sector.

- Value Investing: Focus on companies with strong fundamentals, such as solid earnings growth, low debt levels, and a strong competitive position.

- Regular Rebalancing: Regularly rebalance your portfolio to ensure that it remains aligned with your investment goals and risk tolerance.

Case Studies

- Tech Stocks: The tech sector has seen significant growth in recent years, with many stocks reaching stratospheric valuations. However, some investors have been burned by the sudden decline in tech stocks, such as the drop in Facebook's stock after the Cambridge Analytica scandal.

- Energy Stocks: The energy sector has also experienced periods of overvaluation, particularly during the oil boom in the early 2010s. Investors who bought into overvalued energy stocks during this period suffered significant losses when oil prices plummeted.

In conclusion, while the US stock market has seen remarkable growth, it is crucial for investors to be aware of the risks associated with overvalued stocks. By understanding the reasons behind overvaluation and implementing sound investment strategies, investors can protect their portfolios and achieve long-term success.

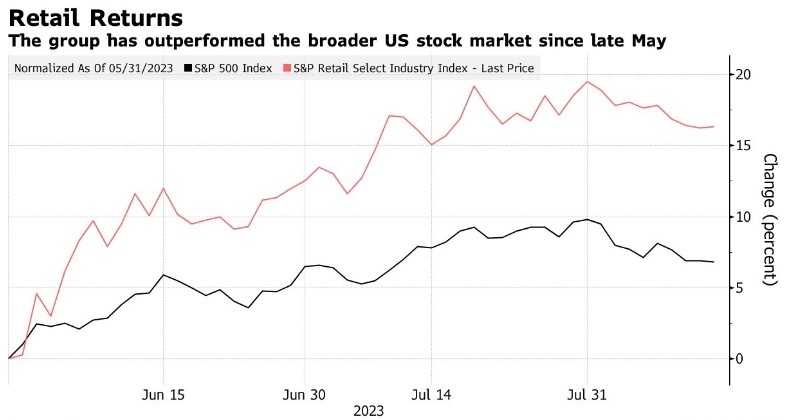

us stock market today live cha