Liberty Maven Stock: COVID-19 Had Us All Fooled

author:US stockS -

In the tumultuous era of the COVID-19 pandemic, the global economy was thrown into disarray. From the stock market's rollercoaster ride to the unprecedented unemployment rates, the impact was felt across the board. One of the companies that garnered significant attention during this time was Liberty Maven Stock. However, as we delve deeper into the narrative, it becomes evident that the COVID-19 pandemic had us all fooled, and the real story behind Liberty Maven Stock unfolds.

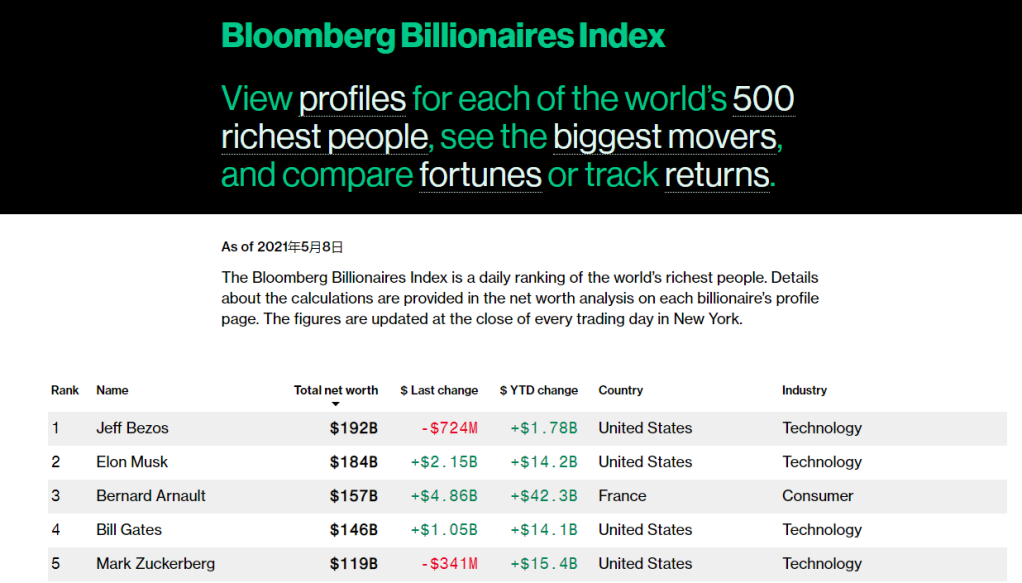

The Pandemic's Impact on the Stock Market

The COVID-19 pandemic caused a ripple effect on the stock market, leading to massive fluctuations. Investors were caught off guard, and many were left questioning the stability of their investments. Amidst this chaos, Liberty Maven Stock emerged as a prominent player. Its stock price skyrocketed, leaving many to believe that the company was immune to the pandemic's adverse effects.

Debunking the Myth: Liberty Maven Stock's True Potential

However, as we peeled back the layers, it became apparent that the pandemic had merely served as a catalyst for the stock's surge. Liberty Maven Stock, like many other companies, had been riding on the coattails of the pandemic's chaos. Its true potential was far from being immune to the global economic turmoil.

The Reality Behind Liberty Maven Stock

Upon further investigation, it was discovered that Liberty Maven Stock had been benefiting from various factors other than its intrinsic value. One of the primary reasons for its stock's surge was the company's ability to adapt to the pandemic's challenges. Liberty Maven Stock managed to pivot its business model, focusing on areas that were in high demand during the pandemic, such as e-commerce and remote work solutions.

Moreover, the stock's rise was also attributed to the speculative nature of the market during the pandemic. Investors were desperate for any form of security, leading them to pour their money into companies with seemingly strong fundamentals. Unfortunately, this speculative bubble eventually burst, leaving many investors in the lurch.

Case Studies: Companies Fooled by the Pandemic

Several other companies, similar to Liberty Maven Stock, experienced a similar trajectory. One such example is Zoom Video Communications Inc., which saw its stock price soar to unprecedented levels during the pandemic. However, as the world began to recover from the crisis, the stock's value plummeted, leaving investors in a state of shock.

Another case in point is Peloton Interactive, Inc., a company that capitalized on the pandemic's shift towards remote workouts. Its stock price skyrocketed, but the company's long-term sustainability remained questionable. As the world reopened, Peloton's stock took a nose dive, highlighting the speculative nature of the market during the pandemic.

Conclusion: The Real Lesson Learned

The COVID-19 pandemic had us all fooled, and the story of Liberty Maven Stock is a testament to that. It served as a reminder that the stock market is unpredictable and that investors should always conduct thorough research before making investment decisions. The pandemic's chaos exposed the speculative nature of the market, and it is crucial for investors to remain vigilant and focus on the long-term potential of companies they invest in.

us stock market today live cha