Is the US Stock Market Undervalued or Overvalued?

author:US stockS -

In the world of finance, the question of whether the US stock market is undervalued or overvalued is a topic of constant debate among investors, analysts, and market watchers. This article delves into this critical question, exploring the various factors that contribute to the current market valuation and offering insights into where the market might be heading.

Understanding Market Valuation

Market valuation is a measure of the overall worth of a market, typically expressed in terms of the price-to-earnings (P/E) ratio. A P/E ratio below 15 is often considered undervalued, indicating that the market is trading at a discount to its intrinsic value. Conversely, a P/E ratio above 20 is often considered overvalued, suggesting that the market is trading at a premium to its intrinsic value.

Current Market Conditions

As of the time of writing, the US stock market is trading at a P/E ratio of around 19, which is slightly above the historical average. This has led to a debate about whether the market is overvalued or simply reflecting the strong economic growth and corporate earnings.

Factors Contributing to Market Valuation

Several factors contribute to the current market valuation:

- Strong Economic Growth: The US economy has been growing at a steady pace, leading to increased corporate earnings and higher stock prices.

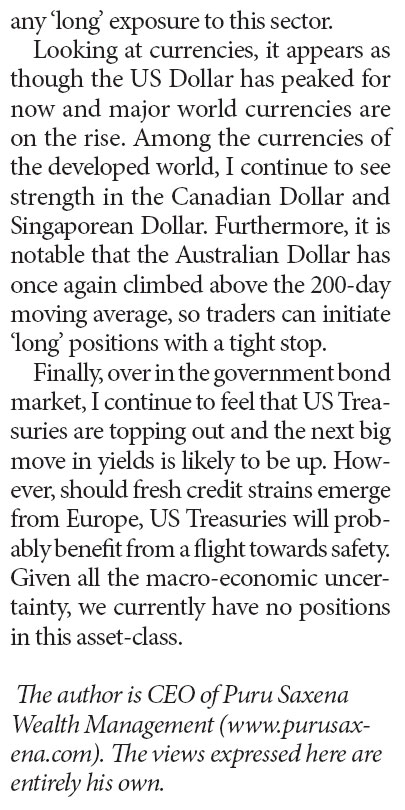

- Low Interest Rates: The Federal Reserve has kept interest rates at historically low levels, making stocks more attractive relative to bonds and other fixed-income investments.

- Corporate Earnings: Corporate earnings have been strong, driven by factors such as cost-cutting, increased productivity, and strong demand for goods and services.

- Technological Advancements: The rise of technology has driven innovation and increased the value of many tech stocks, contributing to the overall market valuation.

Undervalued or Overvalued?

Given the factors mentioned above, some analysts argue that the US stock market is overvalued. They point to the high P/E ratio and the fact that stock prices have been rising despite a lack of earnings growth in some sectors.

On the other hand, others argue that the market is undervalued. They point to the strong economic growth, low interest rates, and strong corporate earnings as reasons to believe that the market is still undervalued.

Case Study: Tech Stocks

One area where the debate is particularly heated is in the tech sector. Tech stocks have been driving the market higher, but some analysts argue that they are overvalued. For example, Apple Inc. (AAPL) has a P/E ratio of over 30, which is significantly higher than the market average.

However, others argue that tech stocks are not overvalued but rather undervalued. They point to the strong growth potential of these companies and the fact that they are leaders in their respective industries.

Conclusion

The question of whether the US stock market is undervalued or overvalued is complex and depends on a variety of factors. While the current market valuation is above the historical average, it is difficult to say definitively whether the market is overvalued or undervalued. Investors should consider their own risk tolerance and investment goals when making decisions about the US stock market.

us stock market today live cha