Impact of Israel War on US Stock Market

author:US stockS -

The recent conflict in Israel has sent shockwaves through the global market, and the United States stock market is no exception. The impact of the Israel war on the US stock market has been significant, with investors and traders closely monitoring its effects. This article delves into the consequences of the conflict, its implications for the US stock market, and the strategies investors are employing to navigate these turbulent times.

Rising Tensions and Market Volatility

The conflict in Israel has led to heightened tensions in the Middle East, which has had a direct impact on the global economy. As a result, the US stock market has experienced increased volatility. Market indices such as the S&P 500 and the NASDAQ have seen sharp fluctuations, reflecting the uncertainty surrounding the situation.

Sector-Specific Impacts

The impact of the Israel war on the US stock market is not uniform across all sectors. Certain sectors, such as energy and defense, have seen increased activity and investment, while others, such as technology and consumer discretionary, have faced downward pressure.

Energy Sector Booms

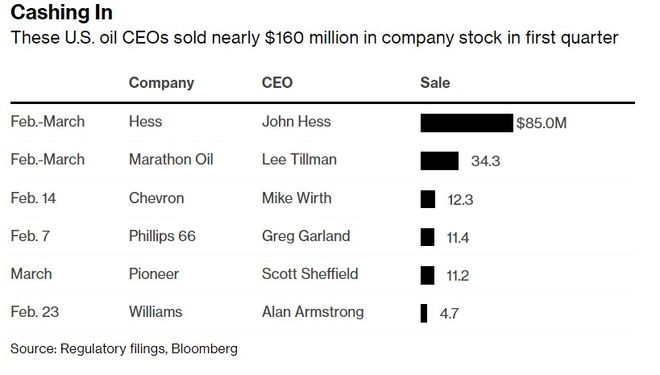

The energy sector has been one of the biggest beneficiaries of the Israel war. Rising tensions have driven up oil and gas prices, leading to increased demand for energy-related investments. Companies in the energy sector, such as ExxonMobil and Chevron, have seen their stock prices surge.

Defense Spending Soars

The defense sector has also seen a significant boost. As the conflict escalates, the US government is expected to increase its defense spending, leading to higher demand for defense-related products and services. Companies like Lockheed Martin and Raytheon have seen their stock prices rise as a result.

Tech and Consumer Discretionary Suffer

On the other hand, the technology and consumer discretionary sectors have faced downward pressure. Investors are concerned about the potential economic impact of the conflict, which could lead to higher inflation and a slower economic growth rate. As a result, companies in these sectors, such as Apple and Walmart, have seen their stock prices decline.

Investor Strategies

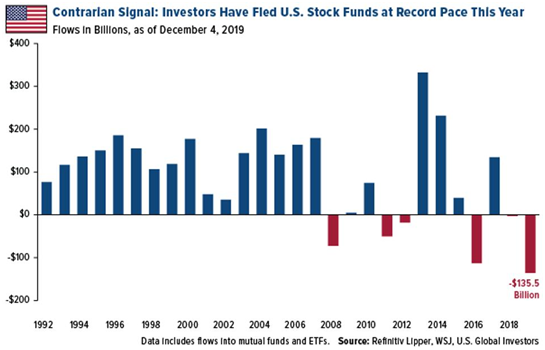

In response to the volatility caused by the Israel war, investors are adopting various strategies to protect their portfolios. Some are focusing on defensive sectors, while others are diversifying their investments to mitigate risk.

Diversification and Risk Management

One common strategy among investors is diversification. By spreading their investments across different sectors and asset classes, investors can reduce their exposure to the volatility caused by the Israel war. Asset allocation and risk management play a crucial role in navigating these turbulent times.

Case Studies

Several case studies illustrate the impact of the Israel war on the US stock market. For example, the stock price of Chevron has risen by 10% since the conflict began, while the stock price of Apple has fallen by 5% over the same period.

Conclusion

The Israel war has had a significant impact on the US stock market, leading to increased volatility and shifts in investor sentiment. As the situation continues to evolve, investors will need to stay vigilant and adapt their strategies accordingly. By focusing on diversification, risk management, and sector-specific investments, investors can navigate these turbulent times and protect their portfolios.

us stock market today live cha