How the 2008 Stock Market Crash Affected Us

author:US stockS -

The 2008 stock market crash was one of the most significant economic events of the 21st century, leaving an indelible mark on the global financial landscape. This article delves into the profound impact of the 2008 stock market crash on individuals, businesses, and the economy as a whole.

The Causes of the 2008 Stock Market Crash

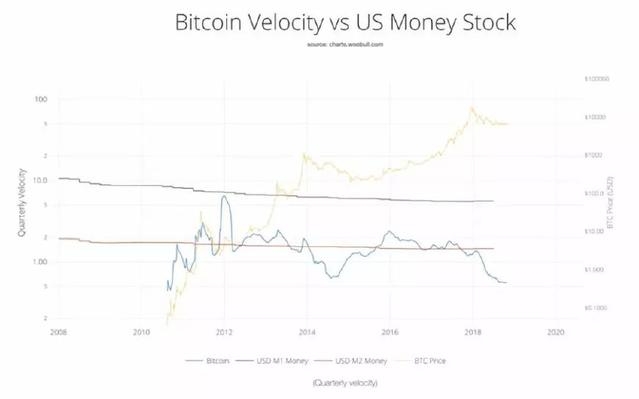

The crash was primarily caused by a combination of factors, including the subprime mortgage crisis, excessive risk-taking by financial institutions, and inadequate regulation. Lenders had been giving out mortgages to borrowers with poor credit histories, and these mortgages were then bundled into complex financial products known as mortgage-backed securities (MBS). These MBS were sold to investors, who were unaware of the underlying risks.

The Immediate Impact

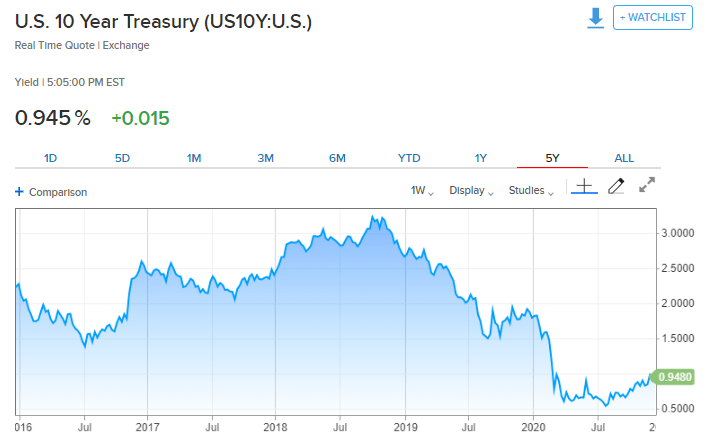

The immediate impact of the crash was devastating. Stock prices plummeted, and investors lost billions of dollars. The Dow Jones Industrial Average, a widely followed stock market index, fell by over 50% from its peak in October 2007 to its low in March 2009. Many retirement funds were decimated, and individuals and businesses faced significant financial hardship.

Long-Term Consequences

The long-term consequences of the 2008 stock market crash were equally profound. Here are some of the key impacts:

- Increased Unemployment: The crash led to a severe recession, with unemployment rates soaring to double digits. Many businesses were forced to lay off workers, and job seekers faced unprecedented competition.

- Homelessness and Foreclosures: The subprime mortgage crisis resulted in a surge in home foreclosures, leading to increased homelessness and financial distress for many families.

- Bank Failures and Government Bailouts: Several major financial institutions, including Bear Stearns, Lehman Brothers, and Merrill Lynch, collapsed or were acquired by other banks. The government was forced to bail out these institutions to prevent a complete financial collapse.

- Reduced Consumer Spending: As individuals and businesses faced financial hardship, consumer spending decreased, further exacerbating the recession.

Case Study: The Housing Market

One of the most significant impacts of the 2008 stock market crash was on the housing market. Home prices plummeted, and many homeowners found themselves "underwater" on their mortgages, meaning they owed more on their homes than they were worth. This led to a wave of foreclosures and a decrease in demand for housing, further driving down prices.

Lessons Learned

The 2008 stock market crash serves as a stark reminder of the importance of prudent risk management and strong regulation in the financial sector. It also highlights the need for a more robust safety net for individuals and families to protect them from the devastating effects of economic downturns.

In conclusion, the 2008 stock market crash had a profound impact on individuals, businesses, and the economy. While the immediate consequences were devastating, the long-term effects are still being felt today. The lessons learned from this event are crucial for preventing future financial crises.

us stock market today live cha