Facebook Stock Price: Understanding the US Dollar Impact

author:US stockS -

In the ever-evolving world of technology, Facebook remains a significant player, and investors closely monitor its stock price. This article delves into the factors influencing the Facebook stock price and its correlation with the US dollar. Understanding this relationship is crucial for investors looking to make informed decisions.

The Basics of Facebook Stock

Facebook, Inc., now known as Meta Platforms, Inc., is an American multinational technology company. It operates one of the world's most popular social media platforms, Facebook, along with Instagram, WhatsApp, and Oculus. The company's stock, listed on the Nasdaq, has seen its fair share of ups and downs over the years.

Understanding the US Dollar Impact

The US dollar plays a crucial role in determining the value of Facebook's stock. Since the stock is listed in US dollars, fluctuations in the currency can significantly impact its price. Here's how:

Exchange Rates: The value of the US dollar relative to other currencies affects the price of Facebook's stock for international investors. If the US dollar strengthens, Facebook's stock becomes more expensive for foreign investors, potentially reducing demand and causing the stock price to fall. Conversely, if the US dollar weakens, the stock becomes more affordable for international investors, potentially increasing demand and driving up the stock price.

Revenue Conversion: Facebook generates a significant portion of its revenue from advertising. Much of this revenue comes from international markets, which are often denominated in currencies other than the US dollar. When Facebook converts these revenues into US dollars, fluctuations in the exchange rate can impact its overall financial performance and, subsequently, its stock price.

Economic Factors: The US dollar is often considered a safe haven currency, particularly during times of economic uncertainty. During such periods, investors may flock to US dollar-denominated assets, including Facebook's stock, potentially driving up its price. Conversely, during periods of economic stability, the stock price may be more influenced by other factors, such as company performance and market sentiment.

Historical Analysis

A historical analysis of Facebook's stock price and the US dollar reveals several interesting trends. For instance, during the 2020 COVID-19 pandemic, the US dollar strengthened, and Facebook's stock price initially fell. However, as the global economy stabilized, the stock price recovered and even reached new highs.

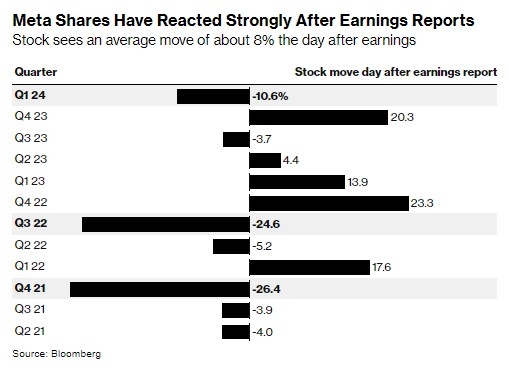

Case Study: Facebook's Stock Price in 2021

In 2021, Facebook's stock price experienced significant volatility. The company faced scrutiny from regulators and investors over privacy concerns and misinformation. Despite these challenges, the stock price remained relatively stable, reflecting the resilience of the company and the influence of the US dollar.

Conclusion

Understanding the relationship between Facebook's stock price and the US dollar is crucial for investors looking to make informed decisions. By analyzing factors such as exchange rates, revenue conversion, and economic factors, investors can better predict the future movements of Facebook's stock price. As the technology landscape continues to evolve, staying informed about these factors will be key to success in the stock market.

us stock market today live cha