Almgren Market Impact on US Stocks: Understanding Its Significance

author:US stockS -

In the intricate world of financial markets, the Almgren model has emerged as a crucial tool for assessing market impact, particularly in the realm of US stocks. This article delves into the Almgren model's implications for the US stock market, highlighting its significance and providing real-world examples to illustrate its application.

What is the Almgren Model?

The Almgren model, developed by Peter Almgren, a former quantitative trader at Goldman Sachs, is a mathematical framework designed to estimate the cost of executing a large order in a financial market. It considers factors such as the order size, price impact, and liquidity conditions to predict the optimal execution strategy. By analyzing these variables, the model helps traders minimize the market impact of their orders, thereby maximizing profits.

Understanding Market Impact

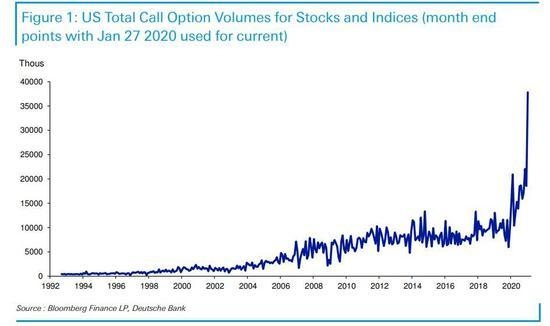

Market impact refers to the effect that a large order has on the price of a security. When a large order is placed, it can cause significant price movements, leading to increased transaction costs and potential losses for traders. The Almgren model addresses this issue by providing a quantitative approach to estimating the market impact of an order.

Significance of the Almgren Model in US Stocks

The Almgren model has gained significant traction in the US stock market due to its ability to accurately predict market impact. Here are some key reasons why it is crucial:

1. Optimizing Execution Strategies

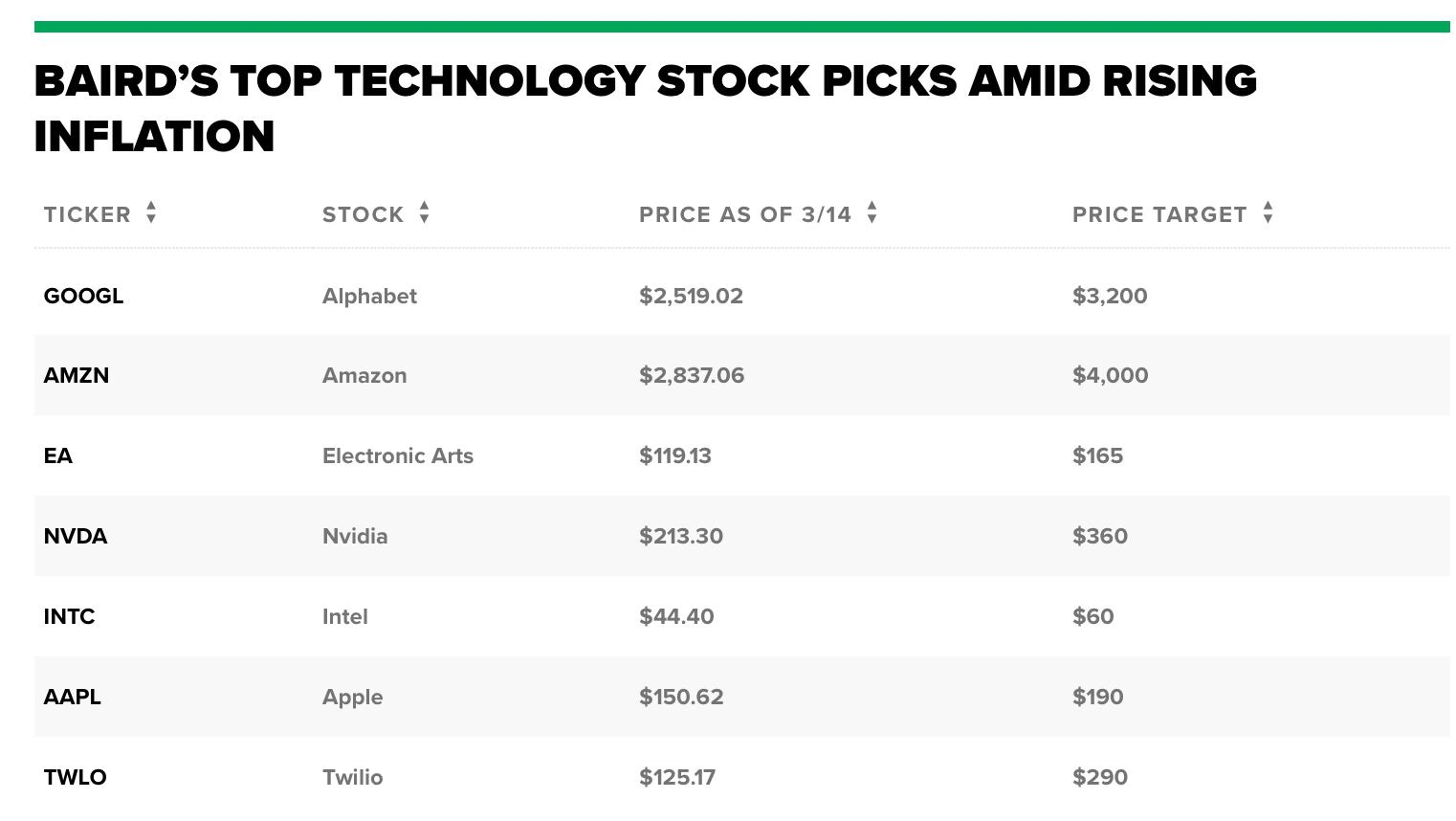

By utilizing the Almgren model, traders can optimize their execution strategies to minimize market impact. This is particularly important for institutional investors and high-frequency traders who execute large orders frequently.

2. Enhancing Profitability

Reducing market impact leads to lower transaction costs, which ultimately enhances profitability. The Almgren model enables traders to make informed decisions regarding the timing and size of their orders, maximizing their returns.

3. Mitigating Risks

The Almgren model helps traders mitigate the risks associated with large orders. By predicting the potential market impact, traders can adjust their strategies to avoid significant losses.

Real-World Examples

Let's consider a real-world example to illustrate the application of the Almgren model. Suppose a hedge fund wants to buy 1 million shares of a particular stock. Without the Almgren model, the fund might place a single large order, causing the stock price to plummet. However, by using the Almgren model, the fund can break down the order into smaller, staggered orders, minimizing market impact and achieving a better price.

Conclusion

In conclusion, the Almgren model plays a vital role in the US stock market by providing a quantitative approach to estimating market impact. By understanding its significance and applying it effectively, traders can optimize their execution strategies, enhance profitability, and mitigate risks. As the financial markets continue to evolve, the Almgren model will undoubtedly remain a valuable tool for investors and traders alike.

us stock market today live cha