Understanding the US Stock Buyback Blackout Period Rules

author:US stockS -

In the world of finance, the term "stock buyback blackout period" is a crucial aspect that investors and corporate executives must understand. This article delves into the rules surrounding stock buybacks, particularly during blackout periods, to ensure that readers are well-informed about this important financial practice.

What is a Stock Buyback?

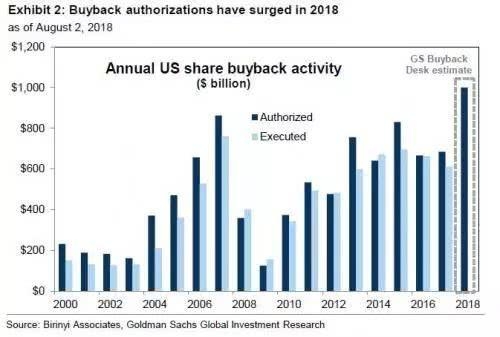

A stock buyback, also known as a share repurchase, is when a company buys back its own shares from the open market. This can be done for various reasons, such as boosting the stock price, returning capital to shareholders, or reducing the number of outstanding shares. However, certain regulations must be followed, especially during blackout periods.

What is a Blackout Period?

A blackout period is a time when a company is prohibited from engaging in certain activities, such as buying back its own stock. This period typically occurs before or after a significant corporate event, such as an earnings release or a merger announcement. The purpose of the blackout period is to prevent any potential conflicts of interest or insider trading.

The Rules of the Blackout Period

During a blackout period, companies are generally prohibited from purchasing their own stock. This includes both open market purchases and purchases made through tender offers. The rules are designed to ensure that all investors have equal access to information and to prevent any potential manipulation of the stock price.

The duration of the blackout period can vary depending on the specific circumstances. However, it typically lasts for a period of time immediately before and after the release of financial results or other significant corporate events. The exact duration is determined by the Securities and Exchange Commission (SEC) and the company's own internal policies.

Exceptions to the Blackout Period

While companies are generally prohibited from buying back their own stock during a blackout period, there are some exceptions. For example, if a company has already entered into a binding agreement to purchase its own stock before the blackout period begins, it may be allowed to complete the transaction.

Additionally, some companies may be granted permission to make certain types of purchases during a blackout period. This could include purchasing shares from employees under a stock option plan or from shareholders under a tender offer.

Case Studies

To illustrate the importance of blackout period rules, let's consider a few case studies:

Apple Inc.: In 2012, Apple announced a significant stock buyback program. However, the company was required to adhere to blackout period rules before and after the release of its financial results. This ensured that all investors had equal access to information during the period leading up to the announcement.

Exxon Mobil Corporation: In 2016, Exxon Mobil announced a merger with Chevron Corporation. As part of the merger process, the company was required to adhere to blackout period rules to prevent any potential insider trading.

Conclusion

Understanding the rules surrounding stock buyback blackout periods is essential for investors and corporate executives alike. By adhering to these rules, companies can ensure that all investors have equal access to information and that the integrity of the financial markets is maintained.

us stock market today